Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Any news is good news for stocks as Fed lifts growth and inflation expectations

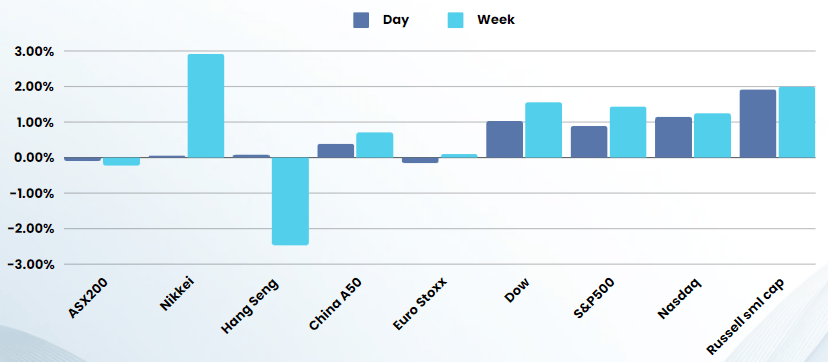

Equities bull run continued as investors sifted through last nights Fed meeting to find the positives, ignoring the higher growth and inflation expectation that are likely to push back the timing of rate cuts

The Federal Reserve kept rates steady overnight, and maintained forecasts for three rate-cuts this year, pointing to the central bank’s confidence that the recent strength in inflation is unlikely to derail the progress made so far. The Federal Open Market Committee, the FOMC, kept its benchmark rate in a range of 5.25% to 5.5%. The decision to keep rates steady for the fifth meeting in a row was widely expected as the Fed chair Jerome Powell previously hinted that March was too soon for the members to have enough confidence from incoming economic data to cut rates.

Fed members continue to see the benchmark rate falling to 4.6% next year, suggesting three rate cuts in 2024, unchanged from the prior projection in December. For 2025 and 2026, however, the Fed sees fewer rate cuts, forecasting rates to fall to 3.9% next year and 3.1% in 2026, up from prior forecasts of 3.6% and 2.9%, respectively.

The unchanged decision on the rate path for 2024 comes even as Fed members upgraded their forecasts for inflation and growth this year. The Feds preferred measure of inflation was forecast at 2.6% from 2.4% and GDP growth was revised up to 2.1% from 1.4% suggesting that rates will remain (as they have said 1000 times) “higher for longer”

At the press conference that followed the decision, Federal Reserve Chairman Jerome Powell said the fed could act sooner on rate cuts if the labor market unexpectedly weakened, although with 500k jobs being added in the last 2 months, this seems unlikely in the short term

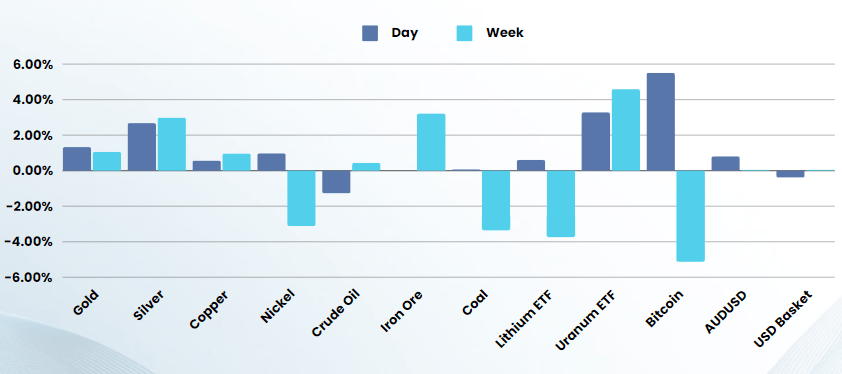

Gold and sliver rallied on the steady nature of the Fed meeting results, while oil pulled back after the recent strong run. Uranium stocks surged on Kazatomprom, the worlds second biggest producer, further reduced production guidance after a shock 20% reduction 2-months ago.

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7744 (+0.61%)

The ASX will have a positive day following the lead of the US after the Fed meeting. Gold, Lithium and uranium stocks should be some of the best performers with the underlying commodities.

While we think the market didn’t read enough of the detail and today may be a good opportunity to take profits into the bullish sentiment.

Company Specific:

- On Thursday, Brickworks, Sigma Healthcare and Washington H Soul Pattinson release earnings results. Cochlear trades ex-dividend.

- Hot defense stock Electro Optic Systems seeks $40m in equity raise The company’s shares have jumped 100 per cent this year and 362 per cent over the past 12 months. It was wall crossing fund managers on Tuesday night