Last Night's Market Recap

S&P 500 - Heatmap

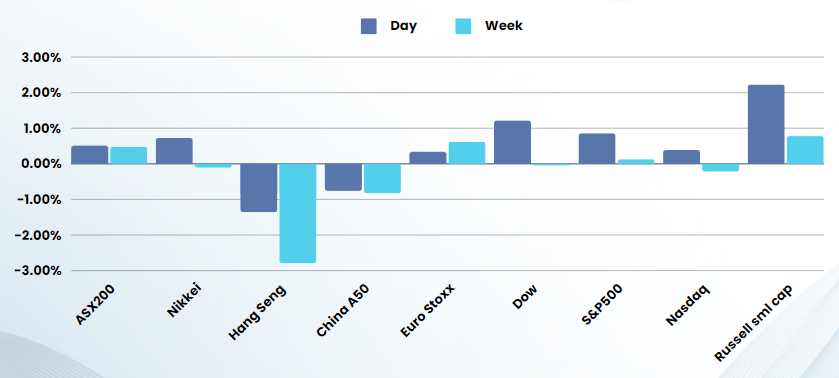

Overnight – Equities bounce back on rate cut optimism

The S&P 500 clinched a fresh record closing high Wednesday, as Treasury yields slipped ahead of a speech from Federal Reserve governor Christopher Waller due later in the day and more cues on inflation.

Treasury yields fell ahead of closely anticipated remarks from Fed governor Waller even as some Wall Street warn that the Fed governor may lean hawkish to rein in dovish Fed expectations. “While not dismissing the prospect of a June cut, Waller may point to sturdy US aggregate demand and ‘sticky’ inflation in the January and February data to justify fewer rate cuts than the median ‘dots’ imply.

In corporate news, pharmaceutical giant Merck jumped 5% to an indicated record high after the U.S. Food and Drug Administration approved its treatment for a rare lung disease.

Energy stocks were in the green, though gains were limited a fall in oil prices following the release of industry data showing a hefty increase in weekly U.S. crude inventories. Data from the Energy Information Administration showed inventories for the week ended Mar. 22 rose by 3.2M barrels, confounding expectations for a draw of 700,000 barrels.

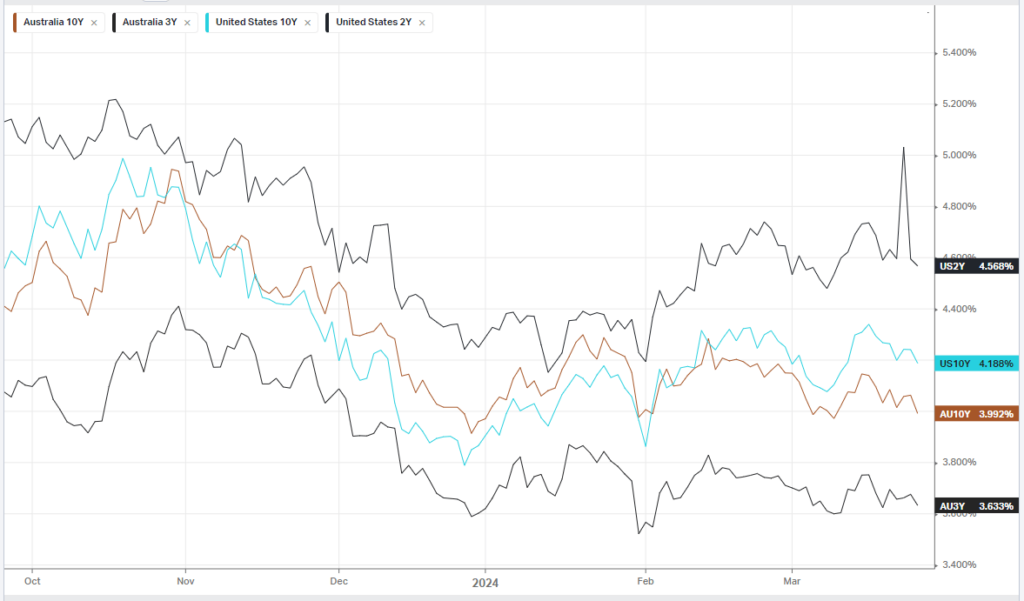

Bonds

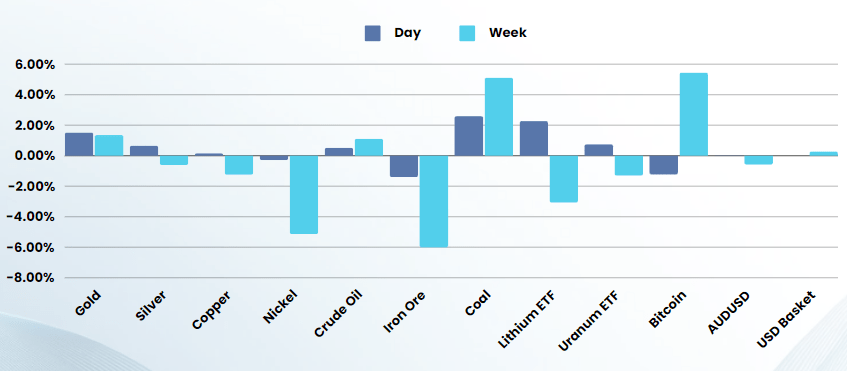

Commodities & FX

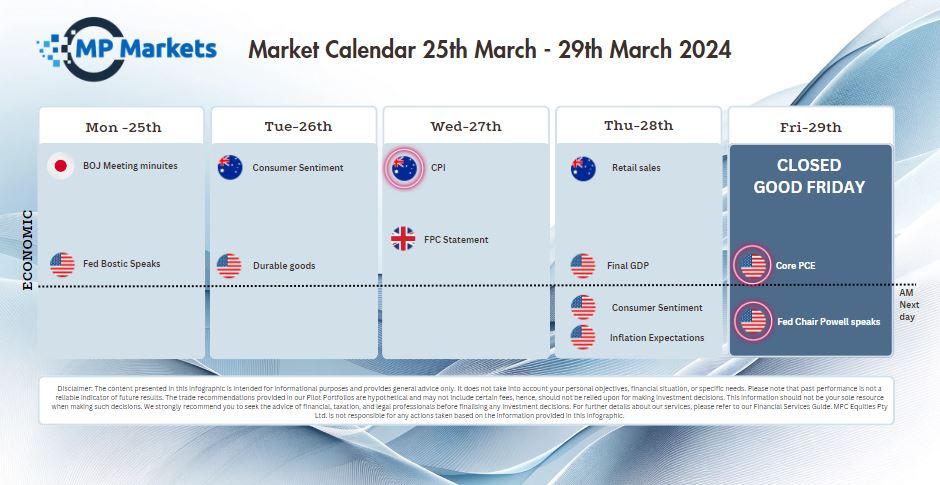

The Day Ahead

ASX SPI 7899 (+0.76%)

With the positive offshore lead and no danger signs of rising inflation yesterday in the AU CPI numbers we are likely to strong rally today. Add to this end of month, end of quarter window dressing and the index is likely to finish at a record settlement price unless Waller speech at 9am derails the US futures.

Company Specific:

- Australian Clinical Labs, Sigma Healthcare and Westgold Resources all trade ex-dividend on Thursday.

- MinRes to auction lithium in quest for ‘real price transparency’Chris Ellison’s Mineral Resources and New York-listed Albemarle sell lithium at well above spot price amid renewed efforts to make an opaque market dominated by China more transparent.