What's Affecting Markets Today

Dow rallies to record high

On Monday night, the Dow Jones Industrial Average ascended to a new peak, increasing by 125.69 points or 0.33%, closing at 38,797.38, as the market anticipated upcoming inflation and earnings reports. Conversely, the S&P 500 slightly declined by 0.09% to 5,021.84, while the Nasdaq Composite dropped 0.3% to 15,942.55. Salesforce’s 1.4% fall contributed to the Dow’s limited gains, whereas Hershey experienced a minor dip following a downgrade from Morgan Stanley due to decreased demand. In contrast, Diamondback Energy saw a significant 9.4% surge after its acquisition announcement of Endeavor Energy Partners. With the S&P 500 surpassing 5,000 for the first time on Friday and continuing its upward trajectory since the year’s start, the market reflected optimism. The upcoming week is poised for a flurry of earnings reports from 61 S&P 500 companies across various sectors. Additionally, key economic indicators, including the CPI, retail sales, and PPI, are scheduled for release, offering insights into the economy’s health and inflation trends.

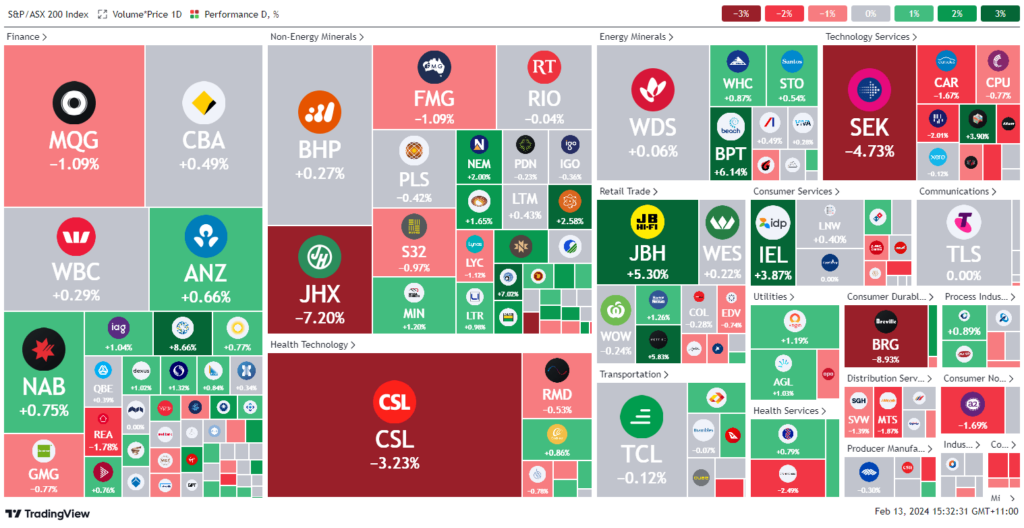

ASX Stocks

ASX 200 - 7,603.6 (-0.2%)

Key Highlights:

Australian shares showed minimal movement on Tuesday afternoon, with the performance of utilities and banks balancing out declines in the healthcare sector, as investors awaited important US inflation data for potential interest rate directions. Amid the earnings season, several companies including Breville, Seek, Seven West Media, and James Hardie experienced sharp declines after reporting unsatisfactory results. By 2 pm, the S&P/ASX 200 was stable, with gains in five out of eleven sectors, particularly utilities and banks, while healthcare suffered due to CSL’s outlook concerns overshadowing its profit increase. The most significant weekly loss since mid-2023 loomed as shares dropped over 7% since CSL halted efforts for a major regulatory approval. Other notable movements included Seek’s 9% drop due to declining profits and customer volumes, Breville’s over 10% fall from expected sales, Seven West Media’s 15% plunge in advertising revenue, and James Hardie’s 5.5% decrease after a profit margin report. Macquarie Group also fell by 1.4% following a profit warning, while Strike Energy faced a 22% drop due to operational issues. The Australian dollar remained steady amidst reduced trading activity, with bond yields rising as rate cut expectations diminished following remarks by central bank officials on the need for more evidence of inflation slowing.

Leaders

TPW Temple & Webster Group Ltd 9.88%

CGF Challenger Ltd 9.04%

EMR Emerald Resources NL 7.02%

CTT Cettire Ltd 6.18%

BPT Beach Energy Ltd 6.14%

Laggards

STX Strike Energy Ltd -21.43%

BRG Breville Group Ltd -8.97%

ZIP ZIP Co Ltd -7.18%

JHX James Hardie Industries Plc -6.94%

IMU Imugene Ltd -6.82%