What's Affecting Markets Today

S&P nears 5000

In the latest trading session, stock futures remained relatively unchanged overnight, following a day where the S&P 500 neared the significant 5,000 level, closing at 4,995.06, a 0.8% increase. The Dow Jones Industrial Average futures edged up by 13 points, while the S&P 500 and Nasdaq 100 futures showed little movement. Disney’s shares surged approximately 6% in after-hours trading, outperforming quarterly earnings expectations and revising its guidance upward amidst cost reduction efforts. Arm, a leading chipmaker, experienced a remarkable 23% increase in share price after-hours, following robust earnings reports and a positive profit outlook. The technology sector led the rally, with Meta Platforms, Nvidia, and Microsoft each recording significant gains, contributing to new highs for both the Nasdaq Composite and the Dow. The market’s momentum is sustained by factors such as disinflation, a shift towards more dovish monetary policies, and strong earnings. Upcoming jobless claims data will be closely watched for insights into the labor market’s condition.

ASX Stocks

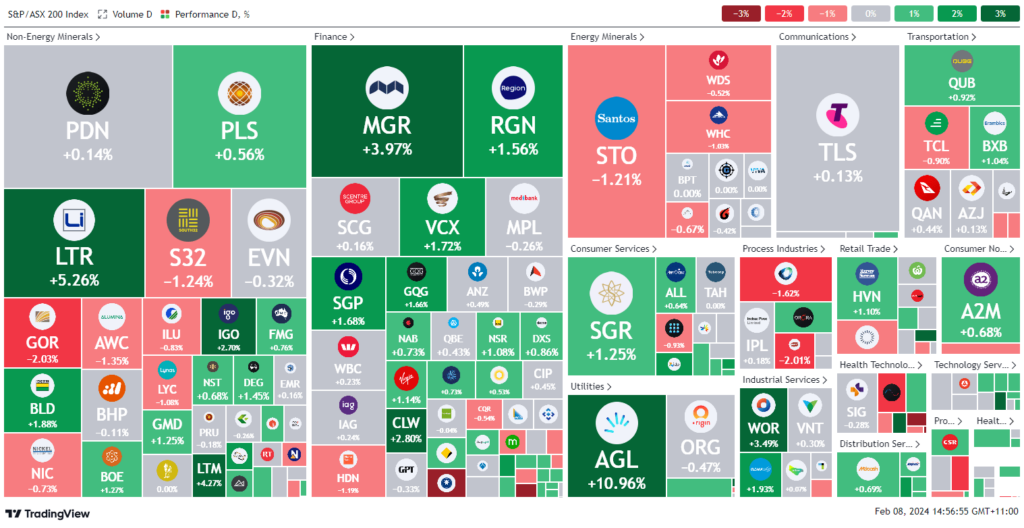

ASX 200 - 7,639.2 (+0.3%)

Key Highlights:

In todays trading session, the S&P/ASX 200 saw a modest gain of 0.3%, reaching 7,639.2 points, amid a busy earnings reporting season. Cochlear’s shares soared by 6% to $308.52, following an upward revision in its profit forecast for FY 2024, underscoring the success of its direct-to-consumer sales strategy and signaling strong future sales growth. Meanwhile, AGL Energy’s shares surged 10% after it reported a dramatic turnaround with a statutory profit of $576 million for the half-year, reversing a previous loss of $1.1 billion. In contrast, Mirvac Group reported a half-year statutory loss of $201 million, a significant shift from a $215 million profit year-on-year, with its operating profit declining by 17%. REA Group announced a 22% increase in net profit to $250 million, leading to a 16% hike in its dividend. Transurban reported a substantial rise in net profit to $230 million, forecasting a 7% dividend increase for FY 2024. Australian bond yields and the Australian dollar experienced slight movements, indicating a cautious market sentiment.

Leaders

AGL AGL Energy Ltd 11.15%

NWS News Corporation 6.38%

LOV Lovisa Holdings Ltd 5.84%

LTR Liontown Resources Ltd 5.79%

COH Cochlear Ltd 5.02%

Laggards

ERA Energy Resources of Australia Ltd -6.78%

IMU Imugene Ltd -6.52%

STX Strike Energy Ltd -4.07%

MMS Mcmillan Shakespeare Ltd -3.64%

MFG Magellan Financial Group Ltd -3.52%