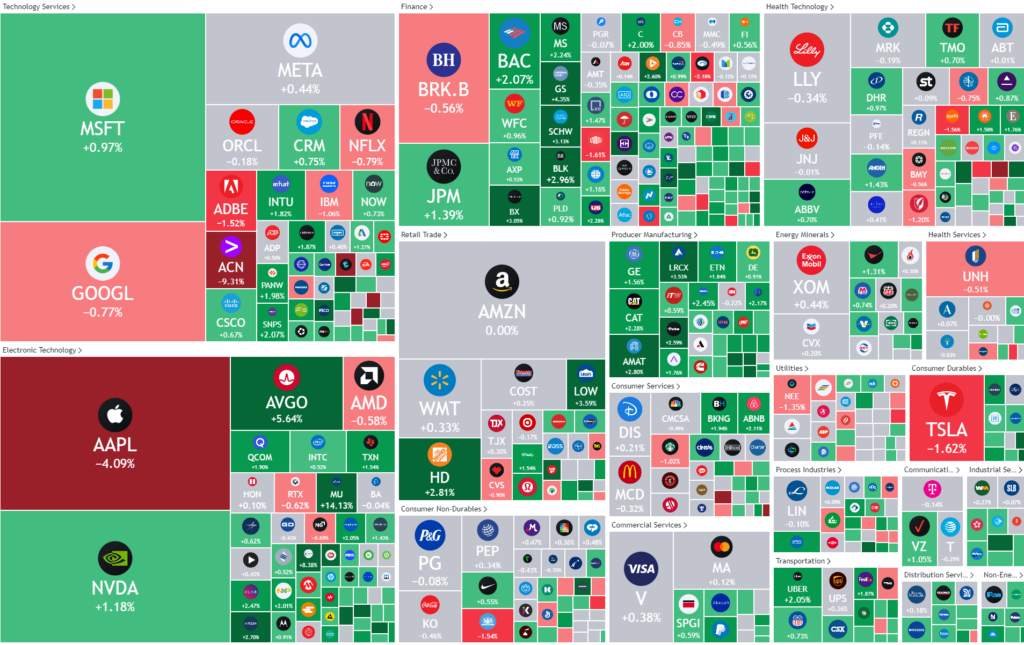

Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Stocks grind higher on the “Goldilocks scenario”

Equities edged higher overnight as risk appetite has been boosted by the prospect of lower interest rates and a resilient U.S. economy, or the “goldilocks scenario” after Fed officials maintained their forecasts for three rate cuts this year.

While the prospect of lower rates and a strong economy, seems like an obvious oxymoron to us here at MPC, the US market has always been an optimistic bunch and the rally may last weeks or months yet as investors

On the economic front, data continued to show strength in the labor market as new claims for unemployment benefits unexpectedly fell last week, while the Philli Fed index reading surprised to the upside, underscoring the recovery in manufacturing activity. Additionally, the Philadelphia Fed manufacturing index showed unexpected growth in March.

Apple fell more than 4% after the U.S. Department of Justice and 16 states on Thursday filed a lawsuit against the tech giant, alleging that it is illegally monopolizing the smartphone market. Apple in statement vowed to “vigorously” defend against the lawsuit, believing it to be “wrong on the facts and the law.”

Micron Technology stock soared 14%, climbing to a record high, after the chipmaker posted a surprise profit and forecast strong current-quarter revenue on soaring demand for its memory chips used in AI computing.

Reddit surged on its stock market debut Thursday, ending the day up 47% after opening up at $47, well above its IPO price of $35 a share. The social media company, which generates the bulk of its revenue of advertising, is aiming to leverage the AI wave by licensing its the data on its platform for the third-party companies seeking to build large learning models.

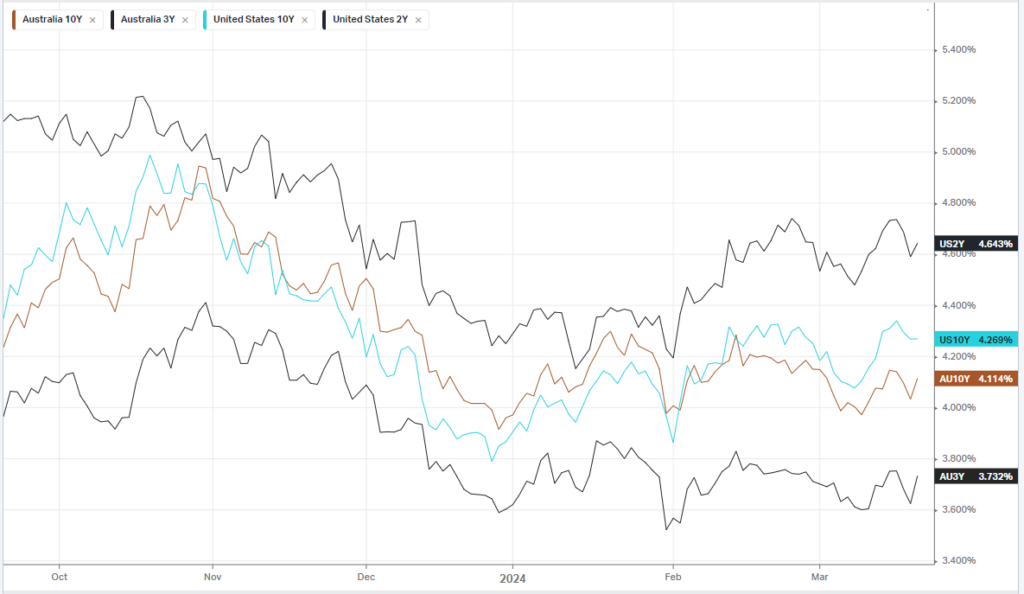

Bonds

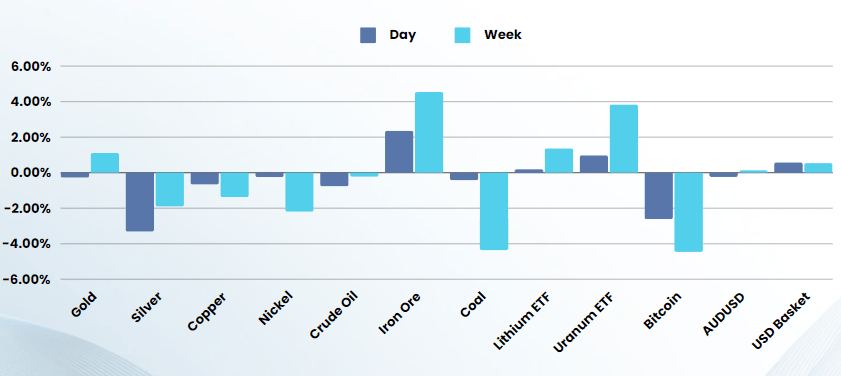

Commodities & FX

The Day Ahead

ASX SPI 7825 (-0.01%)

The AU market is likely to have a fairly quiet day with the possibility of a some profit taking into the weekend. The continued bounce in Iron ore and lithium should support the materials sector, however gold stocks may see some selling due to the stall in the gold rally

Company Specific:

- Fisher & Paykel Healthcarehas updated its earnings guidance for financial year 2024 to be in the range of approximately $NZ260 million ($239.1 million) to $NZ265 million. The forecast is up from the company’s previous net profit after tax projection of a range of approximately $NZ250 million to $NZ260 million.