Last Night's Market Recap

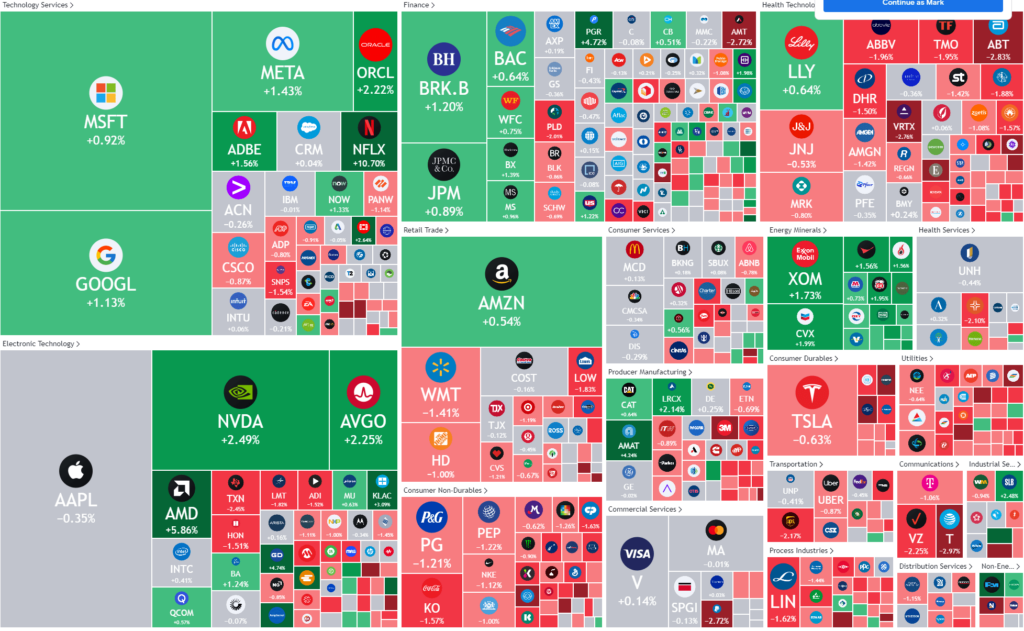

S&P 500 - Heatmap

Overnight – New highs again as Investor selective hearing fuels misguided optimism

Stocks continued their record run Wednesday, as a surge Netflix underpinned an ongoing melt up in tech as the streaming giant delivered blowout quarterly subscriber growth just as the quarterly earnings season heats up.

Netflix jumped more than 11% as the company signed up a hefty 13.12 million users during the three months ended on Dec. 31, a 71% surge compared to the year-ago period and markedly above analyst estimates of about 8.9 million. Revenue grew by around 12% year-on-year to $8.83 billion, also beating projections, overshadowing a miss on earnings per share.

Chip stocks rose more than 2%, led by a surge in the Advanced Micro Devices after New Street Research upgraded the chipmaker to buy on expectations that the AI revolution will spur chip demand. On the earnings front, ASML reported Q4 results that beat on both the top and bottom lines, sending its shares more than 10% higher, but Texas Instruments failed to join in on the rally after reporting weaker-than-expected guidance.

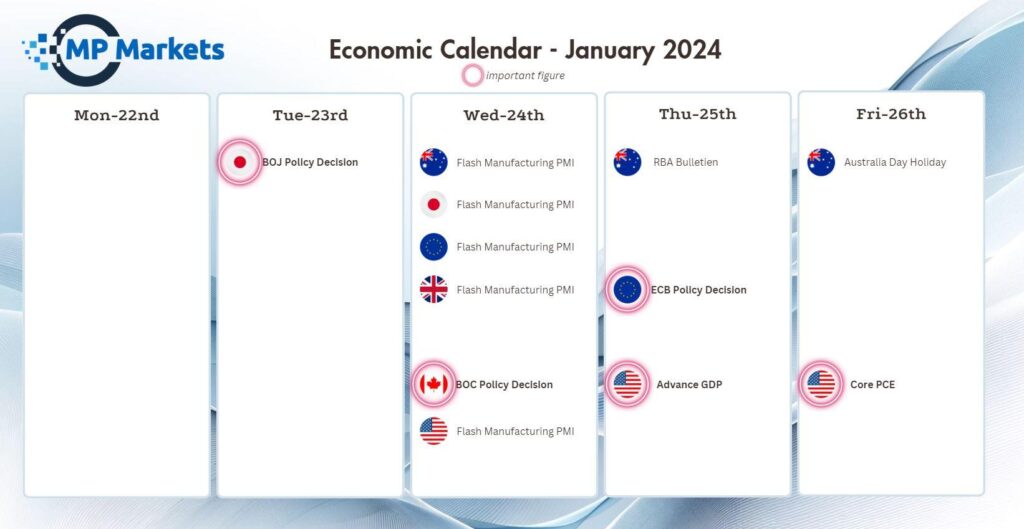

Treasury yields inched higher as stronger manufacturing and services data for January, continued to point to underlying strength in the economy, suggesting there isn’t a need for speed on Federal Reserve rate cuts. Still, fourth-quarter GDP on Thursday and December’s personal consumption expenditures data on Friday, could filter into the Fed’s thinking.

The broad optimism seems misguided, as Netflix tightened security measures which had an obvious effect on new subscriber numbers. This is not demand, it is a one off. Meanwhile it is distracting investors from the fact that most companies have missed or delivered bleak outlooks.

