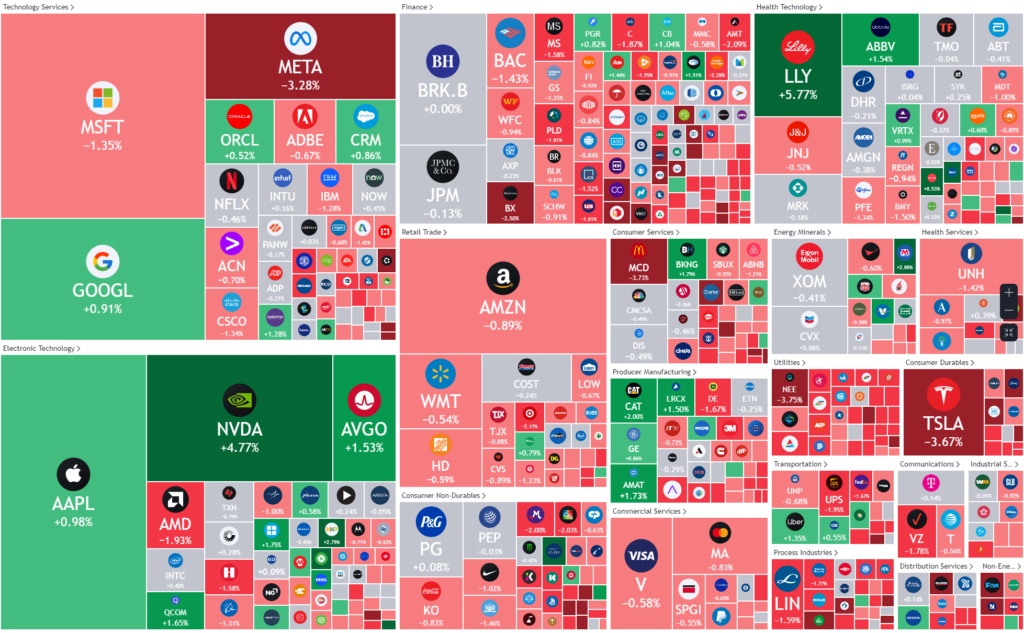

Last Night's Market Recap

S&P 500 - Heatmap

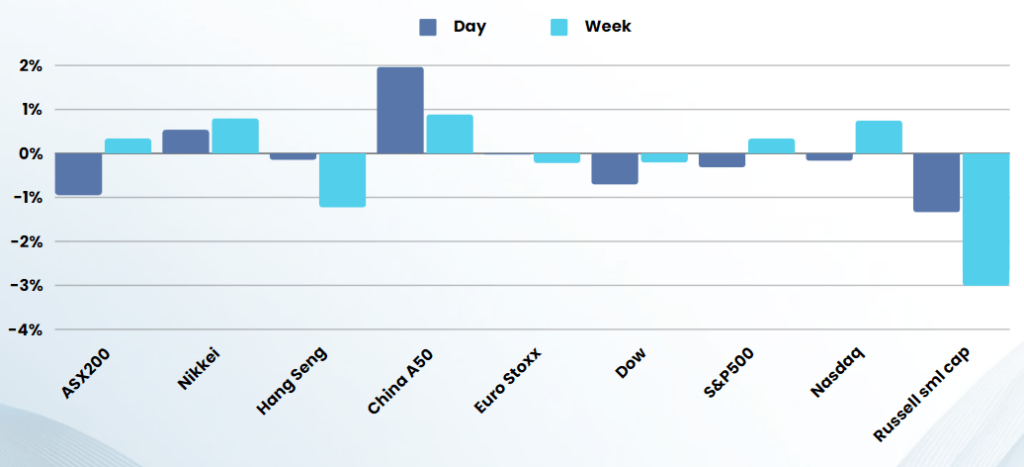

Overnight – Rising bond yields ends record run

Equities finished lower, pressured by a McDonald’s-driven wobble in consumer stocks and jump in Treasury yields after Chairman Jerome Powell shackled hopes of a sooner interest rate cut.

n an interview Sunday with CBS’ “60 Minutes” that aired on Sunday. Powell told the news program that the resilient U.S. economy can give Fed officials more time to take a “prudent” approach to possible benchmark interest rate reductions. Powell added that he would like to “see the data confirm” that inflation — the major focus of an aggressive series of Fed policy tightening that has pushed borrowing costs up to more than two-decade highs — is cooling back down to the central bank’s stated 2% in a “sustainable way.” The cautious view on rate cuts, pushed Treasury yields higher as bets on rate cuts were reined in, with traders now pricing just a 16% cut in March, well below the 80% peak seen earlier this year, and now see just five cuts for this year compared with six previously.

Media firms will also be in focus in the coming days, with results ahead from the industry leaders like Walt Disney, Fox, and Warner Music Group. Chinese e-commerce player Alibaba, ride-sharing firm Uber (NYSE:UBER), and chip designer Arm Holdings are slated to report this week.

