What's Affecting Markets Today

US rebounds. Palantir shares jump

On Tuesday, stock markets experienced gains, with investors evaluating a fresh series of corporate earnings and anticipating the Federal Reserve’s interest rate cut timeline. The S&P 500 increased by 0.23% to 4,954.23, the Nasdaq Composite slightly rose by 0.07% to 15,609.00, and the Dow Jones Industrial Average saw a 0.37% rise, adding 141.24 points to close at 38,521.36. Notably, Palantir Technologies’ shares surged nearly 31% following a fourth-quarter revenue surge, and Spotify Technology’s stock climbed almost 4% after exceeding forecasts and reporting a rise in Premium subscribers. Despite anticipation for imminent rate cuts fueling market optimism, recent comments from Fed Chair Jerome Powell have tempered expectations for a March reduction, suggesting later adjustments. Market concerns are growing over sustainability of the rally due to narrow leadership. Meanwhile, oil prices increased, with U.S. crude production expected to level off after hitting a record in 2023, with West Texas Intermediate and Brent crude closing higher.

ASX Stocks

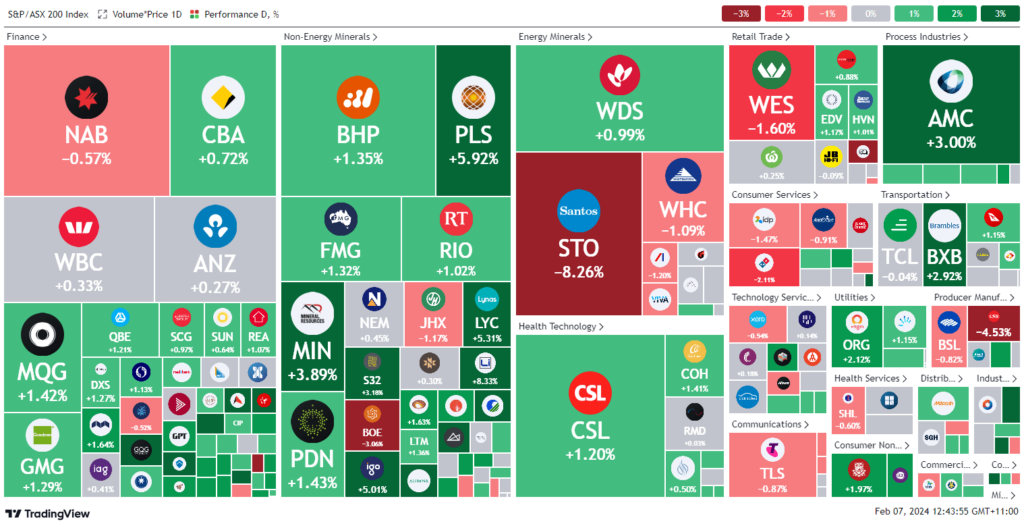

ASX 200 - 7,615.8 (+0.5%)

Key Highlights:

Australian stock markets experienced gains, with the S&P/ASX 200 index rising by 34 points, or 0.5%, to 7,615, and the All Ordinaries index also increasing by 0.6%. The uptick was led by the utilities and real estate sectors, buoyed by a series of positive half-year reports from REITs, marking a partial recovery from a two-day downturn. Real estate emerged as the top performer. However, energy company Santos saw a 7.1% decline following terminated merger talks with Woodside, which conversely rose by 1.6% to $32.79. Mining giants Fortescue, BHP, and Rio Tinto enjoyed gains exceeding 1.3%, rebounding from recent losses, with gold and lithium miners also seeing upward movement. Notably, Core Lithium and Liontown Resources saw significant advances following positive analyst notes. Meanwhile, CSR faced a downturn after a downgrade by UBS, and Amcor announced a substantial job cut alongside a decline in net profit, yet its shares edged higher.

Leaders

CTT Cettire Ltd 19.40%

ZIP ZIP Co Ltd 14.01%

LTR Liontown Resources Ltd 8.89%

SLX SILEX Systems Ltd 8.57%

AWC Alumina Ltd 6.87%

Laggards

STO Santos Ltd -7.75%

SNZ Summerset Group Holdings Ltd -6.79%

CSR CSR Ltd -4.46%

PSI PSC Insurance Group Ltd -3.33%

BOE Boss Energy Ltd -3.14%