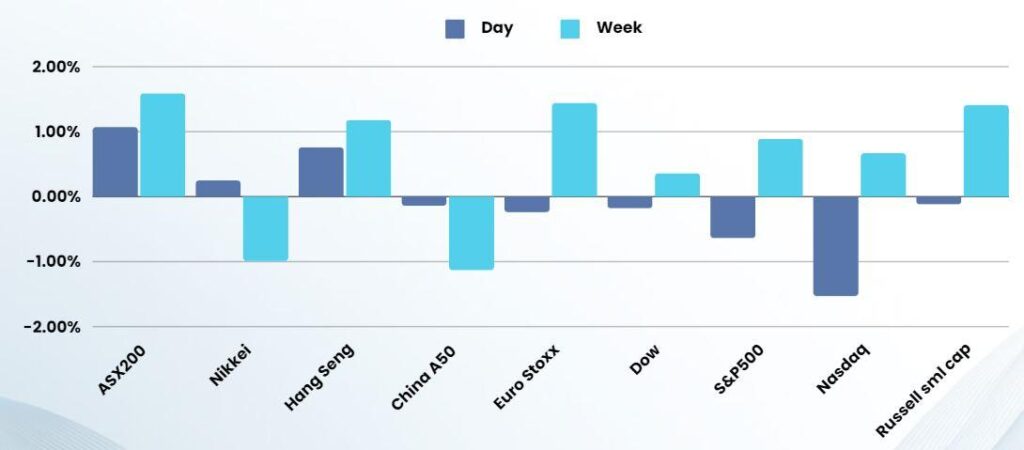

Last Night's Market Recap

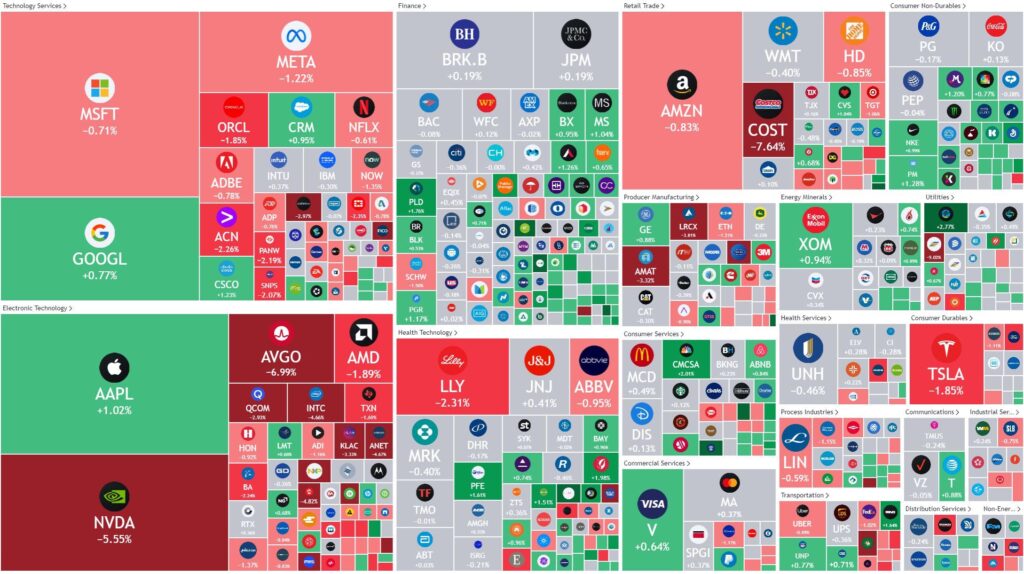

S&P 500 - Heatmap

Overnight – Nasdaq index Market Cap Exceeds value of US Economy Amid Tech Rally

Stocks initially stretched the record-breaking run early in the session Friday, before profit taking emerged, while U.S. Treasury yields dipped despite investors and pundits scraping through the numbers to find a positive spin

Commentators described the number as “not-too-hot, not-too-cold U.S. jobs data reinforcing the conviction that the Federal Reserve will begin easing by mid-year”. The facts are that half a million jobs have been added to the economy in 2 months, Job openings remain at nearly double the historical average, wages rose and the unemployment rate is below “full-employment”

Nonfarm payrolls rose by 275,000 in February, increasing from a downwardly revised total of 229,000 in January, according to data from the Labor Department’s Bureau of Labor Statistics. Economists had called for a reading of 198,000. The better-than-expected jobs added last month kept a lid on wage growth, while unemployment rate unexpectedly ticked up. In February, job gains were widespread across a variety of sectors, including health care, government, food services and transportation, while employment in other major industries like manufacturing and professional services was little changed.

