Last Night's Market Recap

S&P 500 - Heatmap

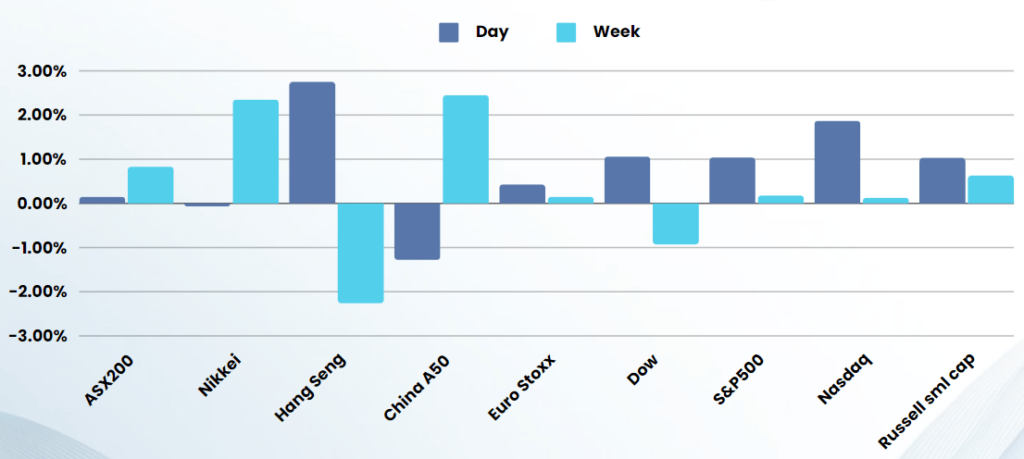

Overnight – Tech Bulls cash out some profits before Powell and Payrolls

Equities as investors eased bullish bets on big tech just a day ahead of Federal Reserve chairman Jerome Powell testimony before Congress that could provide potential fresh clues on monetary policy.

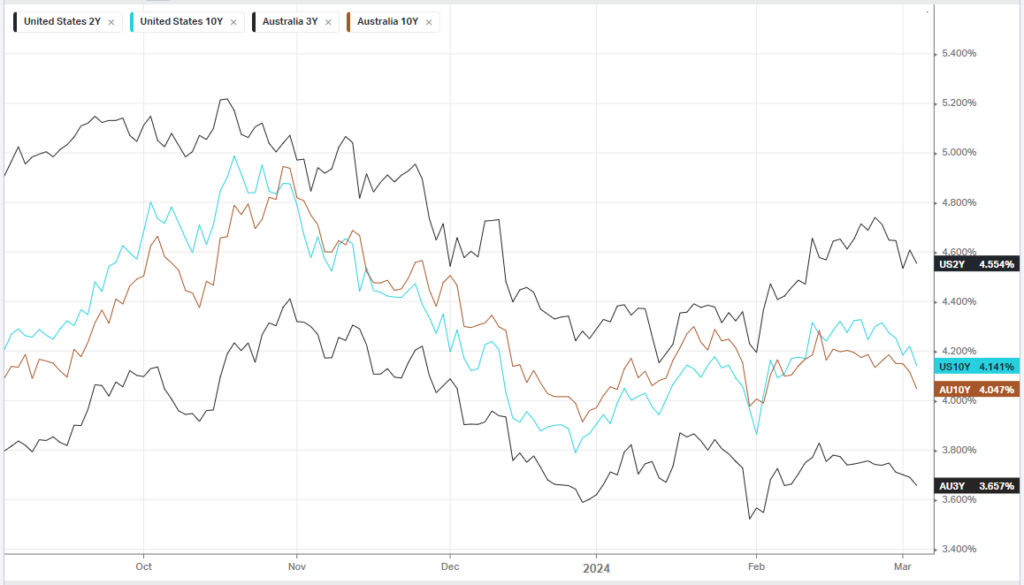

Markets were awaiting fresh cues on monetary policy from Federal Reserve Chair Jerome Powell, who is set to offer a two-day testimony before Congress on Wednesday and Thursday.

Analysts expect Powell to largely maintain a hawkish tilt and reiterate his stance that the central bank needs more convincing that inflation is nearing its annual 2% target. Several Fed officials warned against bets on early rate cuts by the central bank, citing concerns over sticky inflation and resilience in the U.S. economy. Atlanta Fed President Raphael Bostic said on Monday that persistent bets on early Fed rate cuts could trigger an increase in inflationary pressures. Still, analysts expect that the Fed will have enough conviction by June to begin trimming rates. Along with Powell’s testimony, the focus this week is also on key nonfarm payrolls data for February.

