Last Night's Market Recap

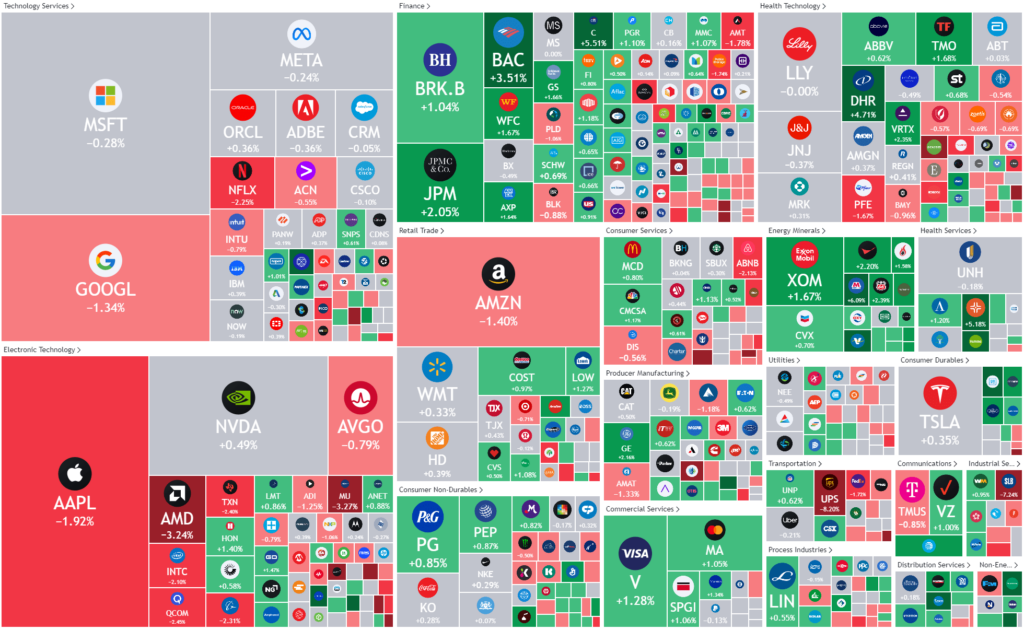

S&P 500 - Heatmap

Overnight – Microsoft and Google beat analysts expectations, but not the markets

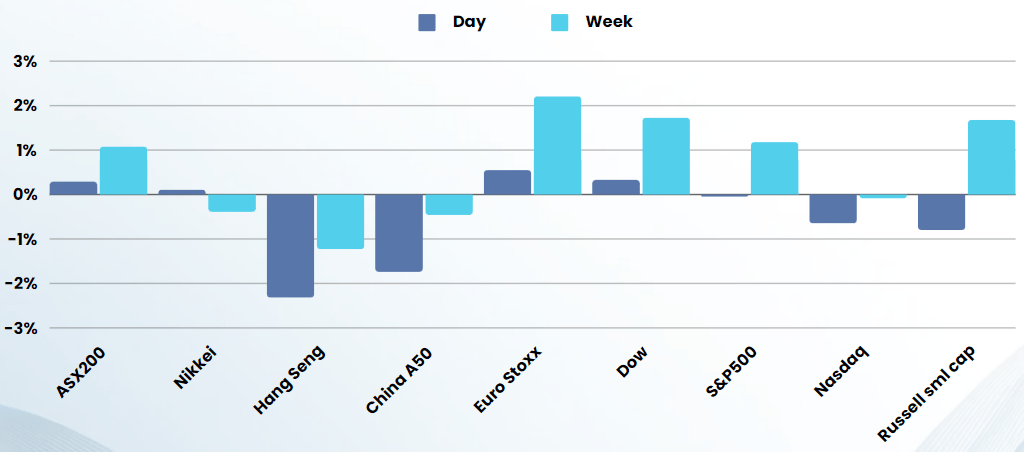

Stocks were mixed leading into Mega Cap earnings from Microsoft and Google which were released after the bell as continued strength in the labour market relieved pressure on the Fed to bring forward rate cuts

Job openings in December climbed to 9.03 million, above economists estimates of for 8.75M. The ongoing signs of labor market strength arrived on the heels of data showing consumer confidence jumped to a 2-year high. The duo of reports, signalling economic strength, pushed 2-year Treasury yields higher, as investors bet that the data will likely encourage the Fed to maintain its higher for longer rate regime as the central bank kicked off its two-day meeting. While the Fed is expected to keep rates unchanged, commentary accompanying the rate decision is likely to underscore the need for ongoing patience with a balanced assessment of risk.

Tech earnings after the bell from Microsoft, Google and AMD all beat analysts expectations on EPS and revenue, however selling immediately emerged in all 3 stocks, Google the worst, falling 5.5%. This is a definite sign that the investors have unrealistic timelines and expectations of these Mega-caps and the AI thematic

