What's Affecting Markets Today

Iron Ore Market Downturn

Dalian iron ore futures have plummeted to a five-month nadir, driven by diminished demand within China, the world’s foremost consumer. The May contract on the Dalian Commodity Exchange dipped 3.35% to 822 yuan ($114.54) per ton, marking its lowest since mid-October. This decline is attributed to a sluggish recovery in demand from downstream sectors, indicating a broader issue of weakening raw material demand. Conversely, Singapore’s April iron ore futures saw a slight uptick of 0.42%, reaching $107.7 a ton, buoyed by anticipations of a US Federal Reserve rate cut. This juxtaposition highlights the diverse impacts of global economic policies on raw material markets.

Gold’s Glimmer Amidst Uncertainty

Gold futures are on an upward trajectory, having surged by 6% in February, amidst lower US bond yields and a depreciating dollar. Vivek Dhar of Commonwealth Bank attributes this rise to a mix of safe-haven appeal and increased Chinese demand, projecting gold to potentially hit between $2200 and $2300 per ounce by year-end. This optimism is tempered by the prospect of fluctuating gold prices, especially if Middle Eastern tensions ease, reducing demand for gold as a safe haven. The forthcoming US inflation data and the Federal Reserve’s potential interest rate cuts are pivotal to gold’s future value, with a weaker dollar bolstering gold prices through 2024.

Bitcoin Breakthrough to New Heights

Bitcoin has astonishingly breached the $72,000 mark for the first time, driven by a notable influx into US exchange-traded funds (ETFs), marking a nearly 70% gain this year. This rally is part of a broader crypto market upsurge, alongside advances in other digital currencies like Ether, Solana, and Avalanche. The enthusiasm in the crypto space is further amplified by the London Stock Exchange’s decision to entertain Bitcoin and Ether ETF applications and Thailand’s allowance for retail investment in overseas crypto ETFs. The anticipation around Bitcoin’s upcoming “halving” event, which cuts its supply growth by half, adds to the fervor, hinting at continued institutional support and potentially higher prices.

ASX Stocks

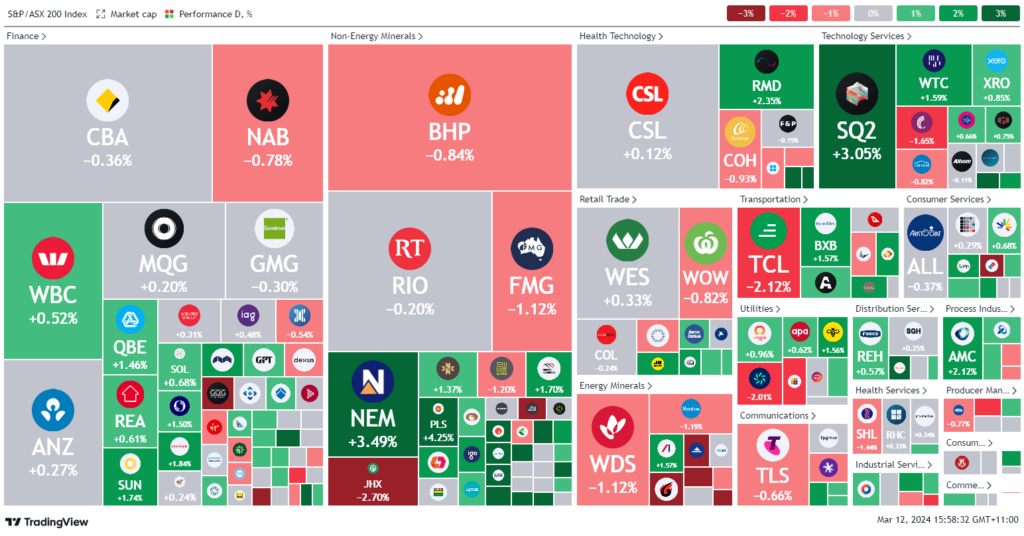

ASX 200 - 7,708.7 (+0.1%)

Key Highlights:

In Tuesday’s afternoon session, the Australian stock market remained stable, with the S&P/ASX 200 slightly up by 1.7 points, despite the banking sector’s early gains diminishing and energy stocks declining ahead of the anticipated US inflation report. This report is expected to influence the Federal Reserve’s interest rate decisions. The market’s stability comes after a significant sell-off on Monday, where nearly $50 billion was erased, marking the largest loss in over a year as profits were taken. Notably, banking shares had previously soared to record highs with the expectation of interest rate cuts by central banks. In other developments, former Reserve Bank of Australia governor Philip Lowe joined Geoff Wilson’s $470 million charitable funds management vehicle, and Bellevue Gold led the ASX 200 performers with a 10.5% increase following a production update. The market also reacted to Alcoa’s formal $3.3 billion all-stock bid for Alumina, boosting Alumina’s shares. Additionally, anticipation builds for the US consumer price index report, which is crucial for future Federal Reserve rate decisions. In the backdrop, the iron ore price slump and concerns over China’s property market and construction season impact the mining sector, while the crypto market sees new highs with Bitcoin and Ether.

Leaders

MSB-Mesoblast Ltd (+28.13%)

NVX-Novonix Ltd (+14.21%)

BGL-Bellevue Gold Ltd (+10.14%)

IMU-Imugene Ltd (+9.52%)

DRO-Droneshield Ltd (+9.30%)

Laggards

YAL-Yancoal Australia Ltd (-7.82%)

BDM-Burgundy Diam. Mines Ltd (-7.69%)

BCK-Brockman Mining Ltd (-7.41%)

CXL-CALIX Ltd (-7.35%)

BOC-Bougainville Copper Ltd (-6.94%)