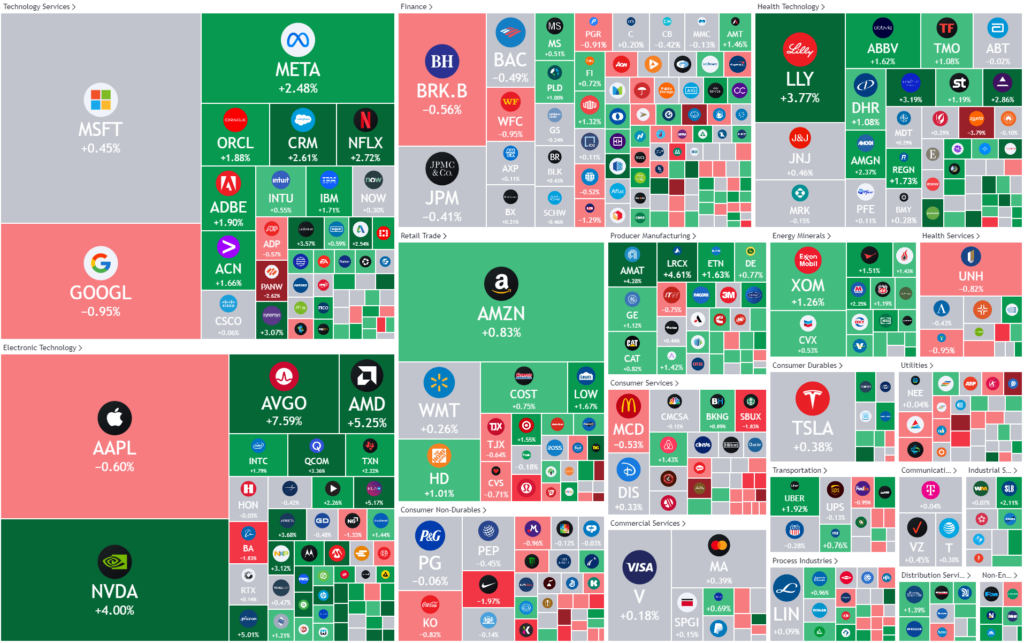

Last Night's Market Recap

S&P 500 - Heatmap

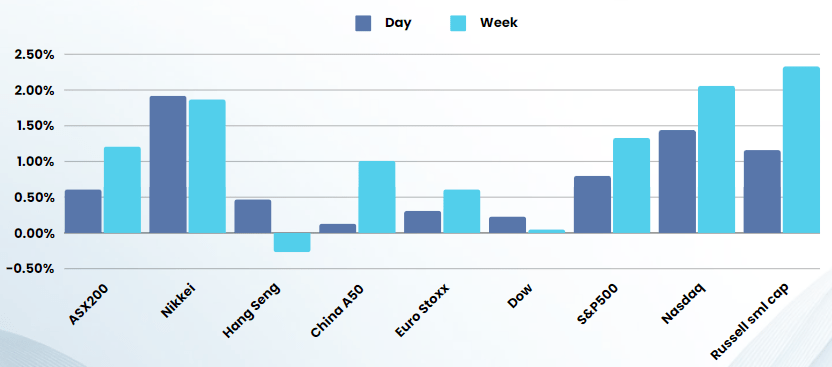

Overnight – Stocks climb despite weakening economic data

Equities scaled records high while Treasury yields fell sharply on Friday after weak U.S. economic data and comments from Federal Reserve officials bolstered expectations for interest rate cuts later this year.

The Institute for Supply Management (ISM) said its manufacturing PMI fell to 47.8 last month from 49.1 in January, the 16th straight month that the PMI remained below 50. This indicates contraction in manufacturing. The University of Michigan surveys of consumers showed all three measures for sentiment, current conditions and consumer expectations falling more than expected. On Thursday, the U.S. personal consumption expenditures (PCE) report was in line with expectations and showed annual inflation growth the smallest in three years.

Also on Friday, Fed Governor Chris Waller kindled hopes for lower interest rates, saying decisions about the ultimate size of the Fed balance sheet have no bearing in its inflation fight rate policy. Investors appeared to shrug off a note of caution from Richmond Federal Reserve President Thomas Barkin, who said U.S. price pressures still exist and it is too soon to predict when the Fed will cut rates.

