What's Affecting Markets Today

Asian session mostly range bound

In the Asia-Pacific region, markets showed limited movement on Thursday, following a decline in the momentum of Wall Street’s technology-led surge. Attention was particularly directed towards Japan’s spring wage discussions, concluding on Wednesday, with anticipations set for the initial comprehensive estimate on Friday. Preliminary reports from local media suggest significant wage increases by large corporations.

Such wage growth is pivotal for the Bank of Japan (BOJ) as it contemplates retracting its expansive monetary policy, ahead of its meeting scheduled for the upcoming Monday and Tuesday. Following these developments, Japan’s Nikkei 225 experienced a minor decrease of 0.3%, reflecting market expectations of potential BOJ policy tightening, while the Topix index hovered around a break-even point.

Elsewhere, South Korea’s Kospi index saw a rise of 0.46%, though the Kosdaq faced a 0.71% reduction. The Hang Seng index in Hong Kong gained 0.28%, recovering from a previous halt in its winning streak, and China’s CSI 300 index increased by 0.3%.

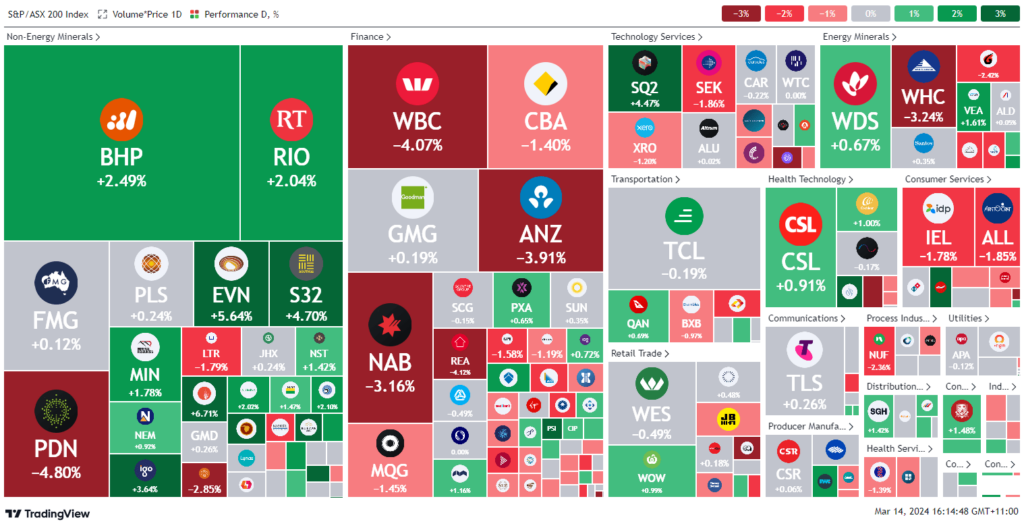

ASX Stocks

ASX 200 - 7,713.6 (-0.2%)

Key Highlights:

At midday, the S&P/ASX 200 saw a modest increase of 0.3%, driven by gains in the retail, healthcare, and banking sectors, although these were partially offset by declines in energy and resources. Notable rises included JB Hi-Fi, Premier Investments, and Accent Group, each climbing over 2%. This uptick mirrored a positive trend on Wall Street, influenced by US inflation data reporting a 3.2% year-on-year increase for February. Concurrently, oil prices fell, while gold remained steady at $2162 an ounce. Iron ore prices declined by 4% to $104.75 per tonne in Singapore futures, with predictions of a further drop below $100. Despite higher bond yields following robust CPI data, equity markets remained resilient. Liontown Resources surged 10% to $1.44, announcing a $550 million debt funding agreement with leading banks. In the wine sector, Treasury Wines and Australian Vintage experienced share price increases, buoyed by optimism over the potential lifting of Chinese tariffs on Australian wines.

Leaders

CUV Clinuvel Pharmaceuticals Ltd 10.91%

A4N Alpha Hpa Ltd 9.55%

SFR Sandfire Resources Ltd 6.71%

PSI PSC Insurance Group Ltd 5.83%

RED RED 5 Ltd 5.71%

Laggards

ABB Aussie Broadband Ltd -17.09%

SLX SILEX Systems Ltd -10.06%

PNV Polynovo Ltd -7.23%

APE Eagers Automotive Ltd -6.76%

ING Inghams Group Ltd -5.39%