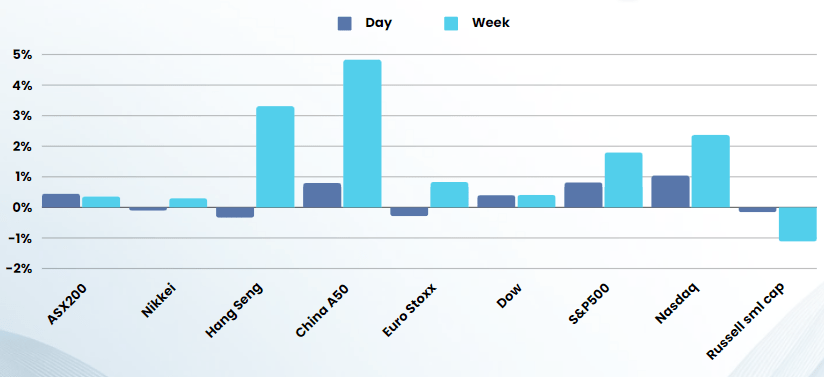

Last Night's Market Recap

S&P 500 - Heatmap

Overnight – S&P500 closes at record as investor sentiment remains fickle

Equities The S&P 500 rallied Wednesday closing at a record high and just shy of 5,000 level as bullish bets on stocks continued, with consumer stocks leading the charge following an earnings-led rally in Chipotle and Ford.

Energy stocks were flat as oil prices pared some gains following a much bigger than expected increase in U.S. weekly crude stockpiles. In the week ended Feb. 2, weekly US crude inventories rose by 5.5 million barrels, well above the prior week’s 1.2 million build and estimates for 1.7 million barrels.

New York Community Bancorp fell 1% even as the regional bank tried to cool worries about its financial strength, saying it had a strong enough liquidity base to more than cover bank deposits that were not protected by U.S. government-backed insurance. The update comes after JPMorgan and BofA Securities downgraded the stock. Investors have been fighting off “negativity overhanging the market” due to concerns about the banking and commercial real estate sectors since last week when New York Community Bancorp reported a surprise loss and cut its dividend. “Elevated anxiety levels become self-fulfilling,” he said, also pointing to volatility among other regional banks. However, the KBW regional bank index pared some losses to close down 0.1% after falling more than 2% earlier in the day.

In further jawboning from the Fed Minneapolis President Neel Kashkari noted he expects two to three rate cuts this year for now, while Fed Governor Adriana Kugler said more assurance is needed before lowering rates.

US Earnings

- Ford Motor Company climbed 6% boosting consumer stocks after the automaker delivered annual guidance and fourth-quarter that topped analyst estimates. Ford guided $10-12B in 2024 earnings before interest and taxes, or EBIT, topping analyst estimates of $9.6B, though some on Wall Street flagged waning EV demand as a worry. Ford’s guidance assumes a reversal of losses at Model E to $5 to 5.5B for 2024, RBC said in a Wednesday note, from $6.3B annualized in 2023, despite “2023 only experiencing worsening EV losses each quarter.”

- Uber Technologies posted its first-ever annual operating profit on a net basis thanks in part to solid holiday demand for its ride-sharing and food delivery services. Shares closed marginally higher on the day.

- Chipotle Mexican Grill up 7%, also reported quarterly results that beat on both the top and bottom lines, driven by an 8.1% rise in same-store sales as foot traffic rose 7.4% in the quarter.