Global factory surveys showed manufacturing output had continued to fall in both Europe and Asia. Also in Asia, Japan’s Nikkei index jumped 1.9% to hit a fresh all-time high, extending a surge of 7.9% the previous month when it breached levels last seen in 1989.

In U.S. Treasuries, yields fell sharply including two-year yields’ biggest daily decline since the end of January after the manufacturing data and Waller’s suggestion of the need for more shorter-dated Treasuries. The 2-year note yield, which typically moves in step with interest rate expectations, fell 11.1 basis points to 4.5354%, from 4.646% late on Thursday

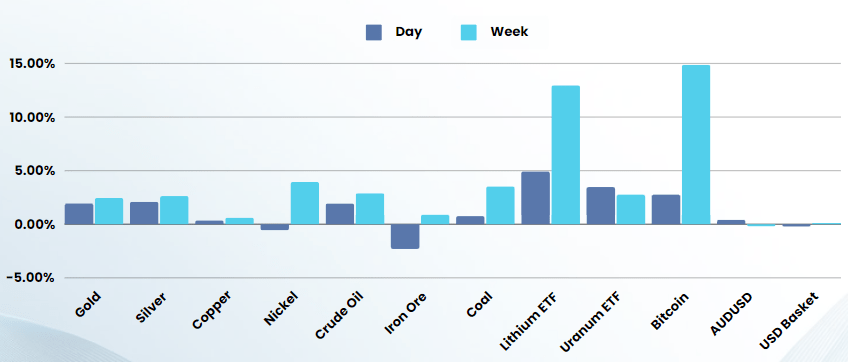

In cryptocurrencies, bitcoin rose 2.36% to $62,898.00 after hitting a more than two-year high of $63,933 on Wednesday.

In commodities, oil prices settled higher and posted weekly gains as traders awaited an OPEC+ decision on supply agreements for the second quarter while they weighed U.S., European and Chinese economic data. U.S. crude settled up 2.2% at $79.97 a barrel. In metals, gold started the month on a positive note, with prices rising to a two-month high the muted economic data. Spot gold added 1.97% to $2,083.41 an ounce.

Bonds

Commodities & FX

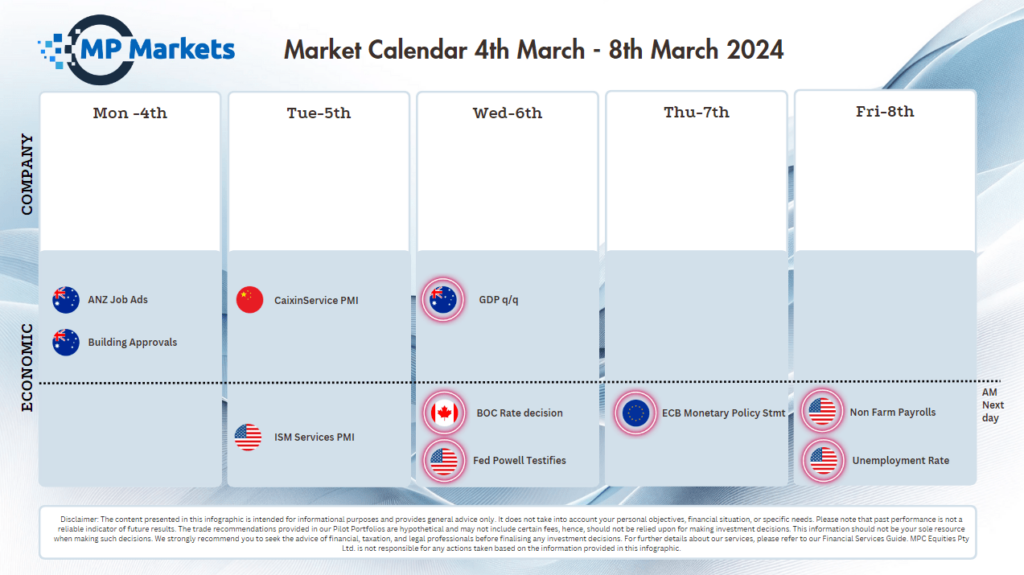

The Day Ahead

ASX SPI 7728 (+0.14%)

The ASX is in for another positive day as global indices got another push from falling yields despite being unaffected by the rise in yields the previous 2 weeks. Gold, oil, Lithium and Uranium stocks benefit from rallies in the underlying.

Shares in Altium, Baby Bunting, Netwealth, Newmont, Nick Scali, REA Group

and Steadfast all trade ex-dividend.