What's Affecting Markets Today

Mixed day in Asian Markets

In Thursday’s trading session, Japan’s stock market faced significant declines, with the Nikkei 225 dropping by 1.22% and the Topix index falling 1.31%. This contrasted sharply with Australia’s market performance, where stocks reached a new peak, driven by a surge in mining shares. The weakening of the Japanese yen to a 34-year low against the dollar, trading at 151.37 after touching 151.97, sparked discussions about possible government interventions to stabilize the currency. Japan’s Finance Minister, Shunichi Suzuki, hinted at the likelihood of taking actions against erratic foreign exchange movements earlier in the week. Meanwhile, in other parts of Asia, South Korea’s Kospi slightly decreased by 0.13%, although the Kosdaq saw a marginal increase of 0.06%. The Hong Kong Hang Seng index experienced a notable rise of 1.63%, with its technology sector jumping 3.8%. Additionally, China’s CSI 300 index witnessed a 1.2% increase, reflecting a mixed day in Asian markets.

ASX Stocks

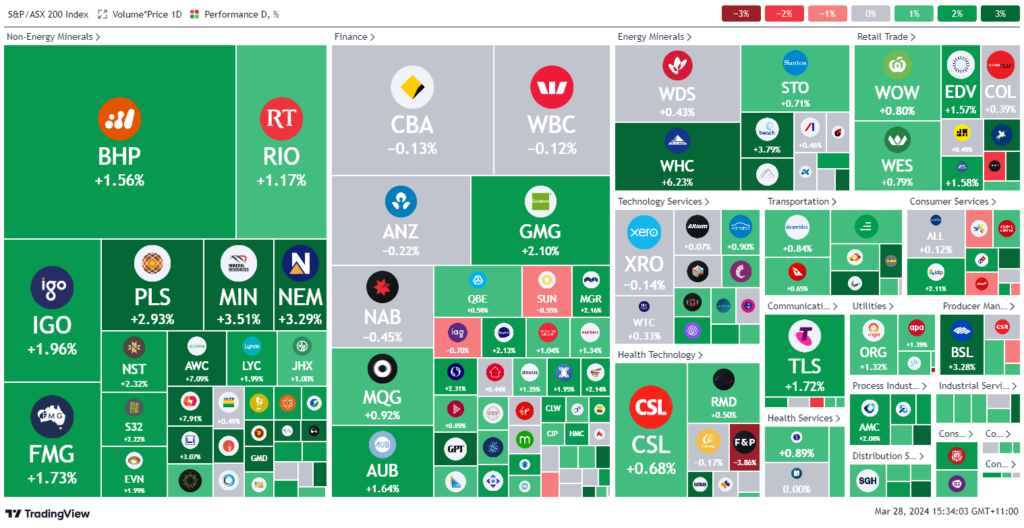

ASX 200 - 7,894.9 (+1.0%)

Key Highlights:

On Thursday, Australian shares soared to a record high, led by significant gains in the mining sector, including gold, iron ore, and lithium companies, buoyed by a resurgence in resource prices. The S&P/ASX 200 index climbed 0.8% to 7,901 points by midday, surpassing its previous record intraday peak of 7,853.1 points set on March 8. The rise was attributed to optimism regarding the global economic outlook and anticipation of interest rate cuts in the latter half of 2024, which also boosted the banking, property, and retail sectors.

Key contributors to the market’s performance included mining heavyweights like BHP, up by 1.8%, and Newmont, which surged 3.6% as gold prices approached a record high of $2,211 an ounce. This increase in gold prices reflected market expectations of declining inflation and potential central bank rate cuts, alongside sustained demand for safe-haven assets.

Despite a slight underperformance in February’s retail sales data, growing only 0.3% month-on-month, select stocks captured investor attention. Ramsay Health Care saw a minor dip after Citi flagged concerns over its French hospital tariffs. Conversely, Beach Energy’s shares jumped 6% following the announcement of a significant staff reduction as part of its restructuring efforts. Meanwhile, Mineral Resources and Albemarle took steps towards enhancing lithium market transparency by auctioning lithium, seeking to establish more transparent pricing in a market traditionally dominated by opaque practices.

Leaders

RSG Resolute Mining Ltd 8.97%

LTM Arcadium Lithium Plc 7.91%

AWC Alumina Ltd 7.09%

WHC Whitehaven Coal Ltd 6.16%

PMV Premier Investments Ltd 5.31%

Laggards

WC8 Wildcat Resources Ltd -6.43%

ZIP ZIP Co Ltd -6.17%

FPH Fisher & Paykel Healthcare -3.99%

MEZ Meridian Energy Ltd -3.55%

RDX REDOX Ltd -2.99%