What's Affecting Markets Today

CSL’s Heartbreak in Drug Development

CSL faced a significant setback with the failure of its largest-ever heart attack drug trial, CSL112, which aimed to prevent secondary heart attacks. Despite investing nearly $1 billion and enrolling 18,200 patients, the drug did not meet its primary efficacy endpoint. This disappointing outcome led to a 5.5% drop in CSL shares, wiping about $8 billion off its market capitalization. Analysts had high expectations, predicting the drug could generate up to $US2.3 billion in sales. This event highlights the high-risk nature of pharmaceutical R&D and has necessitated a reevaluation of CSL’s financial projections and future plans.

Liontown Resources: A Shift in Strategy

Liontown Resources experienced a decline in share value following the expiration of a clause that prevented Gina Rinehart’s Hancock Prospecting from making a takeover offer below the price it initially paid. This development comes after Hancock acquired a significant stake in Liontown, amidst a withdrawn $6.6 billion offer from Albemarle and a failed $760 million funding package due to crashing lithium prices. The situation underscores the volatile nature of the lithium market and potential shifts in ownership and strategy for companies involved in critical resources for the green economy.

Uranium Market’s Upside Potential

The uranium sector is poised for potential growth, as indicated by Bell Potter’s analysis. The firm points out that further production downgrades from Kazatomprom, the world’s largest uranium producer, could exacerbate the supply deficit and push prices higher. With uranium prices already surging to $US107 a pound due to a larger-than-expected production cut for 2024, any additional reductions in 2025 output could further strain supply. Companies like Boss Energy, Paladin, Deep Yellow, and Alligator Energy are highlighted as beneficial investments, offering alternative uranium sources in stable jurisdictions amidst growing demand for nuclear energy.

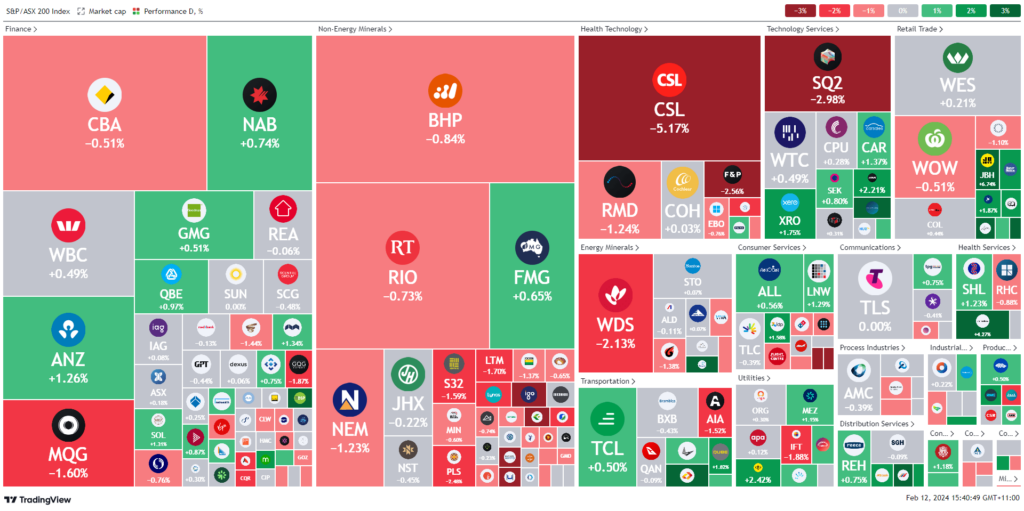

ASX Stocks

ASX 200 - 7,620.5 (-0.3%)

Key Highlights:

The ASX faced a slight downturn, largely influenced by significant losses from heavyweight companies like CSL and Woodside, despite a positive momentum from Wall Street. The S&P/ASX 200 dipped by 0.2% to 7611, while the All Ordinaries saw a minor decline of 0.1%. CSL’s 4.7% drop came after disappointing phase-three trial results for a potential drug, causing it to halt regulatory approval plans. This week is crucial for the ASX, with a plethora of earnings reports expected from major firms including AMP, Commonwealth Bank, and Telstra, which could significantly impact market sentiment. Contrasting the overall market trend, JB Hi-Fi and other retailers experienced rallies after reporting sales that exceeded analysts’ expectations, with JB Hi-Fi’s shares climbing by 7%. Tech stocks also saw gains, mirroring a tech-driven rally on Wall Street, indicating a mixed yet dynamic market environment on the ASX.

Leaders

AD8-Audinate Group Ltd (+20.71%)

IMU-Imugene Ltd (+9.52%)

JBH-JB Hi-Fi Ltd (+6.77%)

BFL-BSP Financial Group Ltd (+5.75%)

AX1-Accent Group Ltd (+4.48%)

Laggards

LTR-Liontown Resources Ltd (-7.62%)

FBU-Fletcher Building Ltd (HALT) (-6.09%)

CSL-CSL Ltd (-5.11%)

HGH-Heartland Group Holdings Ltd (-4.13%)

NIC-Nickel Industries Ltd (-3.46%)