What's Affecting Markets Today

Asian markets mostly lower after strong PPI

Asia-Pacific stocks dipped on Friday, influenced by a notable uptick in U.S. producer prices for February. The Producer Price Index (PPI) increased by 0.6%, surpassing expectations, while the core PPI, excluding food and energy, rose by 0.3%, against economists’ forecasts of a 0.2% rise, as surveyed by Dow Jones.

Market focus in Asia remains on Japan’s ongoing spring wage negotiations, with initial outcomes anticipated later today. Amidst these developments, Japan’s Nikkei 225 experienced a 0.3% decline, though the Topix saw a marginal 0.2% gain, following the finance minister’s declaration that Japan has exited deflation, marking a significant policy shift.

South Korea’s Kospi dropped by 1%, and the Kosdaq decreased by 0.55%. The People’s Bank of China maintained its one-year medium-term lending facility rate at 2.5%. In Hong Kong, the Hang Seng index fell by 0.96%, while the CSI 300 in mainland China remained steady, showing little change from its previous position.

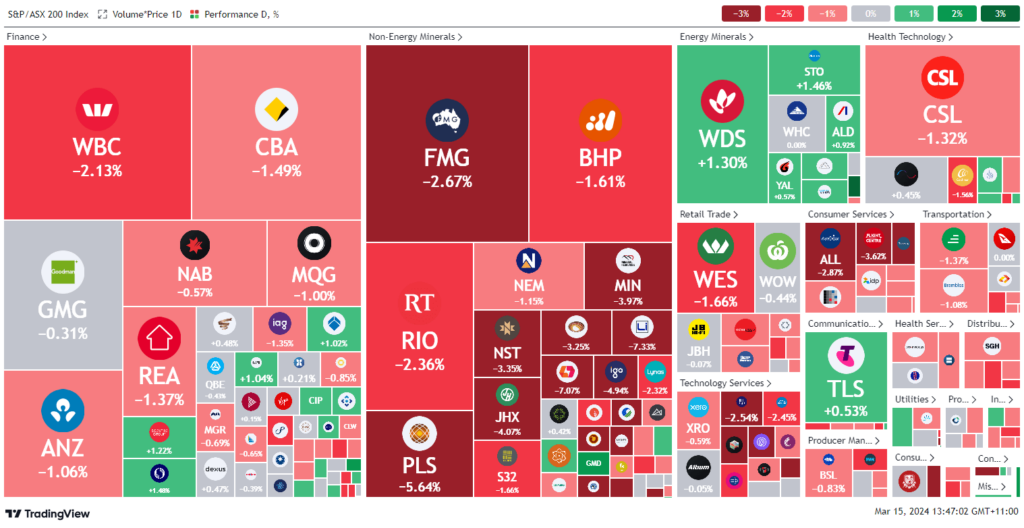

ASX Stocks

ASX 200 - 7,631.9 (-1.1%)

Key Highlights:

Australian shares experienced a downturn, falling 1.5% by midday, amid concerns over unexpected U.S. inflation surges potentially delaying anticipated Federal Reserve rate cuts in 2024. Additionally, apprehensions about China’s economic stability further dampened sentiment, as iron ore miners faced significant losses, with prices dropping to $US102.55 per ton in March.

The materials sector saw a 2.5% decline, influenced by falling lithium futures in China. Contrarily, the energy sector recorded gains, buoyed by oil prices reaching their highest in 2024, with Woodside Energy seeing a slight increase of 0.4% to $29.26.

Banking stocks also suffered, following UBS’s negative outlook on valuation risks, recommending a sell on NAB, Westpac, and CBA. In other news, Iress is set to sell its UK mortgage operations to Bain Technology for $164 million, resulting in a modest 0.5% decrease in its share price. Tabcorp’s shares plunged 7.2% following the resignation of its CEO over misconduct allegations, while EML Payments announced the sale of its Sentenial payments division for $54.1 million, leading to a 6.4% increase in its shares. Pilbara Minerals accepted an offer for its spodumene concentrate at $US1200 per ton, signaling optimism in the lithium market.

Leaders

A4N Alpha Hpa Ltd 5.78%

CEN Contact Energy Ltd 5.14%

DYL Deep Yellow Ltd 3.23%

SNZ Summerset Group Holdings Ltd 3.02%

CNI Centuria Capital Group 2.91%

Laggards

LTR Liontown Resources Ltd -7.51%

LTM Arcadium Lithium Plc -7.08%

TAH Tabcorp Holdings Ltd -5.88%

EMR Emerald Resources NL -5.82%

PLS Pilbara Minerals Ltd -5.76%