3 reasons Copper is at fresh record highs

Copper, often referred to as the lifeblood of modern technology, is facing unprecedented challenges that could propel it into the spotlight as the next major commodity squeeze. Despite its critical role in both traditional and green energy systems, copper has been overshadowed by other metals like lithium and nickel. However, recent developments suggest that copper’s time to shine is approaching, driven by a perfect storm of supply constraints, geopolitical tensions, and surging demand from emerging technologies.

Supply Constraints and Geopolitics

The global copper market is heavily reliant on South America, with Chile and Peru accounting for nearly 43% of global production. However, these countries are facing significant political instability. Peru recently experienced a failed coup attempt, which threatened nearly 30% of its copper supply. In Chile, rising inflation and unemployment have led to increased protests, potentially impacting foreign-owned mines. These geopolitical risks could severely disrupt global copper supplies, exacerbating existing shortages.

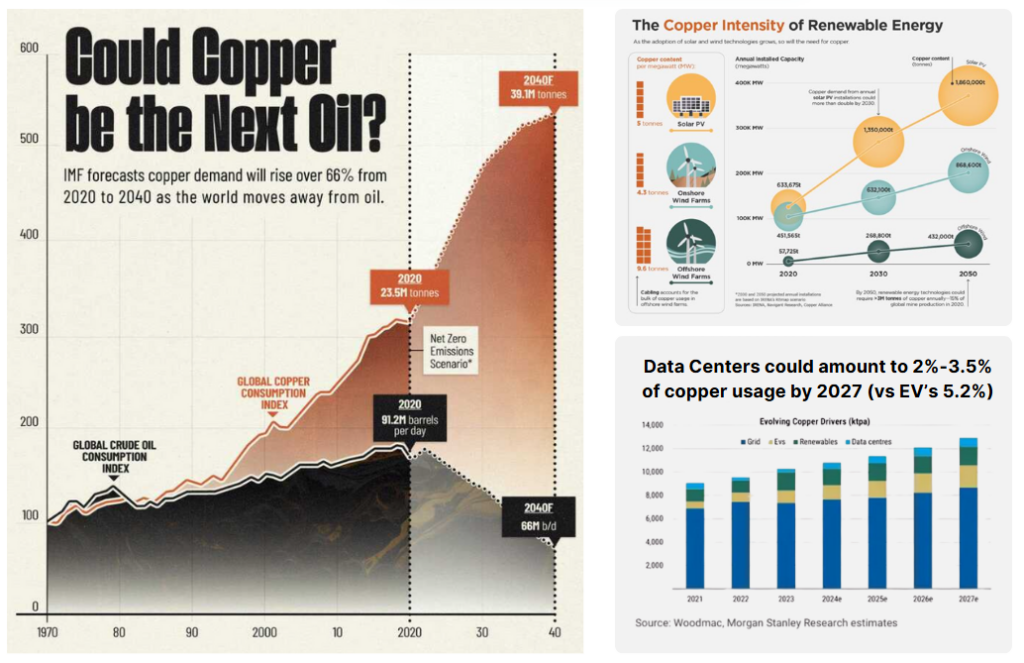

Demand Surge: Energy Transition and AI

The energy transition, driven by electric vehicles (EVs) and renewable energy, is significantly increasing copper demand. EVs require about 83 kg of copper per vehicle, three times more than traditional cars. Additionally, the rapid growth of artificial intelligence (AI) and data centers is creating a new wave of demand. Data centers alone could account for 1.5% to 3.3% of global copper usage by 2027. This dual demand pressure is expected to widen the supply gap, potentially leading to a significant price increase.

Recent Tariff Developments

Copper prices have surged in recent months, partly due to anticipated U.S. tariffs on imports. The Comex copper price reached nearly $5.20/lb, close to its all-time high, as traders stockpiled copper in the U.S. ahead of potential tariffs. This rush has exacerbated global supply shortages, with experts predicting a 320,000-ton deficit in 2025. China’s stimulus measures have also boosted demand, further tightening the market

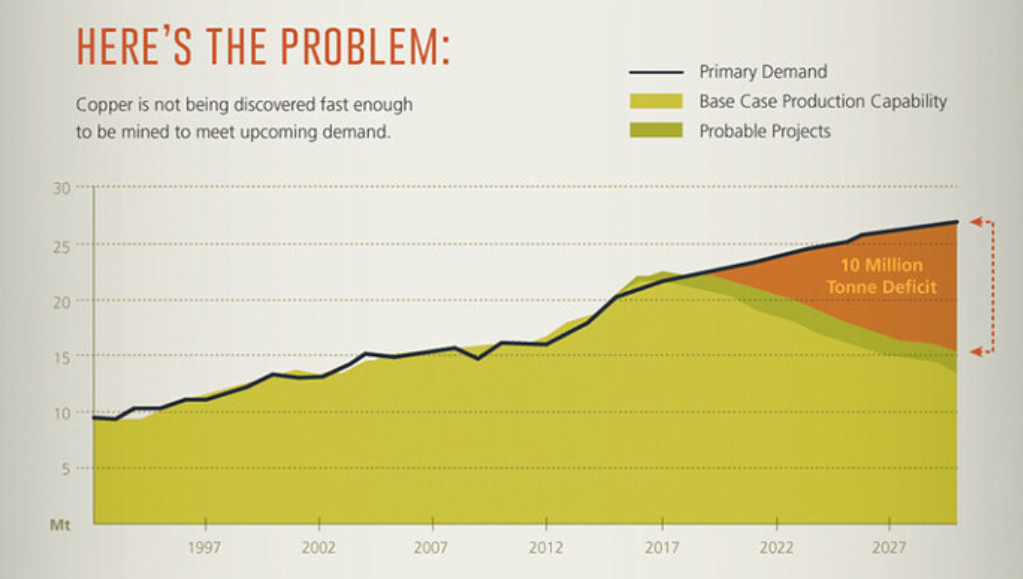

Environmental Restrictions and Mine Development

Copper mining is environmentally intensive, leading to stringent regulations that discourage new mine developments. As a result, the pipeline of committed projects is dwindling, further tightening supply. The lack of new mines, combined with deteriorating ore quality at existing sites, means that producers are struggling to meet demand.

WANT TO KNOW WHICH STOCKS TO PICK?

Ask our Head of Equities, Mark Gardner

GENERAL ADVICE WARNING:

Recommendations and reports managed and presented by MPC Markets Pty Ltd (ABN 33 668 234 562), as a Corporate Authorised Representative of LeMessurier Securities Pty Ltd (ABN 43 111 931 849) (LemSec), holder of Australian Financial Services Licence No. 296877, offers insights and analyses formulated in good faith and

Opinions and recommendations made by MPC Markets are GENERAL ADVICE ONLY and DO NOT TAKE INTO ACCOUNT YOUR PERSONAL CIRCUMSTANCES, always consult a financial professional before making any decisions.