Last Night's Market Recap

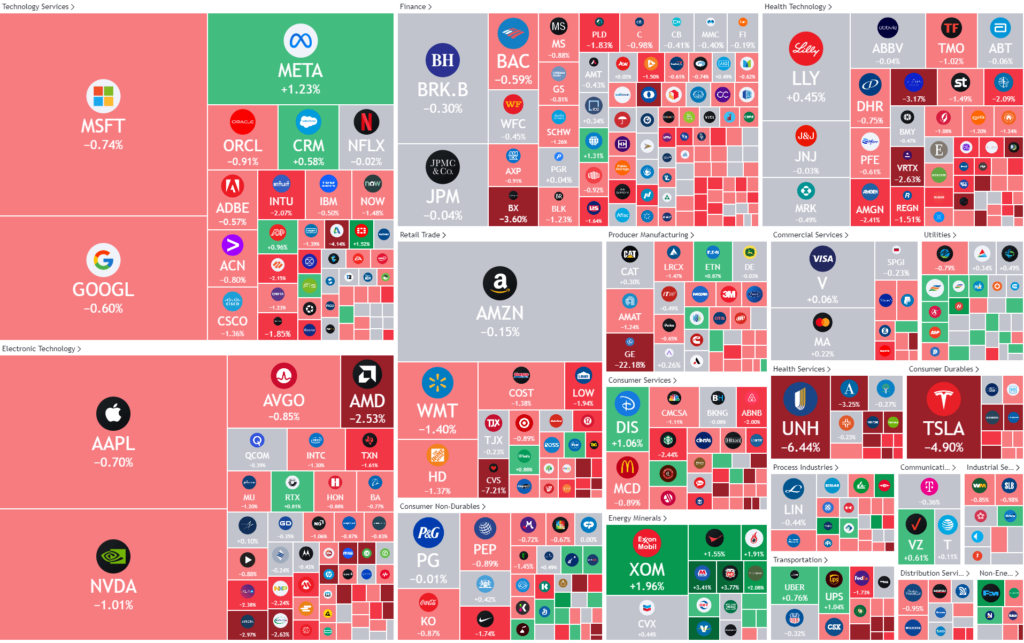

S&P 500 - Heatmap

Overnight – Poor start to the quarter as Fed reiterates the “higher for longer” message

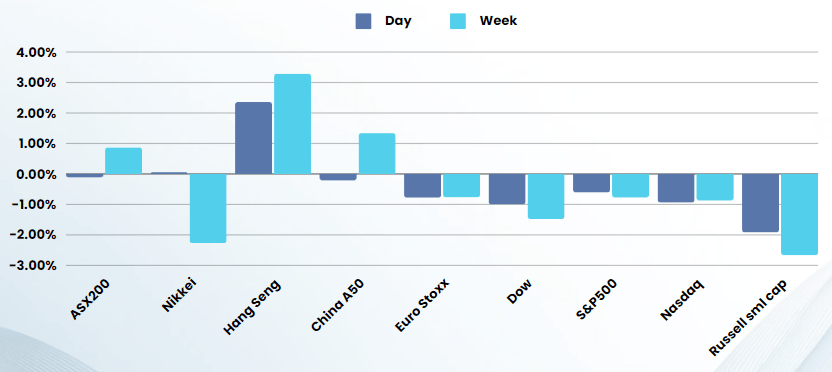

Equities had a broad-based sell-off overnight extending the poor start to the second-quarter, pressured by health care stocks and another big jump in Treasury yields amid remarks from several Federal Reserve officials reiterating the need to keep rates higher for longer.

