What's Affecting Markets Today

US markets weaker overnight, traders wait for inflation data

Wall Street concluded its trading session lower on Monday, with investors taking a cautious approach ahead of key inflation data expected later in the week. The Dow Jones Industrial Average saw a modest decline of 0.16%, closing down approximately 62 points. Similarly, the S&P 500 and Nasdaq Composite experienced drops of 0.38% and 0.13%, respectively. In contrast, Bitcoin showcased a notable recovery, climbing past $54,000 after a period of lackluster performance.

In corporate news, Zoom’s financial results exceeded expectations, driving its shares higher. The company reported a revenue increase of over 2.5% year-over-year to more than $1.12 billion, a figure that could have seen even greater growth barring a sales reorganization.

On the technology front, JPMorgan CEO Jamie Dimon expressed his strong belief in the potential of artificial intelligence, distinguishing it from past technological hypes and labeling it as a significant, enduring advancement.

Meanwhile, the U.S. is positioning itself as a future leader in semiconductor production, with Commerce Secretary Gina Raimondo announcing ambitions for the country to account for around 20% of the world’s advanced logic chips production by 2030, marking a strategic move to bolster competitiveness in the global technology arena.

ASX Stocks

ASX 200 - 7,662.8 (+0.1%)

Key Highlights:

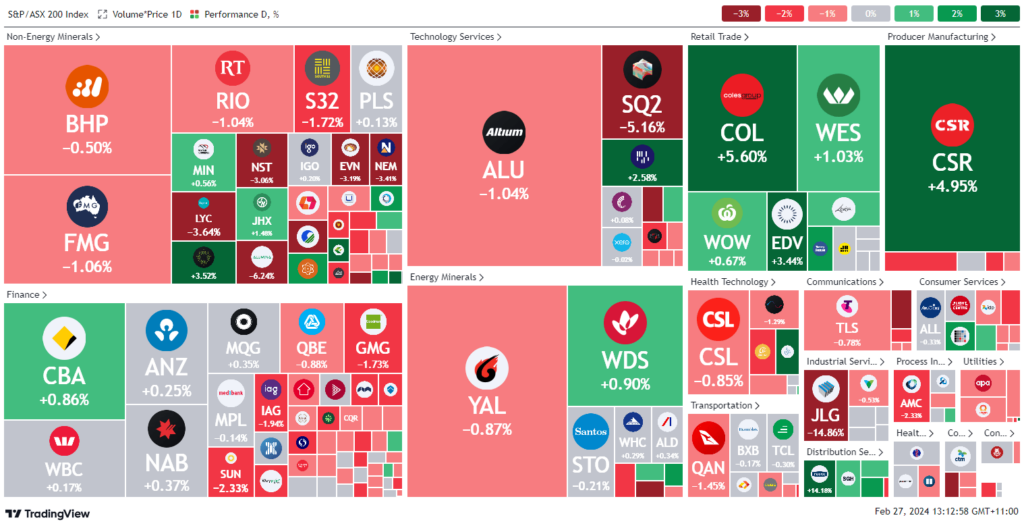

Midday trading saw shares decline, mirroring Wall Street’s downturn as markets braced for forthcoming inflation data from both domestic and U.S. sources. The S&P/ASX 200 Index dipped 0.2%, shedding 15.5 points amid mixed corporate performances. Notably, Coles surged 7%, marking its largest daily increase since the pandemic onset, driven by impressive earnings. Similarly, Woodside Energy climbed 1.1% as its net profit drop was less severe than expected. However, Johns Lyng Group faced a steep decline of nearly 14% following its financial disclosures, positioning it as the day’s most significant underperformer.

The mining sector felt the strain, impacted by a more than 3% fall in iron ore futures due to worries over China’s property market, leading to losses for major players like Rio Tinto, Fortescue, South32, and BHP Group.

In other developments, Alumina and Healius experienced notable declines following disappointing financial outcomes, whereas Adbri enjoyed a 1.6% uplift after approving a lucrative acquisition offer. Meanwhile, payment platforms Zip and Tyro saw double-digit losses amid profit-taking, contrasting with the significant gains observed in Reece Group and G8 Education, both buoyed by strong earnings reports.

Leaders

REH Reece Ltd 14.16%

GEM G8 Education Ltd 11.16%

HLI Helia Group Ltd 9.79%

NAN Nanosonics Ltd 9.13%

TLX TELIX Pharmaceuticals Ltd 6.39%

Laggards

BRN Brainchip Holdings Ltd -22.45%

JLG Johns LYNG Group Ltd -14.24%

ZIP ZIP Co Ltd -9.63%

WBT Weebit Nano Ltd -7.42%

BFL BSP Financial Group Ltd -7.03%