What's Affecting Markets Today

US futures rise after Meta and Amazon results

On Thursday night, S&P 500 futures experienced an uptick of 0.6%, propelled by strong financial performances from major tech companies and anticipation surrounding the January jobs report. Nasdaq 100 futures surged by 1%, while Dow Jones Industrial Average futures remained relatively steady.

In after-hours trading, Meta’s shares soared by 15%, surpassing analysts’ projections. The social media giant, also known as the parent company of Facebook, declared its inaugural quarterly dividend and approved a $50 billion share repurchase program. Amazon witnessed a 7% increase in its stock value following impressive fourth-quarter results. Conversely, Apple faced a 3% decline due to diminished sales in China during the fiscal first quarter.

These movements ensued after a day of market rebounds during Thursday’s trading, with the Dow Jones Industrial Average rising by 0.97%, and the S&P 500 and Nasdaq Composite gaining 1.25% and 1.3%, respectively. The previous day’s sell-off, triggered by Federal Reserve Chair Jerome Powell’s suggestion of an unlikely rate cut in March, was mitigated.

Analysts anticipate the continuation of this year’s market rally, attributing Wednesday’s pullback to a minor setback. Factors contributing to optimism include a robust economy, confident consumers, better-than-expected economic data, and the potential for earnings and revenue growth in 2024.

Investors and the Federal Reserve eagerly await Friday’s release of the January jobs report, with economists predicting a growth of 185,000 positions and a slight uptick in the unemployment rate to 3.8%. Notably, Chevron, Exxon Mobil, Bristol-Myers Squibb, Cigna, and AbbVie are slated to report earnings before Friday’s opening bell.

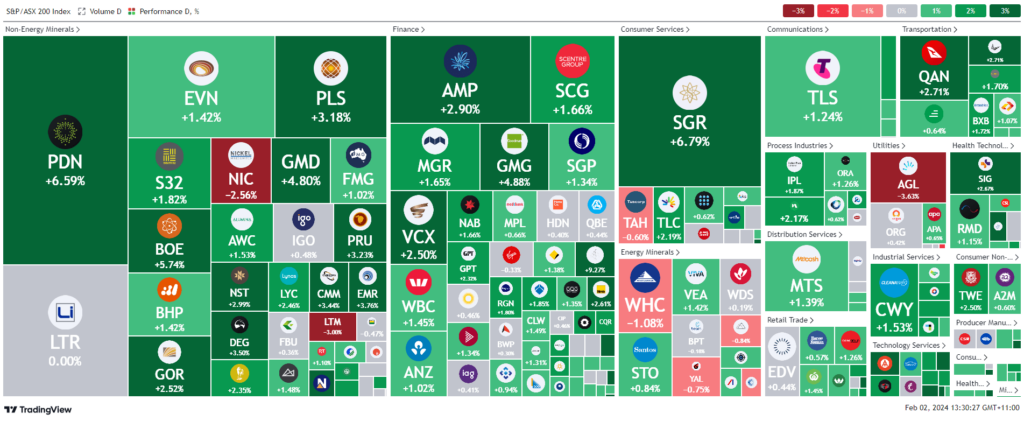

ASX Stocks

ASX 200 - 7699.4 (+1.5%)

Key Highlights:

Australian shares surged 1.1% by midday on Friday, with a notable recovery of 0.7% in the financials sector, particularly the banks. Investors closely monitored potential contagion risks related to bad debt exposure in the US commercial property market. In contrast to the US, Australian commercial real estate exhibited resilience, with valuations holding up well. The local tech sector experienced a 1.1% gain, propelled by Meta’s record-high performance in after-hours trading, driven by optimistic guidance for robust ad sales growth in Q1 2024.

Boss Energy and Paladin saw substantial increases due to a renewed rally in uranium prices, approaching 16-year highs at $106.25 per pound. Concerns over production challenges in 2024, as warned by Kazatomprom, led to discussions about a potential uranium deficit, attracting increased investment in related mines.

Asset manager Pinnacle witnessed a 5% surge after revealing that affiliates’ funds under management exceeded $100 billion in December, alongside reporting a steady half-year profit. Conversely, Atlassian shares declined following a posted net loss of $84.5 million, despite a 21% increase in sales to $1.06 billion.

Leaders

DYL Deep Yellow Ltd 12.42%

ERA Energy Resources of Australia Ltd 10.00%

PNI Pinnacle Investment 9.27%

SKC Skycity Entertainment Group Ltd 6.93%

SGR The Star Entertainment Group Ltd 6.88%

Laggards

SNL Supply Network Ltd -4.36%

WGX Westgold Resources Ltd -3.80%

AGL AGL Energy Ltd -3.40%

LTM Arcadium Lithium Plc -3.06%

MRM Mma Offshore Ltd -2.70%