Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Stocks ride Nvidia to record highs

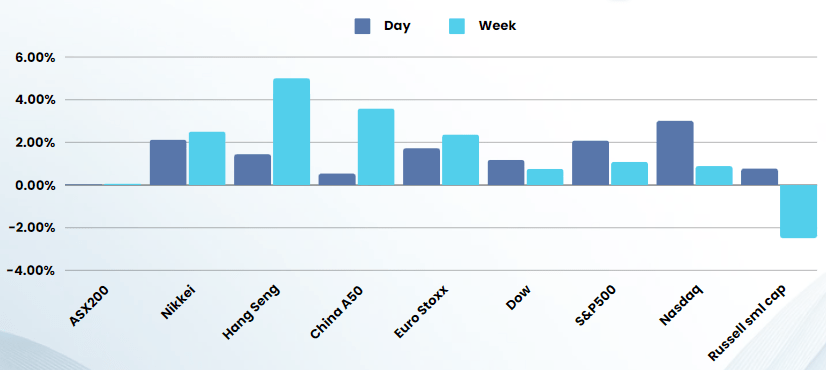

Stocks climbed to record highs after Nvidia’s blowout earning reinforced investor optimism in artificial-intelligence boom, ushering in a sea of green across tech stocks.

Nvidia jumped over 16% closing at fresh record highs after the world’s most valuable chipmaker reported stronger-than-expected fourth quarter earnings, and forecast first quarter revenue at about $24 billion, more than what analysts were expecting. Other chipmakers jumped on the Nvidia bandwagon, with TSMC, Micron Technology and Intel in the ascendency. Nvidia, a barometer of AI demand, reinforced expectations that the AI boost is here to stay, stoking bullish bets across megacap tech including Alphabet, Microsoft and Meta Platforms all posted healthy gains, with all three having AI products in the pipeline.

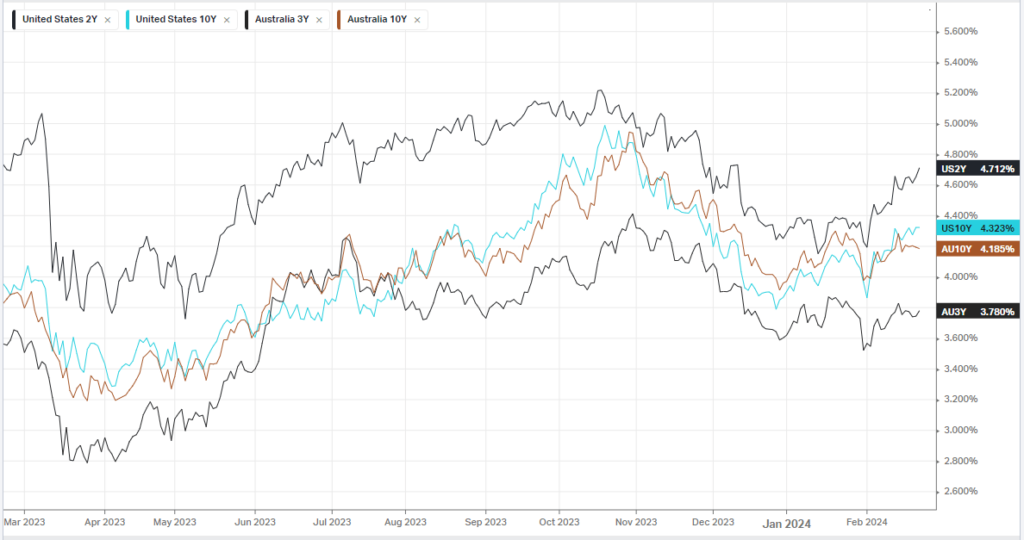

Treasury yields were sharply higher following fresh signs of strength in the labor market a the number of Americans filing new claims for unemployment benefits unexpectedly fell last week, the Labor Department reported Thursday.

The data added fresh doubt on the sooner rather later rate cuts and came just a day after the Fed minutes reinforced the central bank’s stance on keeping interest rates elevated in the near-term. Federal Reserve Vice Chair Philip Jefferson said Thursday he was “cautiously optimistic” in the Fed’s ability to rein in inflation back down to its 2% target. “If the economy evolves broadly as expected, it will likely be appropriate to begin dialing back our policy restraint later this year,” he added. Elsewhere on the economic front, manufacturing activity picked up pace in February, but services slowed.

