What's Affecting Markets Today

China set a growth target of “around 5%” for 2024

In its 2024 government work report, China targets approximately 5% economic growth and plans to issue 1 trillion yuan in “ultra-long” bonds for strategic projects. The deficit-to-GDP ratio is set at 3%, a decrease from last year’s 3.8%. Additionally, 3.9 trillion yuan in local government bonds will be issued, increasing by 100 billion yuan.

Gold rallies to new high

Gold futures reached a historic peak, with the April contract settling at $2,126.30 per ounce, marking the highest level since its 1974 inception. This follows a previous record close at $2,095.70. The surge anticipates potential Federal Reserve rate cuts. Concurrently, the VanEck Gold Miners ETF (GDX) gained 4.3%, surpassing its 50-day moving average.

Bitcoin nears new all time high

Bitcoin surged 9% to $68,635.20, nearing its all-time high, with a peak at $68,848.62, its highest since November 2021. Ether also rose, gaining over 5% to reach $3,650.59, indicating a strong start to the week for the leading cryptocurrencies, according to Coin Metrics data.

ASX Stocks

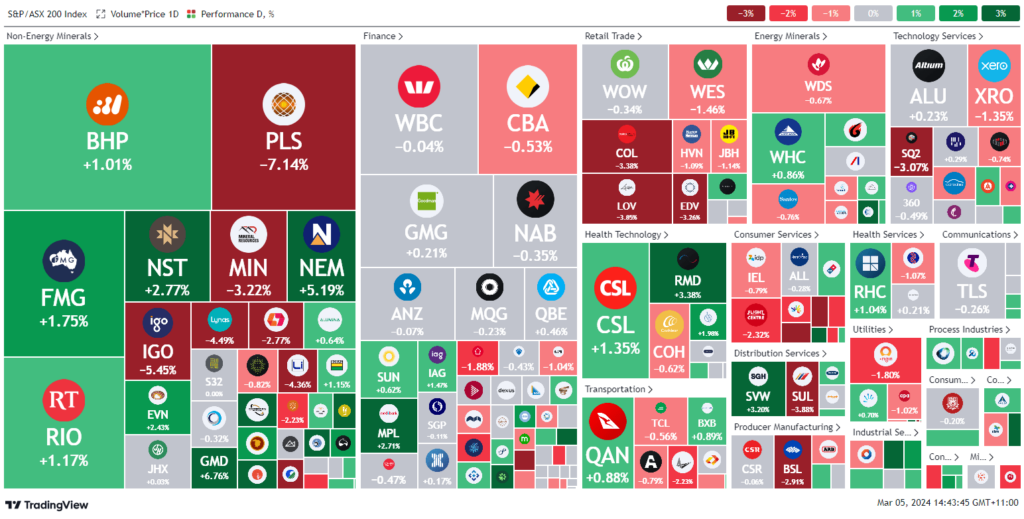

ASX 200 - 7,724.2 (-0.1%)

Key Highlights:

Australian shares rebounded to trade flat mid-Tuesday, led by gains in healthcare stocks after the government approved a rise in insurance premiums starting April. The healthcare and mining sectors were the only ones among the index’s 11 to post gains, counterbalancing losses in consumer stocks. Notably, Medibank and NIB shares surged over 2.5%. Healius emerged as the standout, soaring over 12% upon naming Paul Anderson as its new CEO, marking its potential largest daily gain since 2020. This uplift nudged the S&P/ASX 200 marginally higher by 1.5 points to 7737.3. Gold miners also excelled, riding the wave of rising gold prices, with Regis Resources and St Barbara leaping over 6%. BHP, Rio, and Fortescue saw gains in the mining sector, while major banks faced declines. Additionally, Australia’s current account for the December quarter showed a surplus of $11.8 billion, suggesting positive, though modest, GDP growth in the upcoming report.

Leaders

HLS Healius Ltd 14.44%

WGX Westgold Resources Ltd 7.69%

GMD Genesis Minerals Ltd 7.06%

RRL Regis Resources Ltd 4.94%

NEM Newmont Corporation 4.93%

Laggards

HGH Heartland Group Holdings Ltd -15.35%

PLS Pilbara Minerals Ltd -6.92%

BRN Brainchip Holdings Ltd -6.90%

IGO IGO Ltd -5.64%

MAD Mader Group Ltd -4.74%