The chip sector took a tumble with many not providing guidance. This triggered a chorus of investment bank analysts to release “buy the dip, on future AI income” as the results didn’t not fit into their expectations. Broadcom stock fell just under 7% as investors noted that the semiconductor group did not raise its full-year guidance target despite posting better-than-expected fiscal first-quarter results, suggesting wariness about the future. Marvell Technology fell 11% after its first-quarter guidance fell short of analyst estimates guidance offsetting stronger-than-expected Q4 results. AI poster child NVIDIA fell nearly 6% from record highs as many speculate whether the chip maker will split its stock as its shares nears the $1,000 price level.

The disconnect between Wall St’s high expectations of revenue and profits that AI will bring, versus the reality and timing of such results is one of the largest market risks seen in the last 2 decades.

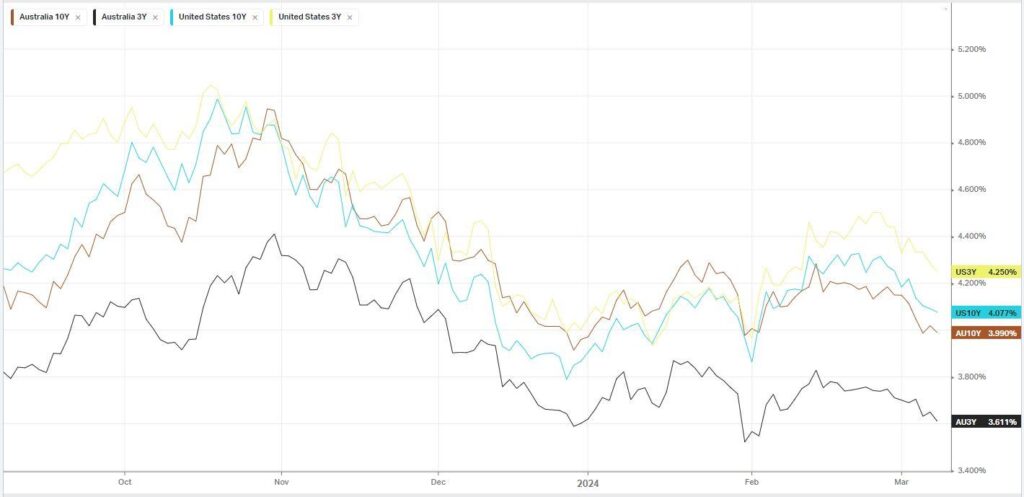

Bonds

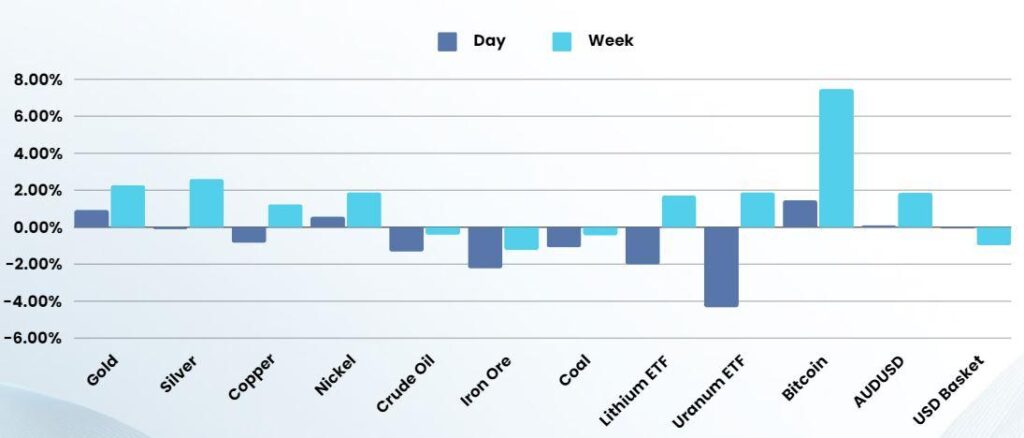

Commodities & FX

The Day Ahead

ASX SPI 7811 (-0.57%)

The ASX is likely to see some profit taking on the open and settle into a grind higher day as the losses in the US market were semi-conductor related.

This week could be pivotal if profit taking emerges in global equity markets, we will have an eye on bond yields and news out of China as potential influences on the market