US Earnings

- McDonalds fell more than 3% reported fourth-quarter comparable sales growth of 3.4%, missing Bloomberg consensus estimates of 4.79%, as the burger chain’s international operations were dented by boycotts relating to the violence in the Middle East. The impact of boycotts are expected to continue as long as the war rages, the company warned, following a “meaningful” impact in Q4.

- Caterpillar the machinery manufacturer that is often viewed as a bellwether for the American industrial sector, rose more nearly 2% after posting fourth-quarter adjusted per-share profit that topped expectations, as higher prices helped offset a dip in sales volume. Shares in Caterpillar rose sharply in early U.S. dealmaking.

- Boeing fell more than 1% after the embattled planemaker warned that a fresh issue in some fuselages of its 737 jets could lead to the “near-term” delivery delays.

Bonds

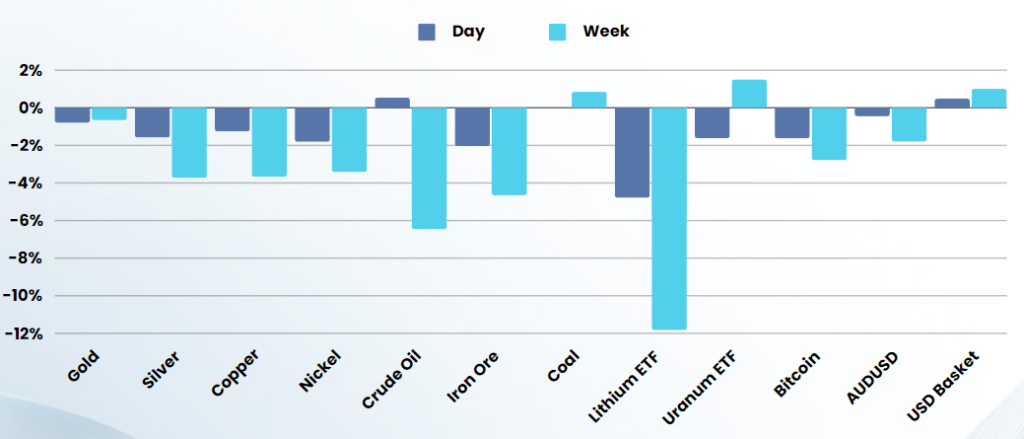

Commodities & FX

The Day Ahead

ASX SPI 7554 (-0.43%)

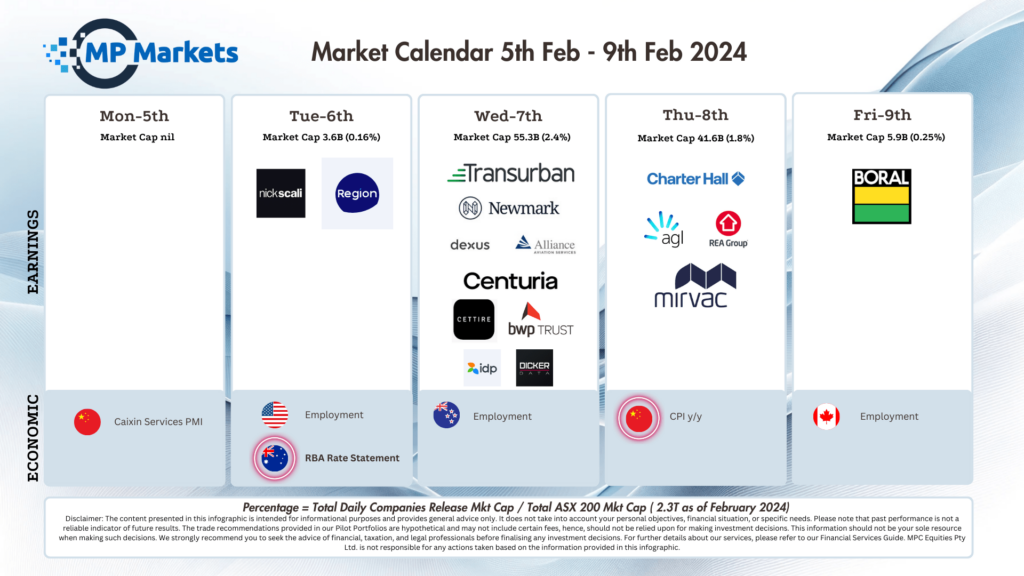

The ASX will follow the US lower due to higher bond yields, compounded by further falls in commodity prices due to a higher USD and delays in China stimulus. The RBA will in focus after the first 2-day meeting for the central bank. No change is expected, however the statement should provide clues to future movement.

ASX earnings are trickling through and will accelerate over the coming weeks.

- Virgin Money UK is set to issue a sales update.

- Furniture retailer Nick Scali has topped its first half profit guidance, posting a 29 per cent fall to $42 million in the first half on the 2024 fiscal year.

- Incitec Pivot’s painfully protracted talks to divest its fertiliser division to state-owned Indonesian group Pupuk Kaltim have rival suitors starting to mobilise.

- In corporate moves, Domain has appointed Peter Williams as chief financial officer. He was previously CFO, digital and publishing at Nine Entertainment.