What's Affecting Markets Today

Asian markets start week weaker

In the Asia-Pacific region, market performances were varied on Monday following a pause in Wall Street’s recent upward trend. Japan’s stock market faced significant declines, with the Nikkei 225 tumbling 2.18%, dropping below the 39,000 threshold for the first time since February 21, and the Topix index decreasing by 1.9%. This downturn occurred despite Japan dodging a technical recession, as revised data revealed a 0.4% economic growth in the final quarter of the previous year, potentially paving the way for the Bank of Japan to consider an interest rate hike. Meanwhile, China reported a 0.7% increase in its consumer price index for February, marking its first inflationary month after four months of deflation, surpassing economist expectations of a 0.3% rise. In contrast, South Korea’s Kospi slightly fell by 0.21%, while its Kosdaq index saw a modest gain of 0.17%.

ASX Stocks

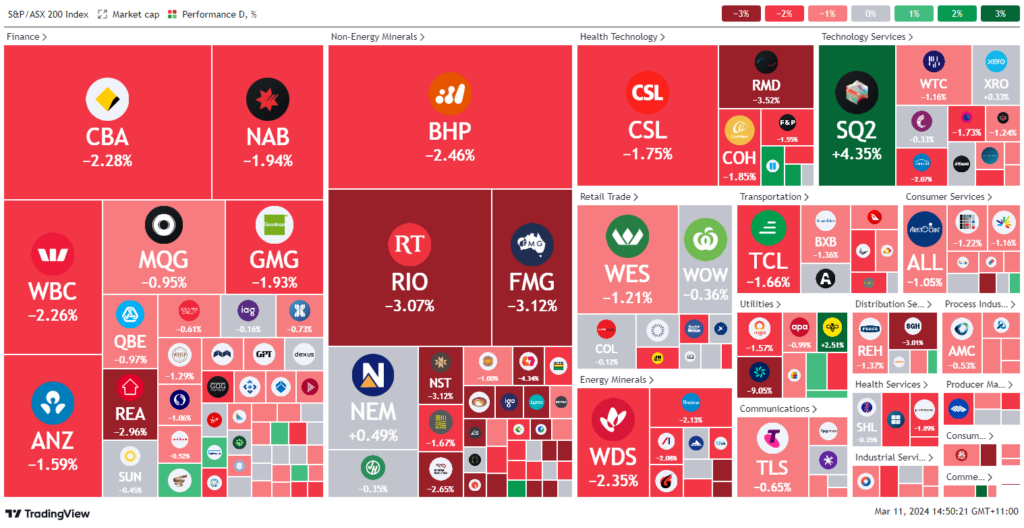

ASX 200 - 7,704.2 (-1.8%)

Key Highlights:

The Australian stock market experienced a downturn on Monday, with the S&P/ASX 200 Index falling by 1.7% to 7,715.8 in early afternoon trading, retreating from the previous week’s record high. The decline was led by significant losses in the materials and energy sectors, primarily influenced by a drop in iron ore and crude oil prices. Specifically, iron ore futures in Singapore fell by 2.1% to $US112.75 per tonne, impacting major mining companies BHP and Fortescue Metals, which saw their shares decrease by 2.6% and 3.1%, respectively. Energy stocks also suffered, with Woodside Energy and Santos experiencing drops of 2.5% and 2.2% as Brent crude oil futures dipped below $US82 a barrel. Banking stocks were not spared, with Commonwealth Bank, National Australia Bank, ANZ, and Westpac all recording declines. Meanwhile, software firm TASK soared by 91.3% following its acquisition agreement with PAR Technology, and Regional Express gained 5.1% after announcing a code-sharing deal with Etihad Airways.

Leaders

JDO Judo Capital Holdings Ltd 4.40%

SQ2 Block Inc 4.32%

CTD Corporate Travel Management Ltd 2.98%

MCY Mercury NZ Ltd 2.51%

EBO Ebos Group Ltd 2.43%

Laggards

MEZ Meridian Energy Ltd -9.05%

BGL Bellevue Gold Ltd -5.15%

CIA Champion Iron Ltd -5.10%

LTM Arcadium Lithium Plc -4.34%

CRN Coronado Global Resources Inc -4.23%