Last Night's Market Recap

S&P 500 - Heatmap

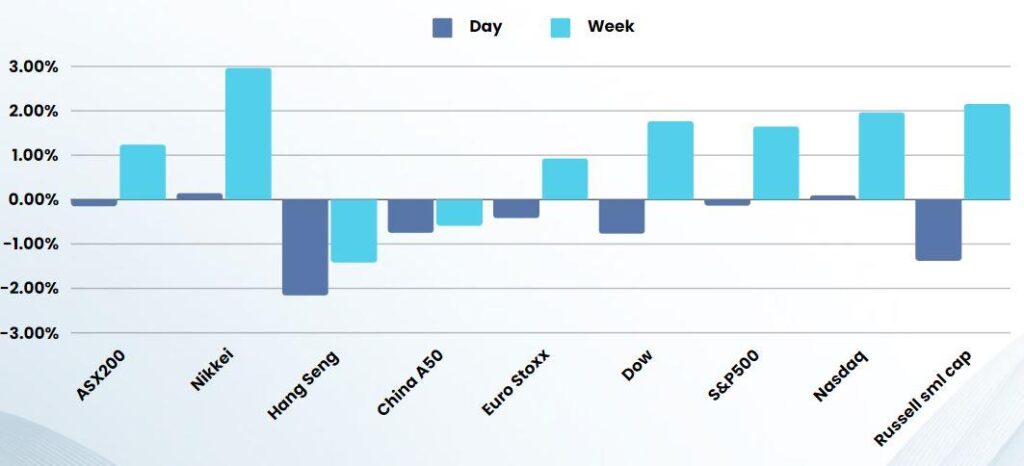

Overnight – Stocks eek out gain as profit taking caps rally

Equities edged higher but profit-taking capped gains on Friday after a week of record-setting advances fueled by a series of dovish central bank signals, while the dollar struggled to extend a gain as U.S. yields ticked lower.

A surprise rate cut by Switzerland’s central bank on Thursday helped push markets to new highs, as traders realized that major central banks around the world would not necessarily wait for U.S. Federal Reserve rate cuts before delivering their own.

Traders also drew confidence from the Bank of England being more dovish than expected, saying the economy is “moving in the right direction” for it to start cutting rates. On Wednesday, the Federal Reserve left the fed funds rate alone at 5.25% to 5.50% but indicated it was still prepared to lower rates by 75 basis points this year, despite a worrying uptick in U.S. inflation and economic growth solid enough to maybe even dodge a soft landing. It said that recent high inflation readings had not changed the underlying story of slowly easing price pressures.

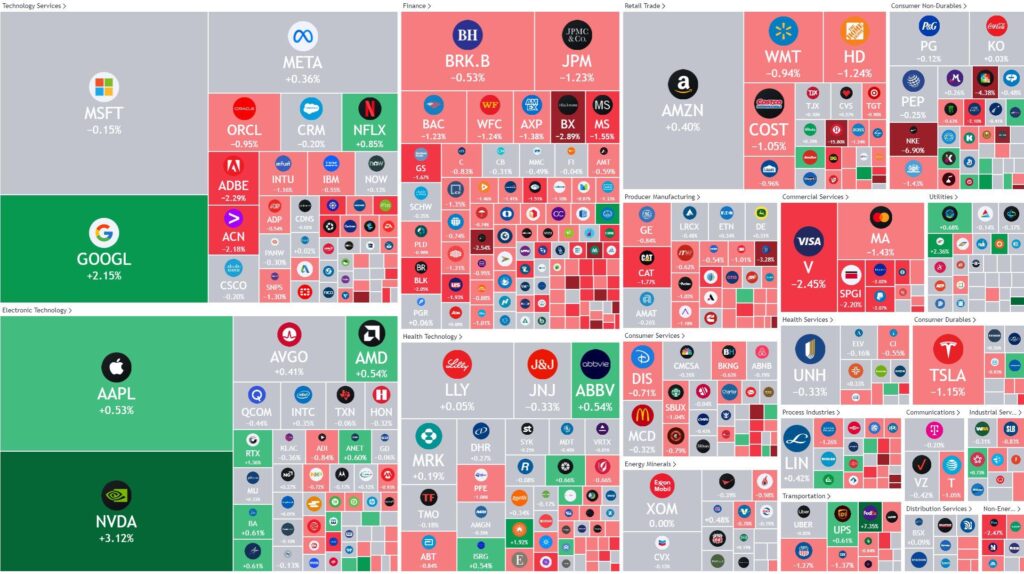

Fedex surged over 7% as the delivery and logistics firm clocked stronger-than-expected earnings, and also approved a $5 billion share buyback.

