What's Affecting Markets Today

US Markets start April in red

On Monday night, the Dow Jones Industrial Average concluded the session lower, declining by 240.52 points or 0.6%, to close at 39,566.85, as investors reacted to new U.S. inflation data and ongoing concerns about the sustainability of the market’s recent gains. The S&P 500 slightly fell by 0.2% to 5,243.77, while the Nasdaq Composite marginally rose by 0.11%, ending at 16,396.83. Market participants remain wary of the Federal Reserve’s interest rate cut projections and its ability to achieve a 2% inflation target soon. Despite Fed Chair Jerome Powell’s comments on strong economic and job market performance, the expectation for a rate cut by the Fed in June stands at 58%, as per the CME FedWatch Tool. Treasury yields saw an uptick, influenced by Powell’s statements and key inflation indicators. Notably, the personal consumption expenditures price index for February indicated a 2.8% year-on-year increase, aligning with forecasts. After a robust first quarter, concerns of an overbought market and potential correction loom, despite the indices’ recent performance.

ASX Stocks

ASX 200 - 7,887.9 (-0.10%)

Key Highlights:

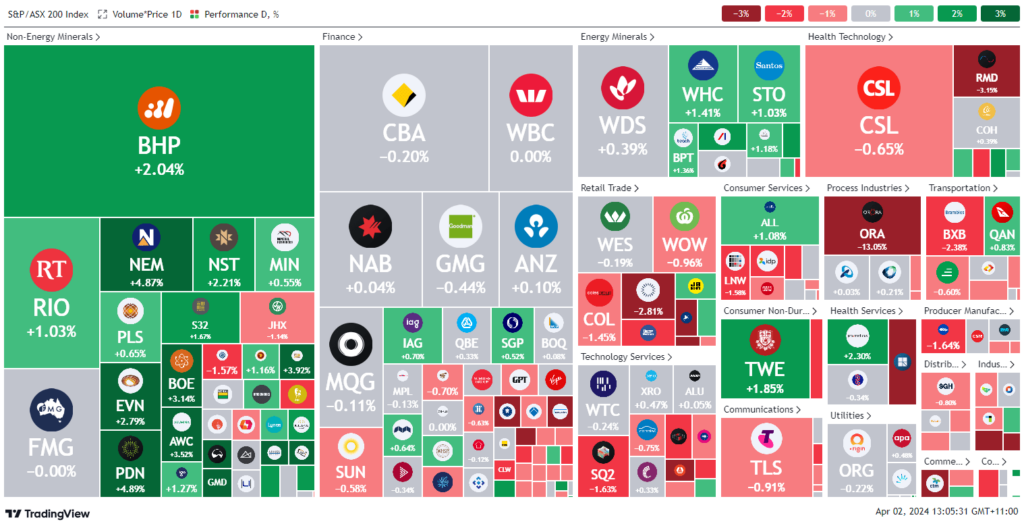

In the latest trading session, the Australian stock market achieved a notable milestone, surpassing the 7900 points mark, with the S&P/ASX 200 Index climbing by 10 points to close at 7907.3. This rise was supported by significant gains in the oil and mining sectors, which each saw approximately 1% increases amid global geopolitical tensions and commodity price fluctuations. Notably, gold miners excelled, propelled by a surge in gold prices to a record $US2246.17 per ounce. The Reserve Bank’s recent minutes indicated a departure from previous considerations on rate hikes, hinting at a more cautious monetary stance.

Several companies experienced notable movements: Orora faced a 14.9% decline after revising its earnings forecast downwards due to a sluggish market, while Austal’s shares rose by 10.5% following a takeover bid from Hanwha Ocean. Mesoblast’s stock soared by 50% amid anticipation of a U.S. FDA submission. Conversely, Cettire suffered an 11.2% decrease after a downgrade from Bell Potter, reflecting the day’s mixed market performances.

Leaders

ASB Austal Ltd 10.91%

PDN Paladin Energy Ltd 4.93%

NEM Newmont Corporation 4.88%

IMU Imugene Ltd 4.76%

WAF West African Resources Ltd 4.58%

Laggards

CTT Cettire Ltd -13.83%

ORA Orora Ltd -13.24%

ZIP ZIP Co Ltd -7.55%

ERA Energy Resources of Australia Ltd -5.26%

TPW Temple & Webster Group Ltd -5.11%