Tesla fell 4% after the electric vehicle giant said shipments of its China-made cars fell by19% year-on-year to 60,365, the lowest level since December 2022, following disruptions caused by the Lunar New Year holidays. The drop came as the firm engaged in a bitter price war with its Chinese peers to capture the world’s largest EV market. Chip stocks, which have played a pivot role in the rally so far, were pressured by a more than 1% fall in Advanced Micro Devices after Bloomberg News reported that the U.S. government had placed a hurdle in front of the company’s effort to sell an artificial intelligence chip designed for the Chinese market.

Apple, meanwhile, fell more than 2% after short-seller Counterpoint Research said iPhone sale had plunged 24% in China amid rising competition local firms including Huawei and Xiaomi.

Bonds

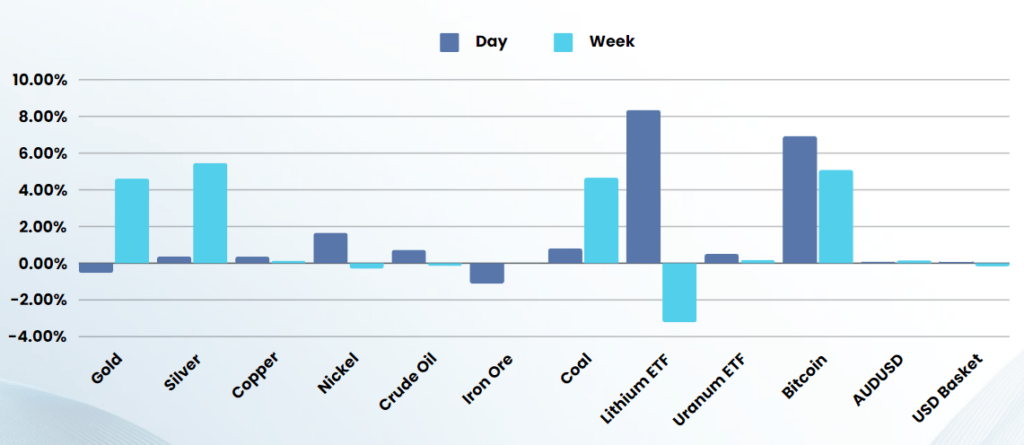

Commodities & FX

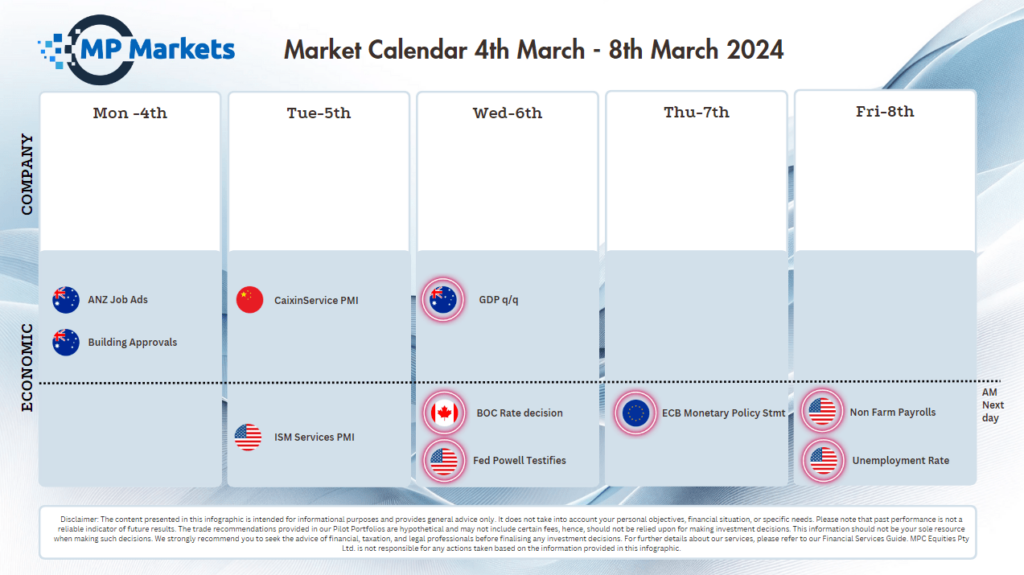

The Day Ahead

ASX SPI 7690 (-0.12%)

Australian shares are poised to fall amid a sell-off in New York where the tech sector in particular was caught in a wave of profit taking.

Shares of Accent Group, EQT, Monadelphous, Northern Star Resources, QBE Insurance, Reliance Worldwide, Servcorp, SmartGroup, Super Retail Group and Treasury Wine Estates all trade ex-dividend on Wednesday.