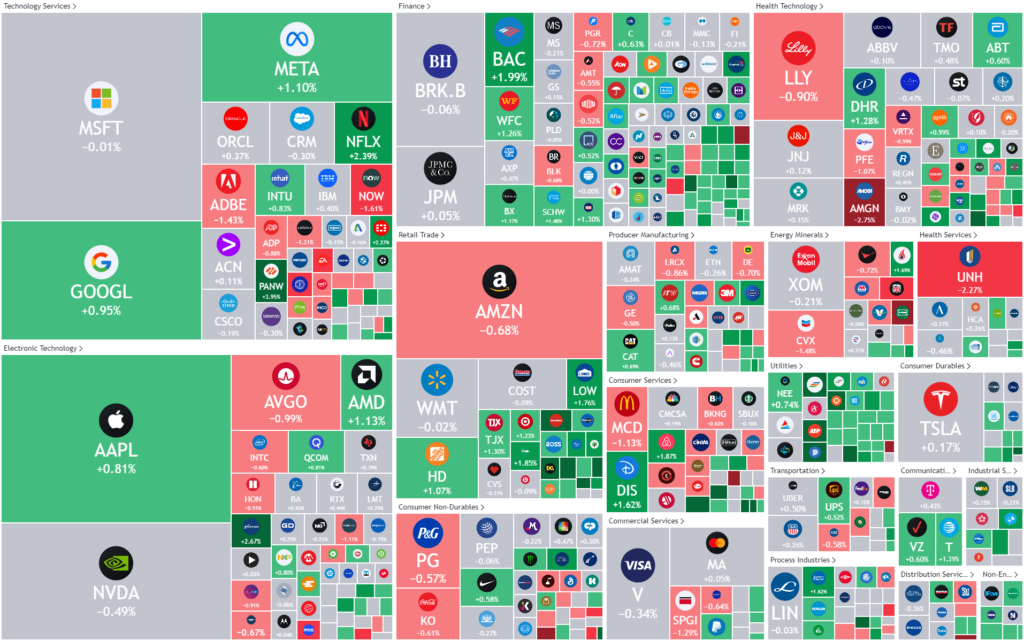

Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Stocks struggle for direction waiting on inflation data

Stocks as dip buyers helped tech cut some losses and better-than-expected quarterly results from retailers, Macy’s and Lowe’s pushed consumer discretionary stocks higher.

Consumer sentiment started to show some cracks as Consumer confidence unexpectedly fell to 106.7 in February from 110.9 the prior month, marking a three-month low, as the impact of inflation continue to weigh on consumers. Similar to businesses curtailing investment amid a still positive but uncertain outlook for the economy as well as monetary and fiscal policy, consumers seemingly bulletproof confidence may be showing early signs of waning. Durable goods orders, meanwhile, fell more than expected in January amid a sharp drop in bookings for commercial aircraft, falling 6.1% last month.

The duo of reports come a Fed officials continue to urge caution on cutting rates too soon as Kansas City Federal Reserve Bank President Jeffrey Schmid said “With inflation running above target, labor markets tight and demand showing considerable momentum, my own view is that there is no need to preemptively adjust the stance of policy,” This was his first extensive public remarks since he began the job last August.

Energy stock slipped, weighed down by weakness in Hess Corp, Chevron and Phillips 66, even as oil prices climbed following a Reuters report that the OPEC and its allies, or OPEC+, are considering extending voluntary oil output cuts into Q2. In November last year, OPEC+ agreed to voluntary cuts totaling about 2.2 million barrels per day for the first quarter this year, though dealmaking between members was fraught with disagreement over output limits.

All eyes will be on tonight’s Core PCE data which is the Federal reserves preferred measure of inflation

Earnings

- Zoom rose 7% after reporting stronger-than-expected earnings, while also announcing a $1.5 billion share buyback The video conferencing firm’s “guidance for an acceleration in 2H [second half of the year] as well as a new $1.5 billion buyback to offset dilution and that might lower the risk of large-scale M&A,” UBS said in a note.

- Unity Software fell 6% after the videogame software maker reported weaker-than-expected guidance amid turnaround plan that includes exiting some businesses.

