Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Tech rebounds leading into deluge of Central Bank updates

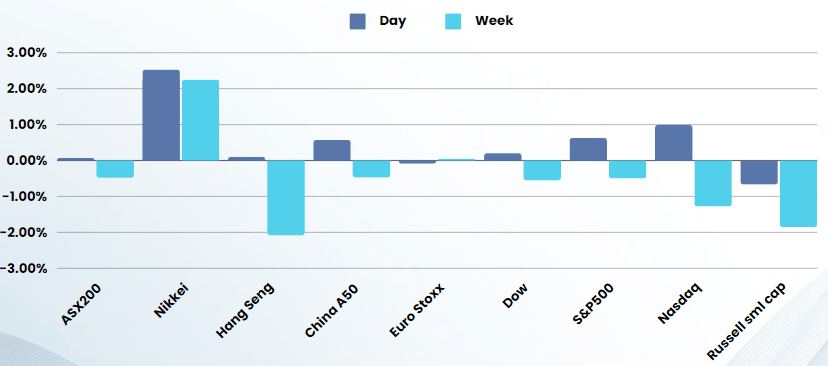

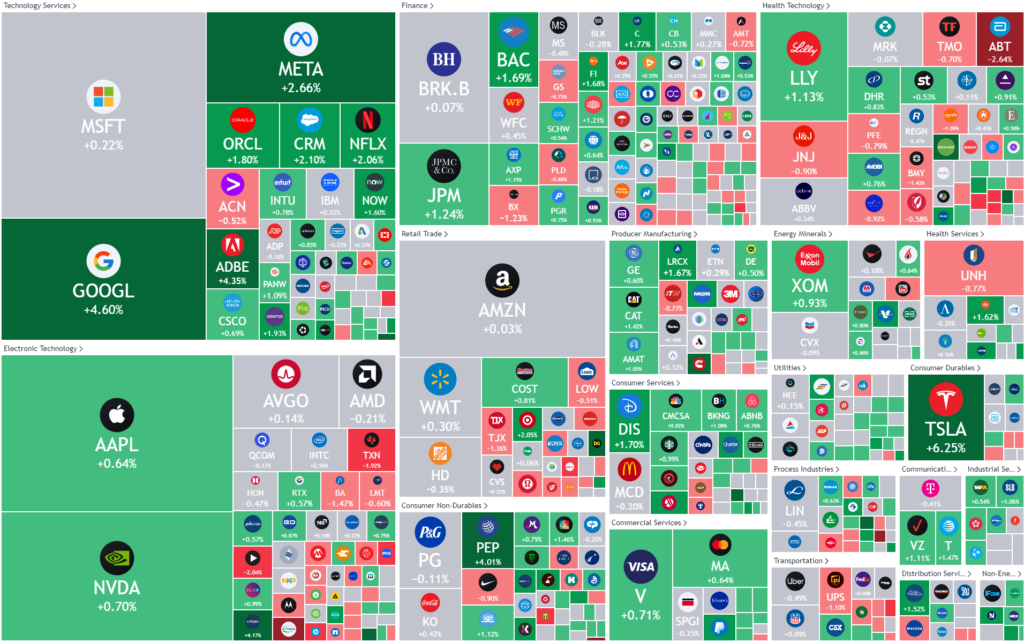

Equities finished higher led by tech as investors looked ahead to the Federal Reserve meeting and interest-rate outlook this week.

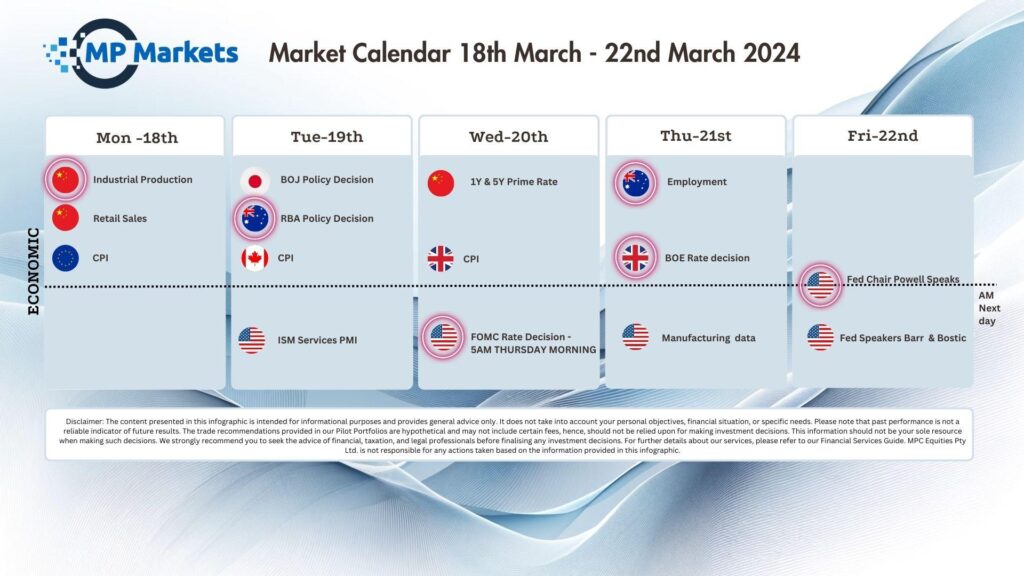

The Fed meeting kicks off its two-day meeting on Tuesday that will likely result in an unchanged interest rate decision on Tuesday. The meeting follows recent data showing that inflation continues to run hot, stoking investor jitters that the central bank may reduce its projection on how many rate cuts are needed this year. In December, the Fed members projected three cuts for this year, but some on Wall Street believe that could be reduced to two. The RBA, Bank of Japan and Bank of England also meet this week, with Japan expected to raise rates for the first time in 17 years.

