What's Affecting Markets Today

Australia’s GDP Growth Misses Expectations in Q4

Australia’s GDP saw a modest increase of 0.2% in the fourth quarter, falling short of the anticipated 0.3% rise. The economy grew by 1.5% year-on-year. This development is significant as the Reserve Bank of Australia (RBA) has been looking for signs of an economic slowdown to achieve its inflation targets, maintaining the cash rate at 4.35% during recent policy meetings. The RBA predicts a further slowdown to 1.5% in 2023 and 1.3% by mid-year, with expectations of recovery thereafter. Amid these figures, there is heightened anticipation of rate cuts in the US by July, with Australia potentially following in September, influenced by a decrease in imports indicating weak consumption.

Cettire Assures Compliance with Import Duties Amidst Scrutiny

Cettire, an online luxury retailer, has responded to concerns about unpaid duties by affirming its compliance with all relevant import charges at customs clearance. This statement comes after an investigation by The Australian Financial Review suggested potential non-payment of federal duties, highlighted by a DHL shipping label stating “Duties & Taxes Unpaid.” Cettire clarified that this label does not necessarily imply unpaid duties but rather the absence of a specific DHL service facilitating these payments. The company stresses that all duties related to shipments are settled, countering implications of duty evasion.

Gold Miners on the ASX Surge as Gold Prices Hit New Highs

The Australian Stock Exchange (ASX) gold miners have witnessed a significant surge in their stocks this week, propelled by gold reaching a new record high of $US2141.79 an ounce, surpassing the previous record. This rally in gold prices has resulted in double-digit returns for some gold mining companies listed on the ASX 200. The upward trajectory of gold prices reflects broader market trends and investor sentiment towards safe-haven assets, further boosting the performance of gold mining stocks amidst this bullish momentum.

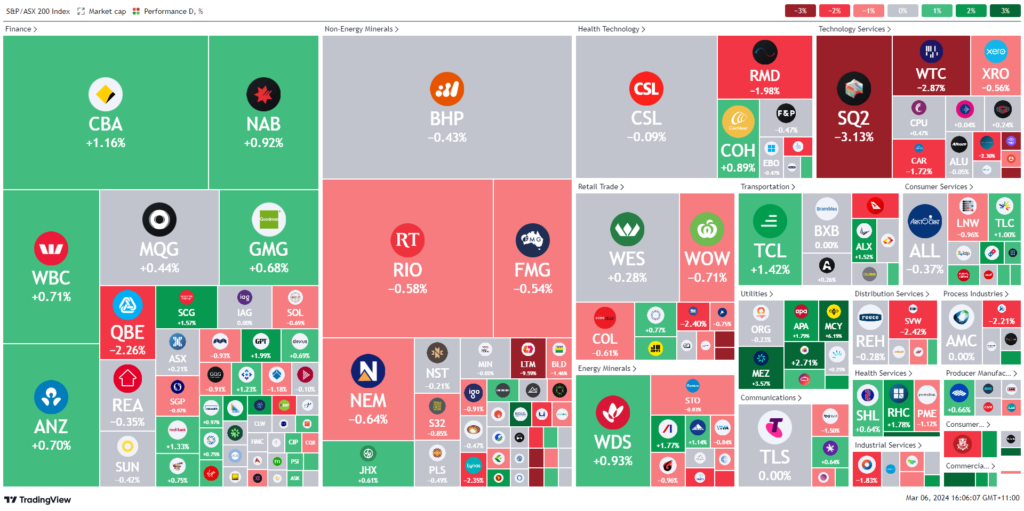

ASX Stocks

ASX 200 - 7,730.9 (+0.09%)

Key Highlights:

The Australian sharemarket managed to recover from earlier setbacks, buoyed by gains in financial and real estate sectors. The S&P/ASX 200 Index modestly increased by 0.2%, closing at 7737.1, with a majority of sectors posting gains. Despite a lukewarm GDP report for the December quarter indicating minimal economic expansion due to cautious consumer spending amid rising borrowing costs, the market’s overall response was relatively subdued. The economy grew by 0.2% in the quarter, slightly below the anticipated 0.3%, while annual growth exceeded expectations at 1.5%. The financial markets are fully anticipating an RBA rate cut by September, with expectations for another by year’s end. The technology sector lagged, reflecting a broader sell-off in tech stocks globally. In contrast, gold miners experienced gains alongside rising gold prices. Notable stock movements included ANZ’s share rise after reducing its stake in AMMB Holdings and Magellan Financial Group’s surge due to increased funds under management. Meanwhile, Cettire’s shares plummeted following revelations of unpaid duties, as reported by The Australian Financial Review.

Leaders

HGH-Heartland Group Holdings Ltd (+8.82%)

MFG-Magellan Financial Group Ltd (+7.90%)

ZIP-ZIP Co Ltd (+7.14%)

MCY-Mercury NZ Ltd (+6.19%)

OBM-Ora Banda Mining Ltd (+5.77%)

Laggards

CTT-Cettire Ltd (-15.13%)

DDR-Dicker Data Ltd (-10.04%)

LTM-Arcadium Lithium Plc (-9.95%)

OBL-Omni Bridgeway Ltd (-9.76%)

IRE-Iress Ltd (-7.00%)