What's Affecting Markets Today

Fed’s Potential Rate Cuts Amid Banking Crisis

Federal Reserve Chairman Jerome Powell has indicated plans to reduce U.S. interest rates in a “careful and thoughtful” manner, aiming to wait until there’s more confidence that inflation is consistently heading towards the Fed’s 2% target. Despite a notable easing in inflation without significantly impacting the unemployment rate, the resurgence of the U.S. regional banking crisis might pressurize the Fed into accelerating these rate cuts. Powell has maintained that the strength of the U.S. economy and job market provides the Fed with the flexibility to navigate rate adjustments cautiously. Market anticipation grows for a potential rate cut announcement by June, reflecting the Fed’s responsive stance to evolving economic indicators.

Nvidia’s Record Stock Rally and Insider Sales

Nvidia’s stock has been on a remarkable rally, achieving new record highs and pushing the company’s market value to $2.2 trillion, only behind tech giants Microsoft and Apple. This surge, attributed to strong sales forecasts for its AI computing chips, has prompted significant insider trading, with two directors recently selling shares worth around $274.2 million. Despite the massive sell-offs, which include other directors unloading shares worth about $80 million following Nvidia’s earnings report, the company continues to experience unprecedented market success. This rally underscores the booming demand for Nvidia’s AI technology and its impact on the stock market.

Australian Banks Reach New Milestones

In the Australian banking sector, the Commonwealth Bank of Australia (CBA) and the National Australia Bank (NAB) have hit new financial milestones, with CBA’s shares reaching a record high and NAB achieving a post-GFC high. This optimism in the banking stocks comes despite concerns over the closure of the Reserve Bank of Australia’s pandemic-era term funding facility, which analysts predict could affect bank margins. However, a robust housing market and immigration levels appear to buoy investor confidence, suggesting that the banks’ earnings prospects remain strong. This trend highlights the resilience and potential growth within Australia’s financial institutions amid global and domestic economic challenges.

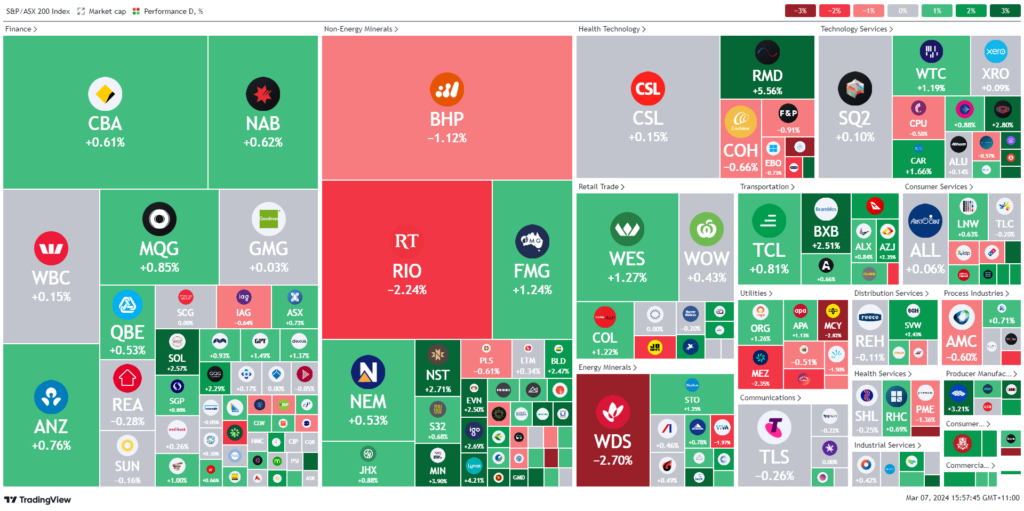

ASX Stocks

ASX 200 - 7,761.3 (+0.36%)

Key Highlights:

Australian shares saw modest gains, with the ASX up by 0.2% at lunchtime, buoyed by optimism in the tech sector and anticipations of upcoming rate cuts announced by US Federal Reserve Chairman Jerome Powell. Leading the surge, Commonwealth Bank (CBA) shares reached a new record high at $119.37, despite being rated as a sell by analysts. Westpac and National Australia Bank (NAB) also saw their share prices increase, hitting their highest levels since 2015 and the post-GFC era, respectively. This bullish sentiment is attributed to expectations that interest rates have peaked, with a favorable outlook for lower rates enhancing the appeal of banking stocks, which offer around a 4% yield. The financial sector’s resilience is further supported by stable economic conditions and manageable bad debt expenses. However, dividends from major companies like BHP and Rio Tinto going ex-dividend tempered overall market gains. Global markets also showed positive trends, with significant movements in the Nasdaq, Bitcoin, gold, and oil prices, highlighting a broad-based optimism in financial markets despite looming election year uncertainties.

Leaders

29M-29METALS Ltd (+11.64%)

ZIP-ZIP Co Ltd (+10.26%)

CHN-Chalice Mining Ltd (+9.71%)

INR-Ioneer Ltd (+9.26%)

IMM-Immutep Ltd (+8.11%)

Laggards

BCK-Brockman Mining Ltd (-14.29%)

HLI-Helia Group Ltd (-13.97%)

DRO-Droneshield Ltd (-13.67%)

RBD-Restaurant Brands NZ Ltd (-8.25%)

BOC-Bougainville Copper Ltd (-5.00%)