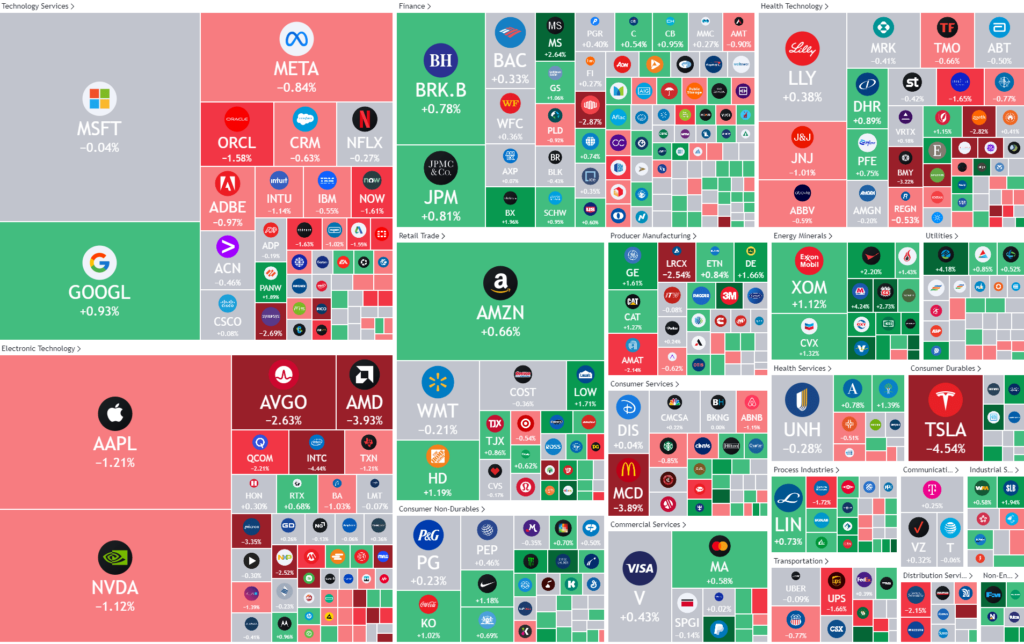

Last Night's Market Recap

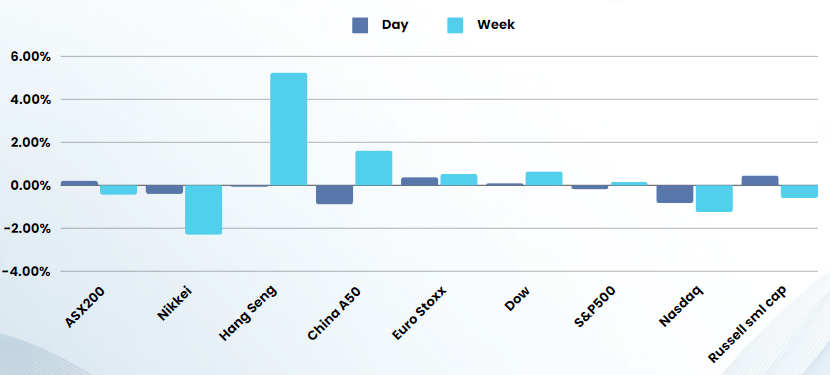

S&P 500 - Heatmap

Overnight – Tech stocks drift lower on pressure from higher yields

Tech stocks drifted lower overnight under the pressure of rising bond yields due to hotter than expected inflation numbers in the previous session increased concerns around Thursdays PPI numbers

The DOW closed higher for a third-straight day, underpinned by energy stocks, led by Valero Energy, Marathon Petroleum, APA Corporation, driven by a jump in oil prices after an unexpected decline in weekly U.S. inventories. Weekly U.S. crude supplies fell by 1.5M barrels last week, the Energy Information Administration reported Wednesday. As well as falling domestic supplies, Ukrainian attacks on Russian refineries also boosted oil prices.

In tech stocks, Shares of Tesla fell over 4% Wednesday after Wells Fargo downgraded the EV giant to the equivalent of a sell rating calling the company a “growth company with no growth.” Nvidia fell more than 1% to weighing on the broader tech sector even as BofA Securities lifted its price target on the chip maker to $1100 from $925 ahead of next week’s GTC conference. Intel Corp, meanwhile, fell more than 4% to add further pressure on chip stocks following media reports that the Pentagon scrapped plans for a $2.5 billion chip grant for the company.

The U.S. House of Representatives passed a bill that could ban TikTok in the United States unless its Chinese owner Bytedance sells the company within six months amid national security concerns. Still, the bill — dubbed Protecting Americans from Foreign Adversary Controlled Applications Act — faces an uncertain path in the Senate amid division among lawmakers. A ban on TikTok in the U.S., would likely prove a boon for rival social media platforms including Meta, Instagram and Google, Youtube

Ahead of the Fed’s meeting next, investors will parse the producer price index data and retail sales data for February due Thursday, for further clues on inflation and the strength of consumer spending, respectively. The data come ahead of the Fed’s meeting on Mar.19-20, when the central bank is expected to keep interest rates unchanged. Traders are pricing in a 60% chance of a 25 basis point cut in June

Bonds

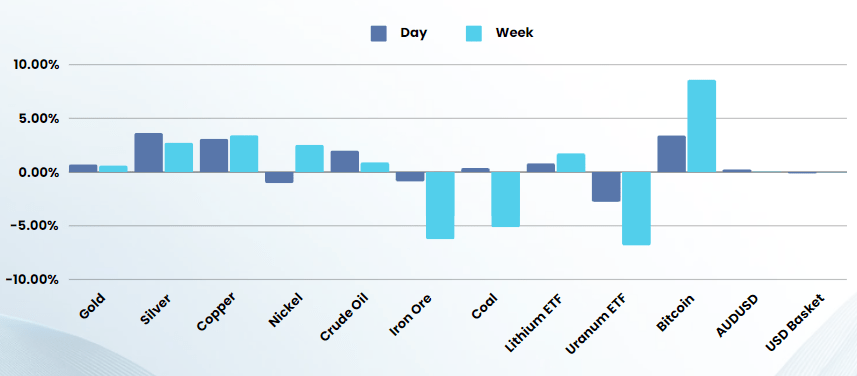

Commodities & FX

The Day Ahead

ASX SPI 7759 (+0.28%)

The ASX edge higher, shrugging off US sharemarkets, which mostly closed modestly lower, as investors await pending February retail sales data to ascertain whether it will further dent hopes for a pivot to rate cuts. Copper prices have jumped to an 11-month high after Chinese smelters flagged possible production cuts to explore to cope with the drop in processing fees. Fears that the production cuts could lead to undersupply triggered price to jump as much as 3 per cent to trade nar $US4.05 per pound, after executives from multiple Chinese plants discussed the issue in Beijing on Wednesday.

Company Specific:

- Myerreleases earnings results. Aristocrat Leisure hosts a management roundtable.

- Shares of Breville, Eagers Automotive, Inghams, Regis Healthcare, Southern Cross Mediaand TPG Telecom all trade ex-dividend on Thursday.