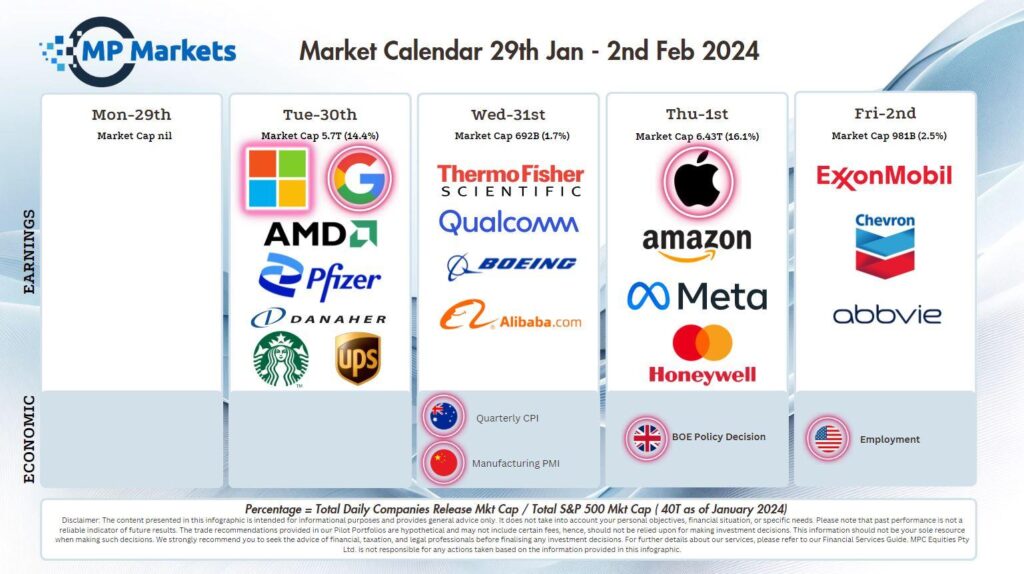

US Earnings

- Microsoft beat analysts’ forecasts as growing demand for artificial intelligence continued to bolster growth in the the tech giant’s cloud computing business. Earningsper share of $2.93 on revenue of $62 billion. Analysts polled by Investing.com anticipated EPS of $2.77 on revenue of $61.14B. The better-than-expected results were underpinned by growth in its cloud business Azure, which grew 30%, beating analyst estimates of 27.5%. Despite this the stock fell 1.8% in afterhours trade

- Google fourth-quarter results that beat Wall Street estimates, as its cloud business continued to strengthen, but advertising growth fell just shy of expectations. Google-parent Alphabet reported earnings per share of $1.64 on revenue of $86.31 billion. Analysts polled by Investing.com anticipated EPS of $1.59 on revenue of $85.23B. The better-than-expected results were driven by advertising growth and stronger margins, which grew 27% from 24% in the same period a year ago. The stock fell 6% in afterhours trade

- AMD reported better-than-expected financial results for its fourth quarter. The chipmaker posted an earnings per share (EPS) of $0.77, exactly matching the analysts’ estimates. In terms of revenue, AMD reported a strong quarter with $6.2 billion in revenue, surpassing the consensus estimate of $6.13 billion. The stock was up 1.5% in after-hours trade. Looking ahead, AMD expects its revenue to be between $5.1 billion and $5.7 billion. This forecast fell below the consensus estimate of $5.73 billion. The stock was down over 7% in the post market trade

- General Motors stock rose 8% after the auto giant provided investors with an upbeat outlook for 2024 and signaled more capital could be returned to shareholders. It appears the profit margins and growth targets are still very much on track despite this murky backdrop,” Wedbush said in a note, following a few quarter in which the automaker’s“EV vision [was] in flux“

- United Parcel Service stock fell over 7% after the world’s biggest package delivery firm forecast annual revenue below expectations, facing sluggish domestic and international e-commerce demand. The company also detailed plans to cut 12,000 jobs to rein in costs.

- Pfizer fell more than 1% after the drugmaker reported a surprise quarterly profit, though weaker-than-expected sales of key products including cancer drug Ibrance weighed on sentiment.

Bonds

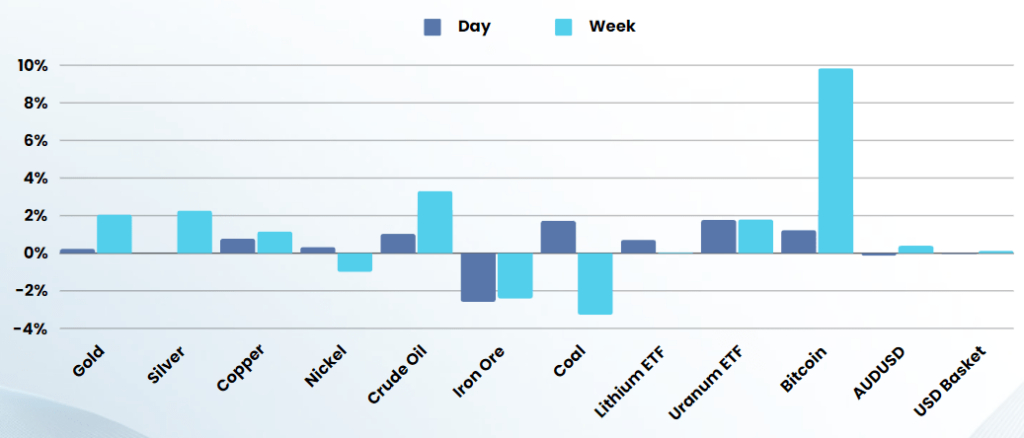

Commodities & FX

The Day Ahead

ASX SPI 7568 (+0.01%)

The ASX is likely to fall away from yesterdays (close to) record highs as the headlines from the US mega-cap results will weigh on the market today, although the big focus will be quarterly CPI numbers at 11.30am.

- Australian debt collecting giant Credit Corpsaid it was on track to come in at the bottom end of its profit guidance., after posting a net loss in its most recent half-year.

- Origin Energyhas reported a slip in its LNG production in the December quarter.

- IGO is also expected to issue earnings. Aurelia Metals, Liontown Resources, PointsBet, Resolute Miningand Syrah Resources all provide sales updates. Incitec Pivot trades ex-dividend.