Bonds

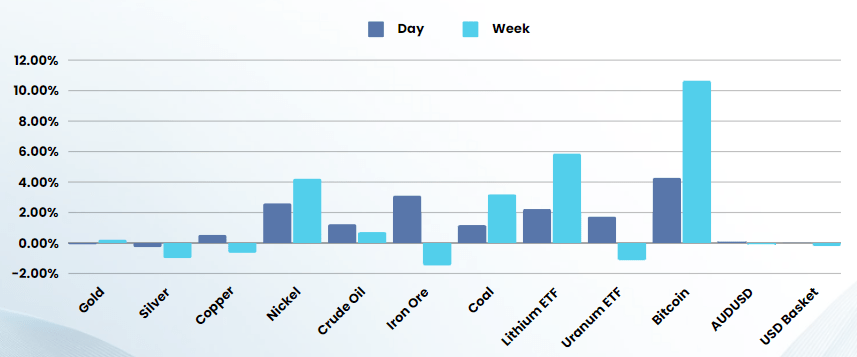

Commodities & FX

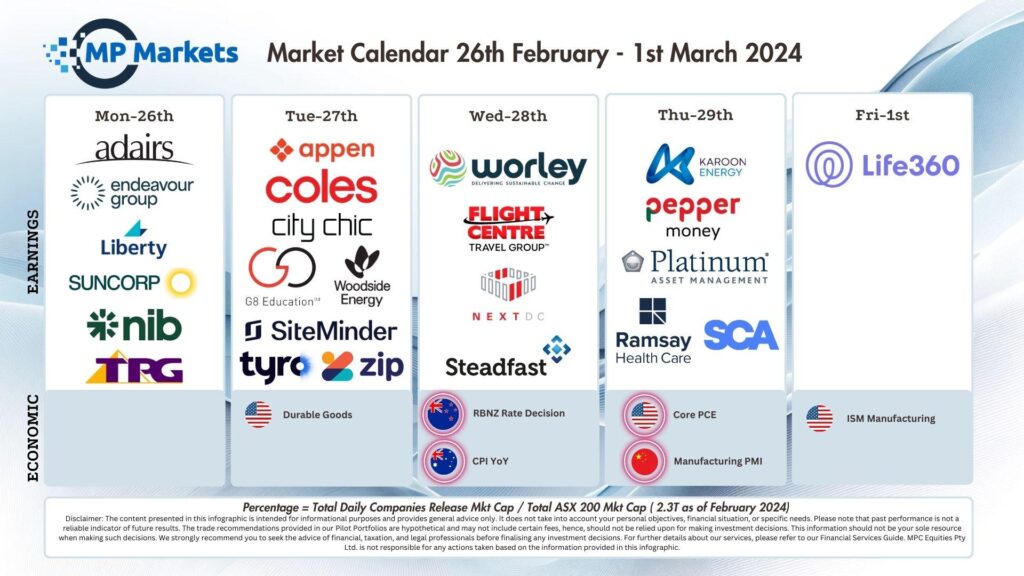

The Day Ahead

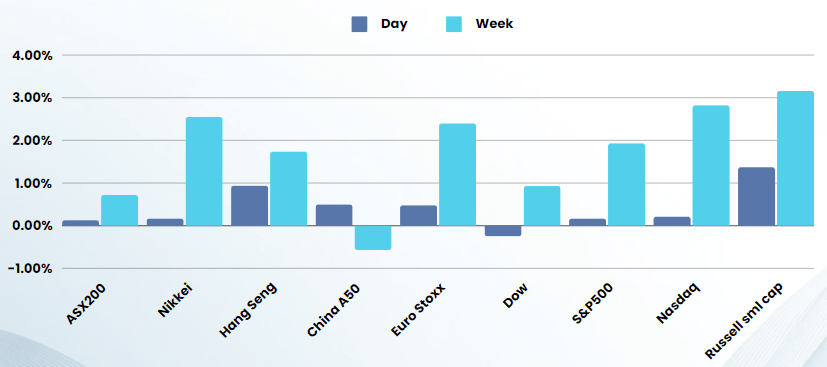

ASX SPI 7645 (+0.24%)

The ASX should have a positive day following the lead of global markets. The materials sector will be helped by the bounce in iron ore, lithium, oil and uranium

With earnings drawing to a close, sentiment will turn to the macro outlook with inflation data due here in AU today at 1130 and Core PCE tonight in the US

Companies scheduled to report results on Wednesday: Worley, Kelsian, Light & Wonder, NextDC, Perpetual, Spark NZ, Steadfast, Strike Energy.

Flight Centre is boasting its “second-best start to the year” after reporting total transaction values had jumped in the first half of FY2024.

Beach Energy, EVT, Fortescue, Lottery Corp, Telstra and Woolworths shares trade ex-dividend.