In Consumer Discretionary, Nike sank 7% after the sportswear retailer issued a warning for a decline in first-half revenue as it looks to ramp-up innovation efforts amid competition from upstarts including On and Hoka. Lululemon Athletica slid nearly 16% on weak annual revenue guidance of between $10.7 billion and $10.8 billion, slightly below forecasts for $10.9 billion.

Tech was boosted by further AI cheer as Nvidia rose more than 2% as it continued to push the broader chips sector higher after detailing plans to ship its new AI chips later in 2024. Micron Technology was marginally higher, adding to its recent gains following an unexpected to an unexpected profit in the December quarter, and forecasting strong revenues on AI-fueled demand. Apple closed above the flatline after plunging yesterday on regulatory concerns as the Department of Justice filed an antitrust lawsuit against the tech giant.

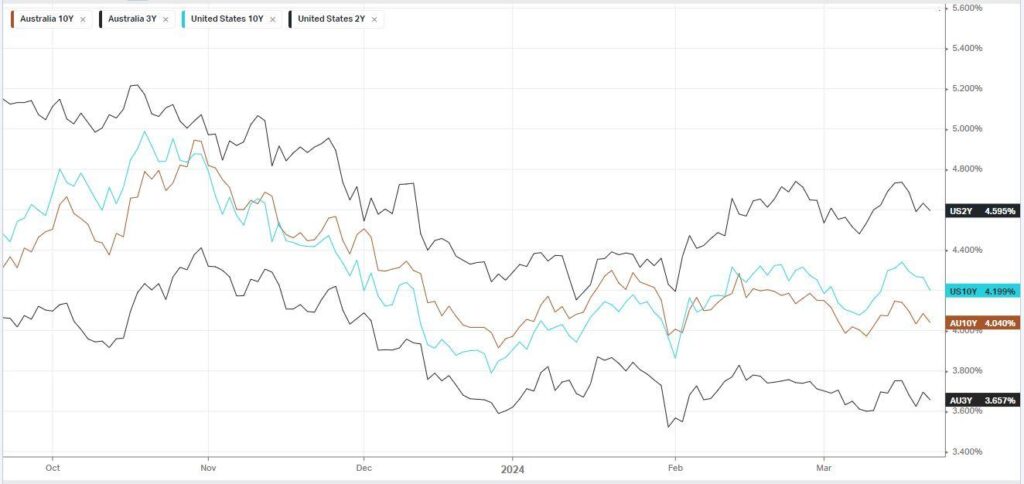

Bonds

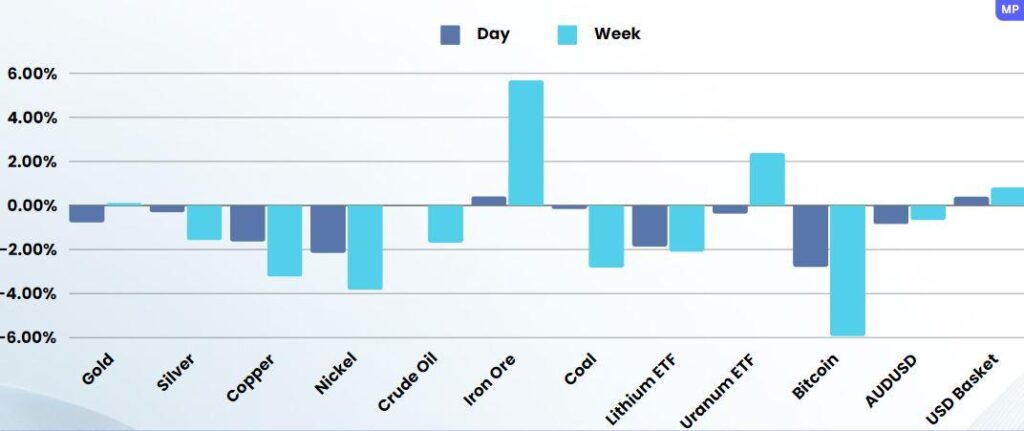

Commodities & FX

The Day Ahead

ASX SPI 7829 (+0.01%)

The AU market will have another shot at its all-time high this week, building on the momentum that has pushed major global equity benchmarks to fresh records as investors position for a world-wide rate cutting cycle.

it is likely to be a fairly quiet day with a shortened week and CPI data on Wednesday.

Company Specific:

- NRW Holdings and Perenti both trade ex-dividend.

- The Daily Telegraph has revealed that financial giant Macquarie is considering taking a large stake in Heathrow Airport.