Apple is in talks with Alphabet’s Google unit to use the latter’s Gemini generative artificial intelligence engine to incorporate AI features into its flagship iPhones, according to a report from Bloomberg Monday. Tesla rose 6% after the electric carmaker said it would increase the price of its Model Y EVs in some European countries by about 2,000 euros this week. The EV maker has been under pressure in recent weeks on concerns about demand amid rising competition.

Nvidia unveiled on Monday its latest artificial intelligence (AI) chips and software at its developer’s conference in San Jose, marking a significant step in reinforcing its leadership in the AI sector. The new AI graphics processors, named Blackwell, with the first chip, the GB200, are set to be released later this year. These chips promise to deliver a substantial performance boost, offering 20 petaflops of AI performance, a significant leap from the 4 petaflops provided by the current H100 model. The GB200 is designed to enhance the ability of AI companies to develop larger and more complex models, thanks to its built-in transformer engine, which is optimized for running transformers-based AI, crucial for technologies like ChatGPT. While impressive, there is increasing skepticism on Nvidia’s valuation as their largest customers are developing their own chips with the intention of only using Nvidia until internal products are complete and new software being written for AI is increasingly efficient and doesn’t require the huge processing power provided by Nvidia products.

Oil rallied to 5-month highs as Iraq and Saudi Arabia cut supply totaling over 3m barrels a day.

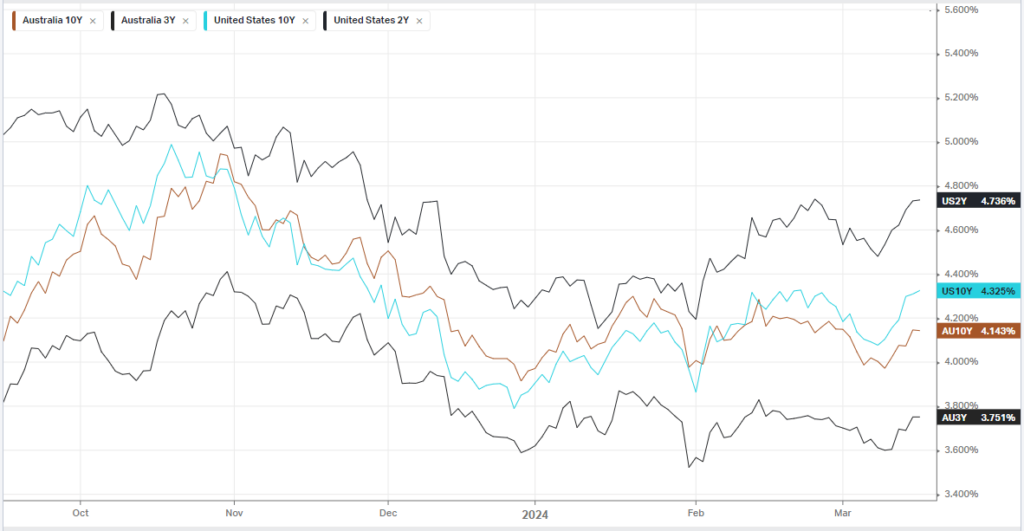

Bonds

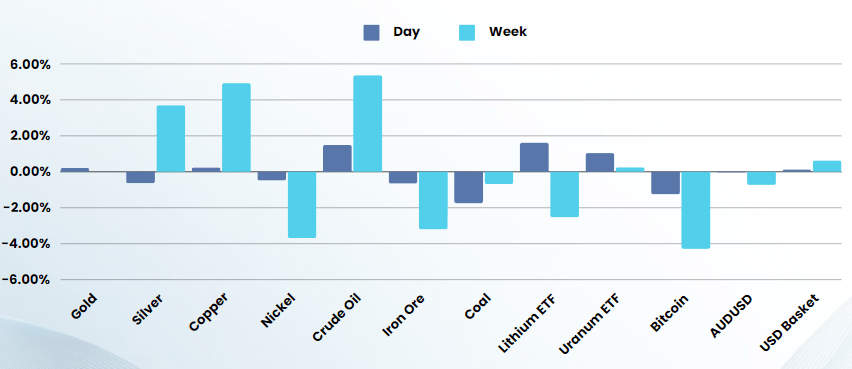

Commodities & FX

The Day Ahead

ASX SPI 7687 (+0.03%)

The ASX is likely to get a lift into the RBA decision today with a positive offshore lead, stronger oil prices and a small bounce in Iron Ore. Lithium and uranium also rallied, while gold and copper edged higher.

The RBA will decide on interest rates today, with no change expected. The press conference will be held at 1430 AEDST

Company Specific:

- KMD Brands, the name behind Kathmandu and Rip Curl, booked a 14.5 per cent decrease in group sales to $NZ468.6 million ($434.67 million) in its interim half-year results.

- The retailer recorded its underlying earnings before interest tax and amortisation at $NZ15.1 million, down 66.8 per cent year-over-year, due to lower sales. It said no interim dividend was to be declared as a result of its operating performance.

- Boral‘s board has recommended shareholders reject Seven Group Holdings’ takeover bid of the company. The ASX-listed cement company said independent expert Grant Samuel has concluded the SGH offer is “not fair and not reasonable”. It has assessed fair value for Boral in the range of $6.50 to $7.13 per share.

- MinerNew Hope has declared an interim dividend of 17¢ a piece. It will be payable to shareholders on May 1. Underlying earnings before interest, tax and amortisation was recorded at $424.8 million. Net profit was booked at $251.7 million.

- Shares of Auckland International Airport, Credit Corpand SEEK all trade ex-dividend on Tuesday.