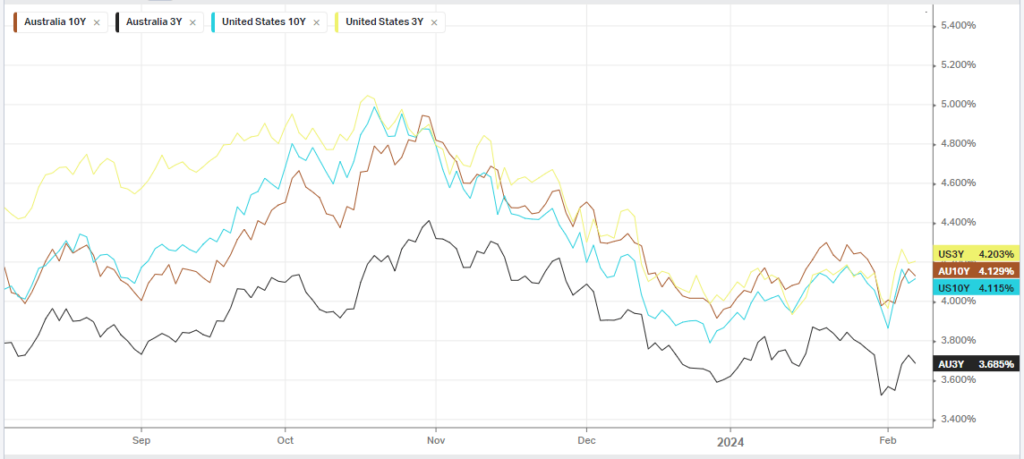

Bonds

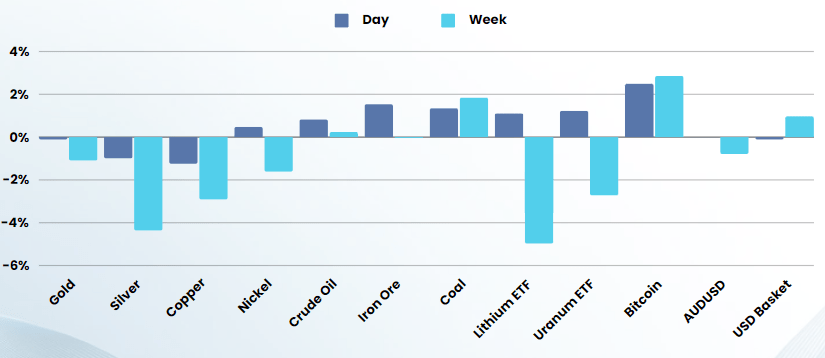

Commodities & FX

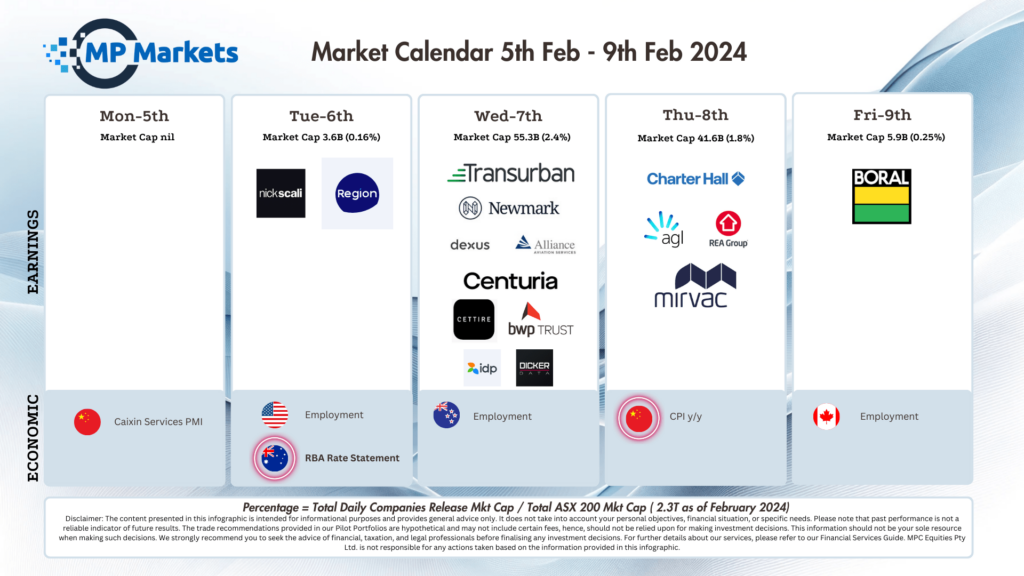

The Day Ahead

ASX SPI 7571 (+0.04%)

The ASX should have a positive day with a rise in iron ore and the US market hitting record highs. Earnings season will go into full swing next week, so expect some book squaring in some stocks. The main focus will be at a company level for the next 3 weeks,

- REA Grouphas lifted its dividend 16 per cent after reporting a 22 per cent jump in net profit to $250 million for the half year.

- Toll road operator Transurbanexpects dividends to climb 7 per cent in financial 2024, versus financial 2023. That’s after net profits more than quadrupled to $230 million.

- AGL Energy has booked a statutory profit of $576 million for the six months to December 31 from a loss of $1.1 billion in the year earlier period.

- News Corp posted a 95 per cent drop in second quarter profit to $US183 million on sales that rose 3 per cent to $US2.52 billion.

- Charter Hall Long Wale REIT, Mirvac, and Unibail-Rodamco-Wesfieldall release earnings.