Last Night's Market Recap

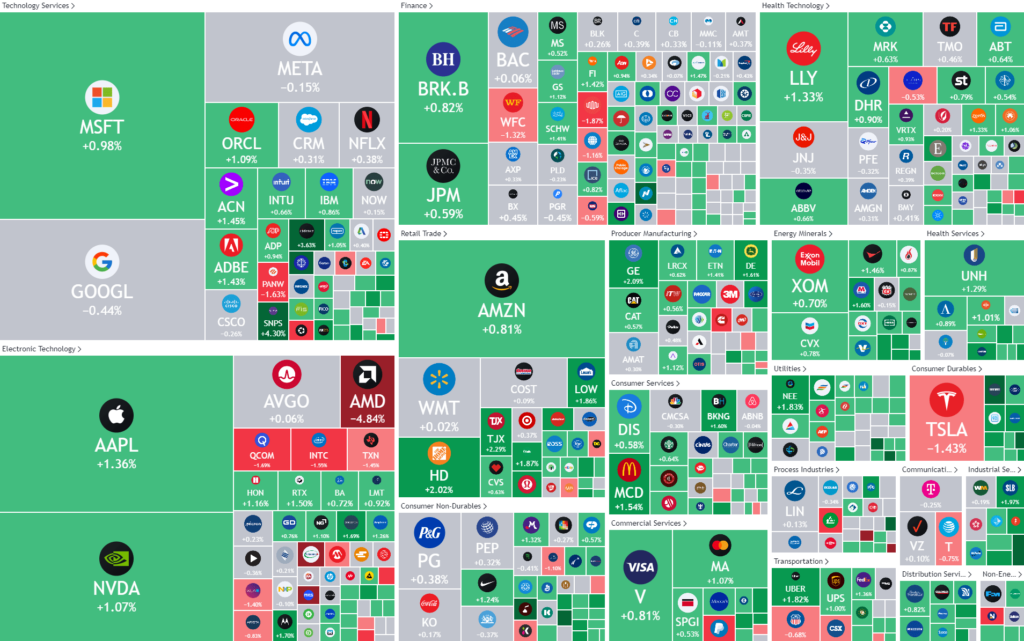

S&P 500 - Heatmap

Overnight – Investors juggle Central Bank nerves and AI enthusiasm

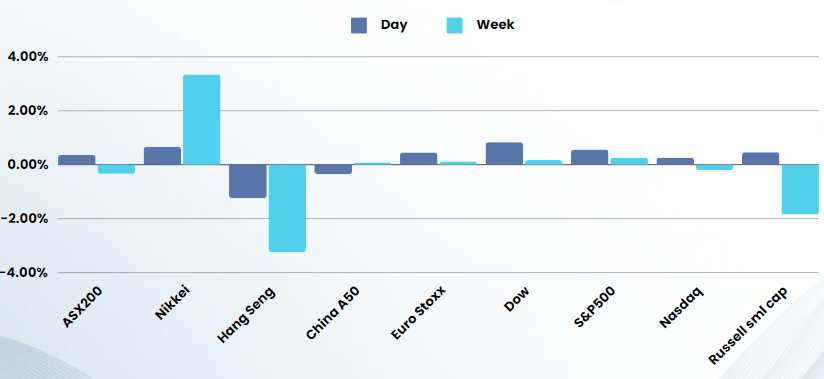

Equities finished higher with megacap growth stocks such as Alphabet and Tesla supporting a rebound in technology-heavy Nasdaq while investors also waited anxiously for the U.S. Federal Reserve’s meeting this week.

The Nasdaq snapped three straight days of losses. Google’s parent Alphabet provided a sizeable boost to the market after a media report that Apple is in talks to build Google’s Gemini AI engine into the iPhone. This supported the communication services sector, which ended up almost 3%, leading gains among the 11 major S&P 500 sectors after hitting its highest level since Sept. 2021. Tesla shares finished up 6.3%, leading S&P 500 percentage gains, after the electric carmaker said it would soon increase the price of its Model Y EVs in parts of Europe.

Nvidia shares added 0.7% but closed well below its session high. The artificial intelligence poster-child kicked off its annual developer conference as investors waited for new chip announcements from Chief Executive Jensen Huang. Investors were torn between enthusiasm about the prospects for AI on the technology sector and worries ahead to the Federal Reserve’s policy update on Wednesday, according to Lindsey Bell, chief strategist at 248 Ventures in Charlotte, North Carolina

The Philadelphia Semiconductor index gave up gains to end the day virtually unchanged while the S&P 500 technology index finished up 0.5%.

Of the S&P’s 11 major sectors the weakest were rate sensitive real estate and healthcare, with both off 0.02%.