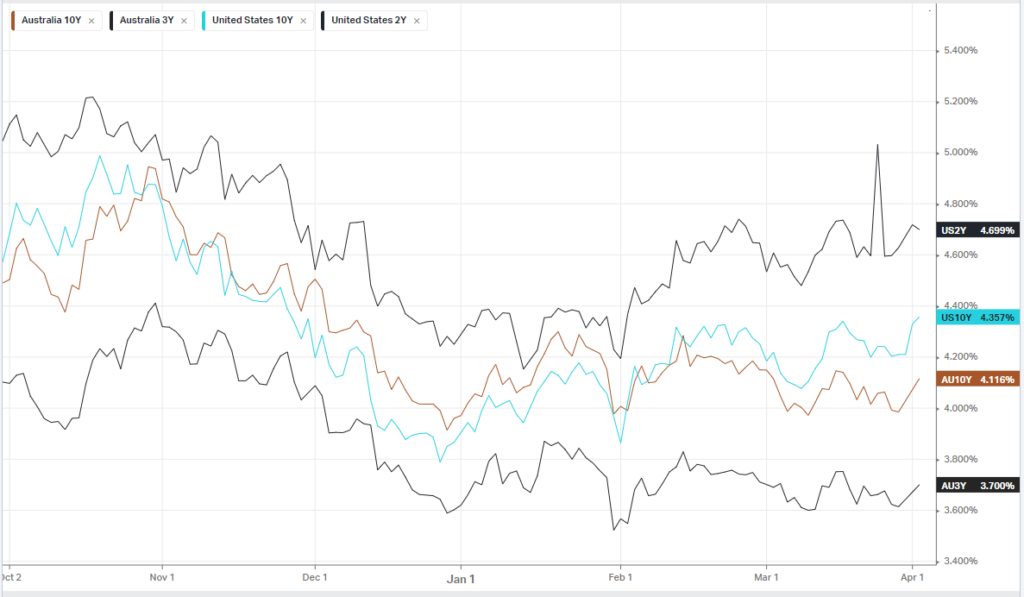

Treasury yields increased, reflecting the impact of recent strong economic data and Federal Reserve officials tempering expectations for early rate cuts. San Francisco Fed President Mary Daly emphasized the lack of urgency for rate reductions, given inflation remains above the 2% target, aligning with Cleveland Fed President Loretta Mester’s cautious stance on premature rate cuts. The CME’s FedWatch tool indicates a decreased likelihood of a June Fed rate cut, now at 62% compared to 70% a week earlier. This adjustment follows data showing a slight increase in job openings in February, though just below expectations. The focus remains on employment, with the March payrolls report anticipated to show a job addition of 205,000, a slowdown from February’s 275,000, amid optimism for a “soft landing” where inflation eases without a significant economic downturn.

Health care stocks including Humana, UnitedHealth Group and CVS Health were down sharply to lead losses in the broader market after the Center for Medicare and Medicaid Services private Medicare Advantage rates will increase an average 3.7% from 2024. The rate was unchanged from the initial proposals in January, signalling the insurers’ margins will remain under pressure next year. That took Wall Street by surprise as only once in the past 10 years have final rates not increased from the initial proposals

Tesla fell 5% after the electric vehicle manufacturer reported its first-quarter delivery numbers, falling well short of expectations and described by analysts as an “unmitigated disaster”. The EV giant delivered 386,810 vehicles against the estimated 449,080, according to Bloomberg consensus.

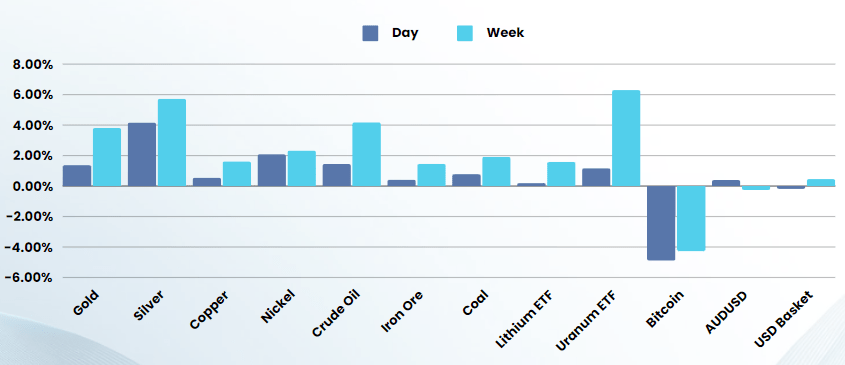

Gold rallied to all-time highs, while silver played some catch up surging 4% to 52 week highs, on the back of a weakening dollar. Hope that China’s manufacturing fortunes have turned, saw oil surge to 5-month highs and Iron ore grind out of recent lows.

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7907 (-0.03%)

The ASX is likely to initially dip on the weak US lead, however gold, Iron ore and energy stocks should limit any losses. The recent readjustment in rate expectations is hardly unexpected as economic strength and rate cuts have always been (and always will be) mutually exclusive.

In the event of an extended fall in equities, we expect the AU market to hold up better than the US which is sitting at (or beyond) Goldilocks scenario prices

Company Specific:

- Ridley Corp trades ex-dividend on Wednesday.