Bonds

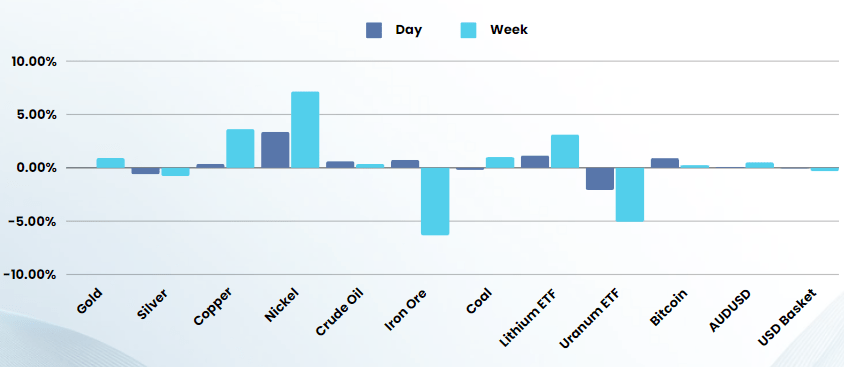

Commodities & FX

The Day Ahead

ASX SPI 7603 (+0.43%)

The ASX should have a positive day with the US going into full frenzy mode on AI. The index will be helped by the recovery in Iron ore, oil and lithium helping the materials sector. Commodities have been climbing as hopes that China’s recent stimulus will pick the economy up off the ground, while elsewhere in Asia the Nikkei hit a record high yesterday

Earnings

- PDN says production activities started on January 20 at its Langer Heinrich mine in Namibia. The uranium price has roughly doubled over the past 12 months to lift Paladin’s shares 64 per cent over the period to $1.16 on a market cap of $3.5 billion.

- Home internet business Aussie Broadband has posted a net profit up 14.6 per cent to $9.8 million on sales up 17.7 per cent to $445.9 million for the six months to December 31.

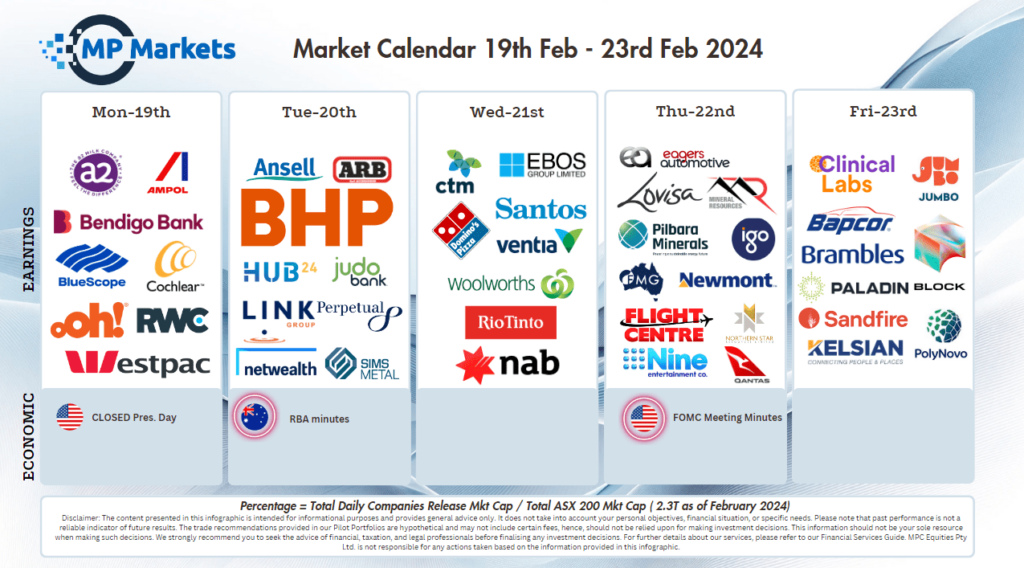

Companies reporting today: AMA Group | Arcadium Lithium | Aussie Broadband | Bapcor | Brambles | Jumbo Interactive | Latitude | Monash IVF | PEXA | Sandfire | Yancoal