CNN’s Fear and Greed Index has entered ‘extreme greed’ territory with a 77 out of a 100 reading.

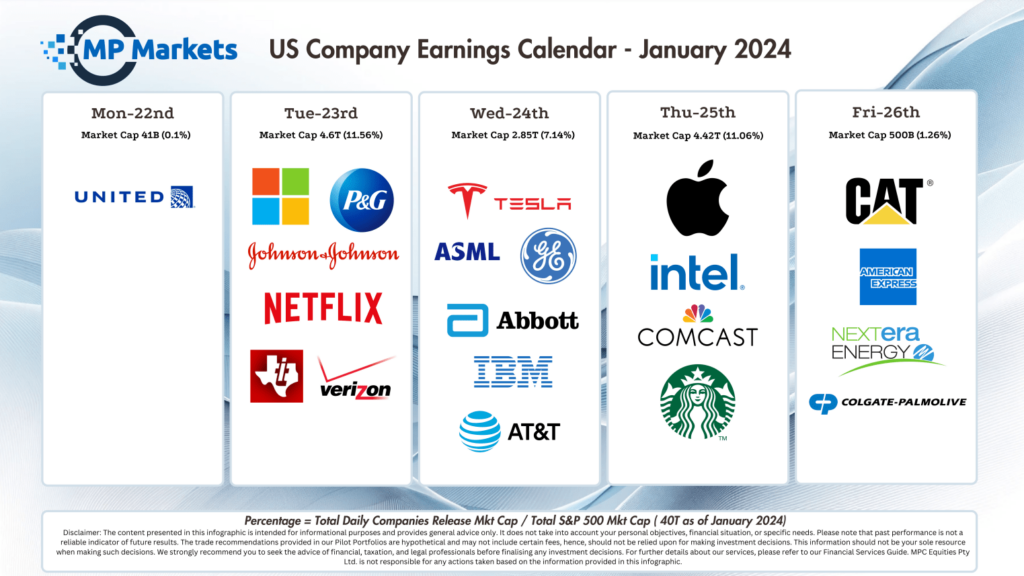

US Earnings

- Tesla reported Wednesday fourth-quarter results that missed Wall Street estimates and the electric vehicle warned of annual production growth will be “notably” slower this year amid a weaker backdrop for electric vehicle demand. Tesla shares fell 3% in afterhours trading Wednesday, following the release of the results.

- AT&T stock fell 3% after the telecom giant forecast annual profit below market estimates as it lowered the value of its old equipment and grapples with competition from cable operators.

- Dupont De Nemours stock slumped 13% after the chemicals company announced that it expects to report a fourth-quarter loss compared to a year-ago profit.

- Kimberly-Clark stock fell nearly 5% after the consumer goods company’s fourth-quarter sales missed market expectations as price hikes softened amid choppy demand for its consumer goods products.

- Abbott Laboratories stock fell 2.5% after the medical device manufacturer reported lower-than-expected sales in its pharmaceuticals unit.

Bonds

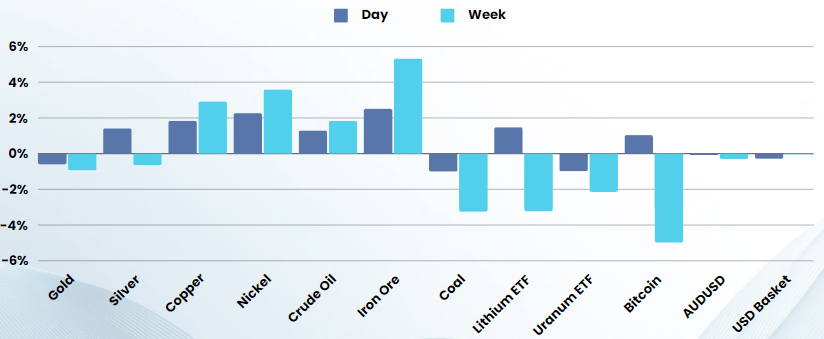

Commodities & FX

The Day Ahead

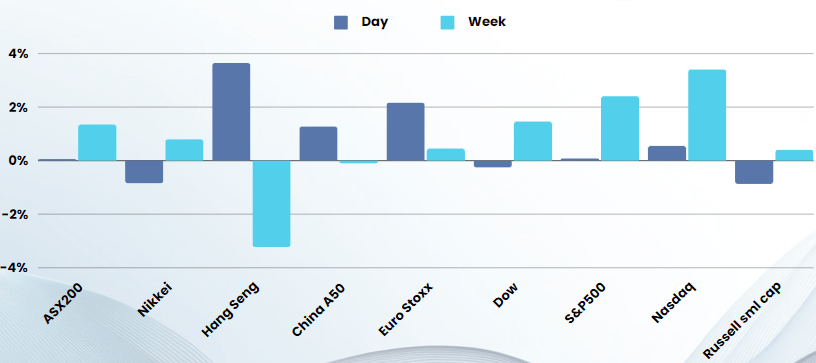

ASX SPI 7504 (+0.21%)

The ASX has largely lost independence as the US earnings results pull the index higher overnight, while China woes drag it back down during the day. The market is shut for Australia day tomorrow

- Fourth quarter production reports are expected from Fortescue, Santosand Mineral Resources.

- RMD is expected to release earnings with margins expected to compress but net income to rise by 9%

Economic Calendar

Earnings Calendar