What's Affecting Markets Today

Inflation in Australia for February

In February, Australia reported a 3.4% annual inflation rate, slightly below the expected 3.5%, remaining steady from the previous month. Significant price increases were observed in housing, food and beverages, alcohol and tobacco, and insurance and financial services. The Reserve Bank of Australia maintained the cash rate at 4.35%, watching for signs of inflation stabilization. Following recent jobs data indicating a tight labor market, traders are now adjusting their expectations for rate cuts, possibly delaying monetary easing to September. Upcoming retail sales data will provide further insight into economic conditions.

Platinum Asset Management Faces Major Fund Withdrawal

Platinum Asset Management’s shares dropped over 20% after losing $1.4 billion in funds from a major client, which aims to diversify its investment strategy. This move will cost Platinum approximately $18 million in annual fees, significantly impacting its financials. The firm, known for its benchmark-agnostic global equity management, is undergoing a turnaround program to improve performance and reduce costs. The loss highlights challenges within the investment sector, especially for firms relying heavily on large, institutional clients.

Iron Ore Prices Decline Amid China Demand Concerns

Iron ore futures experienced a sharp decline in Singapore, driven by uncertainties over Chinese demand, contributing to a volatile trading period. The price drop reflects broader concerns about China’s construction sector and the overall demand for steel, exacerbated by the country’s prolonged property market crisis. Iron ore prices fell to $104.05 a tonne, amidst fluctuating steel trading volumes in China and growing inventories at ports. The situation is further complicated by declines in other base metals like aluminum, copper, zinc, and nickel, underscoring the impact of weakened Chinese demand on global commodity markets.

ASX Stocks

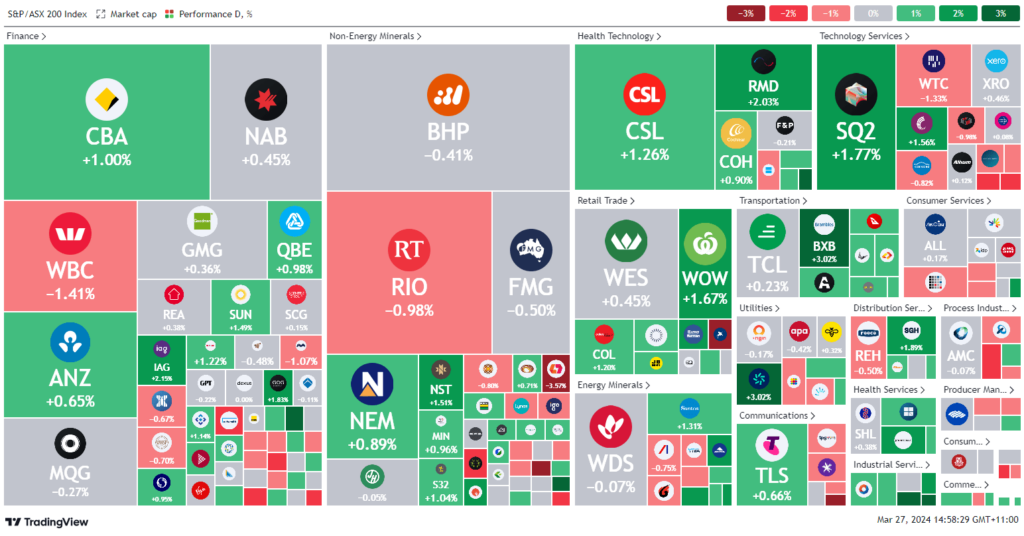

ASX 200 - 7,797.8.1 (0.2%)

Key Highlights:

Today, the Australian sharemarket saw a positive shift, climbing higher by lunchtime, fueled by stable inflation figures for February, which remained constant for the third consecutive month at 3.4%, slightly below the forecasted 3.5%. This stability has contributed to a growing optimism regarding potential rate cuts by major central banks, soothing concerns following Australia’s strong employment data last week. The S&P/ASX 200 Index experienced a 0.4% rise, with consumer staples leading the gains, notably Woolworths and Coles. However, the mining sector faced challenges, with a dip in iron ore prices due to persistent worries over Chinese demand affecting stocks like Fortescue Metals and Rio Tinto. Meanwhile, Platinum Asset Management suffered a significant loss, dropping over 19% after losing $1.4 billion in funds from a key client. Additionally, APM Human Services announced a trading halt pending news from CVC Capital Markets, and in the US, Donald Trump’s social media venture saw a 16% increase on its public debut.

Leaders

AFP-Aft Pharmaceuticals Ltd (+16.40%)

COE-Cooper Energy Ltd (+12.50%)

BOT-Botanix Pharmaceuticals Ltd (+7.50%)

MSB-Mesoblast Ltd (+7.29%)

WC8-Wildcat Resources Ltd (+7.14%)

Laggards

PTM-Platinum Asset Mgmt. (-20.88%)

29M-29METALS Ltd (-9.38%)

ERA-Energy Resources of Australia Ltd (-8.48%)

CAT-Catapult Group International Ltd (-7.26%)

BRN-Brainchip Holdings Ltd (-6.06%)