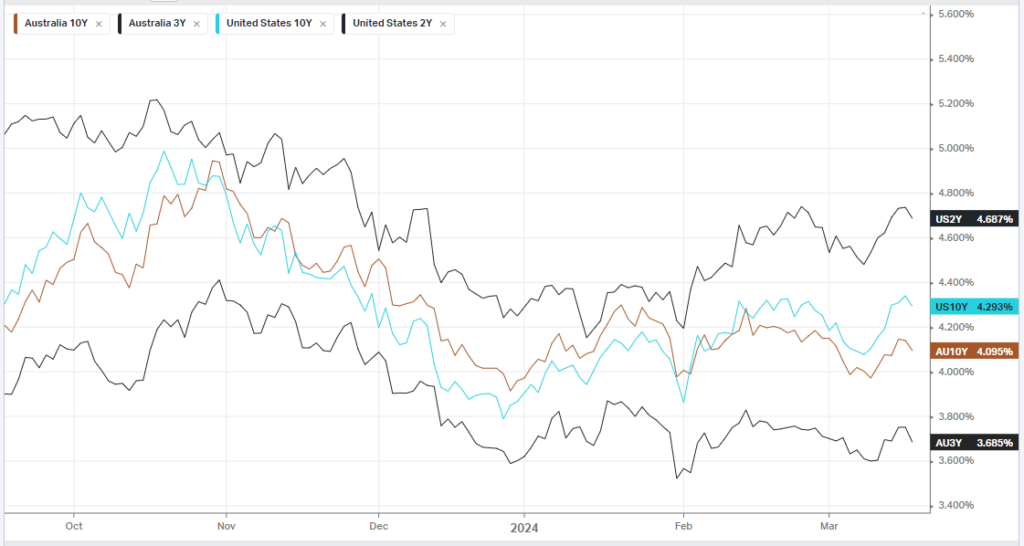

Stronger-than-expected inflation figures have prompted traders to rethink when and by how much policymakers will lower rates this year, with traders pulling back the probability for a June rate cut to around 51% from about 71% just a week ago, according to the CME FedWatch Tool.

Oil prices rose to multi-month highs for the second straight session on Tuesday as traders assessed how Ukraine’s recent attacks on Russian refineries would affect global petroleum supplies.

Bonds

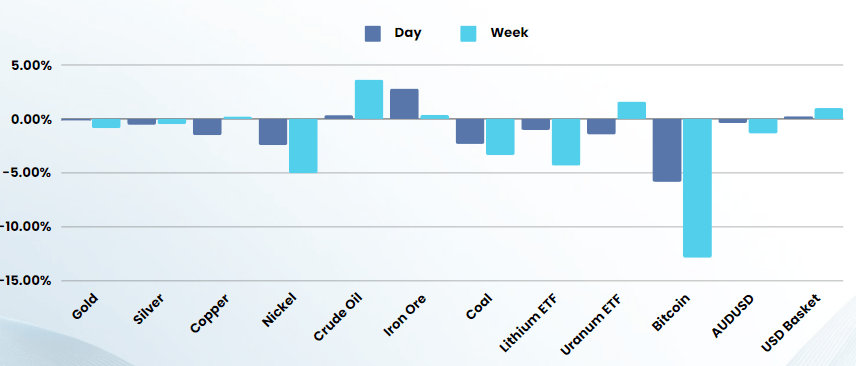

Commodities & FX

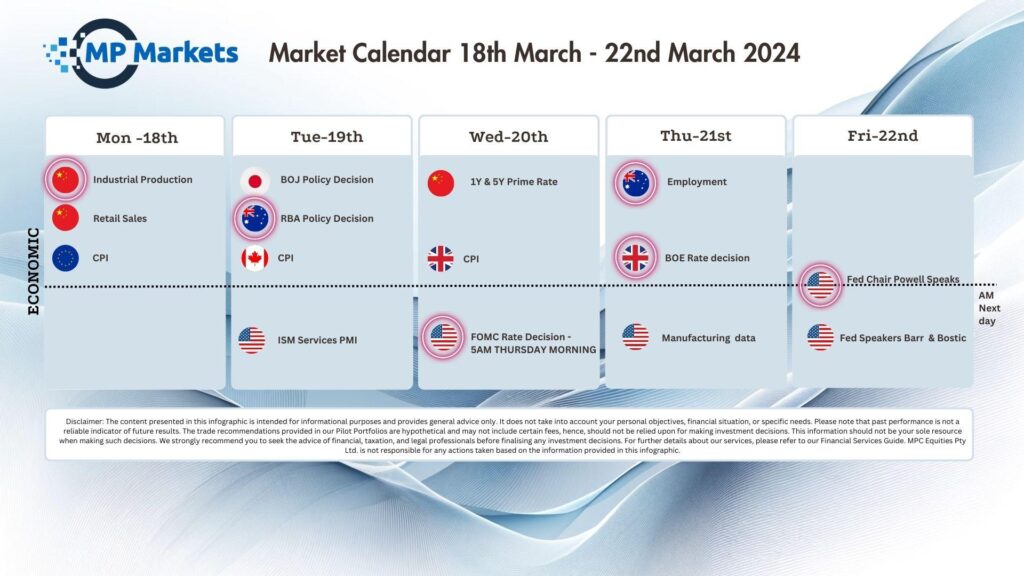

The Day Ahead

ASX SPI 7779 (+0.16%)

The Aussie market is likely to drift higher in the morning session before some risk-off selling into tomorrow mornings Fed meeting which will deliver the “dot plots” a more definitive timeline on rates. The RBA yesterday was ambiguous at best with Michelle Bullock saying “nothing is off the table” which gave room for market pundits to gleefully reverse engineer their view into the open ended comments.

Iron ore continued to bounce which will help the materials sector. Oil continued to rally on supply cuts, while lithium, gold and silver took a breather.

Tonights Fed meeting will have a large influence on markets, as equities have ignored rising yields, until the meeting. Any hawkishness will result in a sharp sell of

Company Specific:

- Shares of Kelsian Group and Macmahon Holdings trade ex-dividend on Wednesday.

- NAB, Virgin Money prevail in British lawsuit National Australia Bank and its former UK unit, Virgin-owned Clydesdale, have fended off what could have become a potentially costly class action.